It seems that the stalemate in Ukraine has slowed down gold’s bold movements. Will the Fed’s decision on interest rates revive them again?

Bullion.Directory precious metals analysis 15 March, 2022

Bullion.Directory precious metals analysis 15 March, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

What is comforting in this situation is that Russian troops have made almost no advance in recent days (although there has been some progress in southern Ukraine). They are attempting to envelop Ukrainian forces in the east of the country as they advance from the direction of Kharkiv in the north and Mariupol in the south, but the Ukrainian Armed Forces continue to offer staunch resistance across the country.

So, it seems that there is a kind of stalemate. The Russians don’t have enough forces to break decisively through the Ukrainian defense, while Ukraine’s army doesn’t have enough troops to launch an effective counteroffensive and get rid of the occupiers. Now, the key question is: in whose favor is time working? On the one hand, Russia is mobilizing fighters from its large country, but also from Syria and Nagorno-Karabakh.

The invaders continue indiscriminate shelling and air attacks that cause widespread destruction among civilian population as well. On the other hand, each day Russian army suffers heavy losses, while Ukraine is getting new weapons from the West.

Implications for Gold

How is gold performing during the war? As the chart below shows, the recent stabilization of the military situation in Ukraine has been negative for the yellow metal. The price of gold slid from its early March peak of $2,039 to $1,954 one week later (and today, the price is further declining).

However, please note that gold makes higher highs and higher lows, so the outlook remains rather positive, although corrections are possible. On the other hand, gold’s slide despite the ongoing war and a surge in inflation could be a little disturbing.

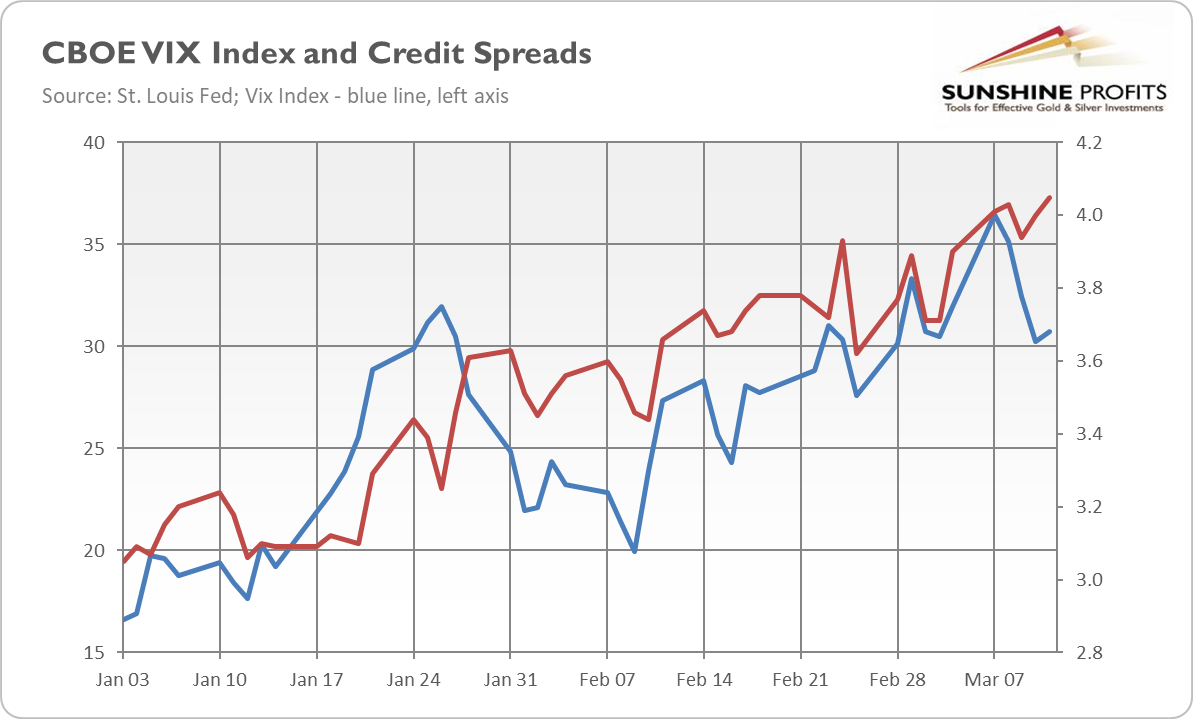

However, the reason for the decline is simple. It seems that the uncertainty reached its peak last week and has eased since then. As the chart below shows, the CBOE volatility index, also called a fear index, has retreated from its recent peak. The Russian troops have made almost no progress, the most severe response of the West is probably behind us, and the world hasn’t sunk into nuclear war. Meanwhile, the negotiations between Russia and Ukraine are taking place, offering some hope for a relatively quick end to the war. As I wrote last week, “there might be periods of consolidation and even corrections if the conflict de-escalates or ends.” The anticipation of tomorrow’s FOMC meeting could also contribute to the slide in gold prices.

However, the chart above also shows that credit spreads, another measure of risk perception, have continued to widen in recent days. Other fundamental factors also remain supportive of gold prices. Let’s take, for instance, inflation.

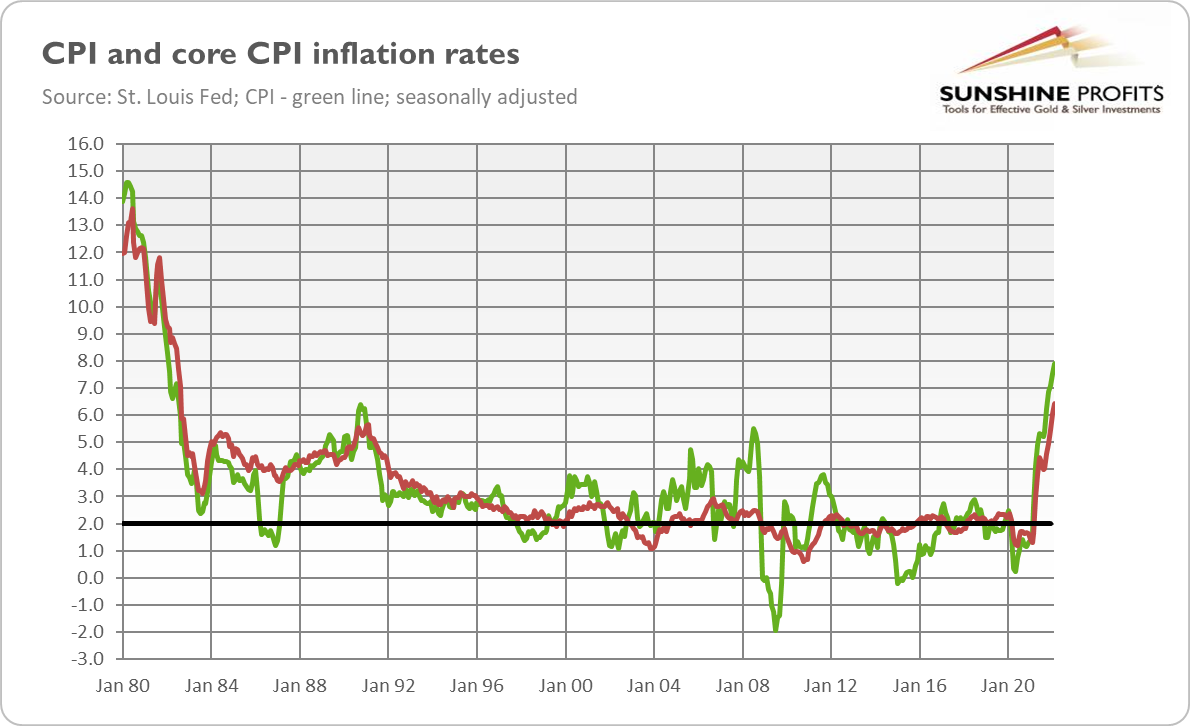

As the chart below shows, the annual CPI rate has soared from 7.5% in January to 7.9% in February, the largest move since January 1982. Meanwhile, the core CPI, which excludes food and energy prices, surged from 6.0% to 6.4% last month, also the highest reading in forty years.

The war in Ukraine can only add to the inflationary pressure. Prices of oil and other commodities have already soared. The supply chains got another blow. The US Congress is expanding its spending again to help Ukraine.

Thus, the inflation peak would likely occur later than previously thought. High inflation may become more embedded, which increases the odds of stagflation. All these factors seem to be fundamentally positive for gold prices.

There is one “but”. The continuous surge in inflation could prompt monetary hawks to take more decisive actions. Tomorrow, the FOMC will announce its decision on interest rates, and it will probably hike the federal funds rate by 25 basis points.

The hawkish Fed could be bearish for gold prices. Having said that, historically, the Fed’s tightening cycle has been beneficial to the yellow metal when accompanied by high inflation. Last time, the price of gold bottomed out around the liftoff.

Another issue is that, because of the war in Ukraine, the Fed could adopt a more dovish stance and lift interest rates in a more gradual way, which could be supportive of gold prices.

The military situation in Ukraine and tomorrow’s FOMC meeting could be crucial for gold’s path in the near future. The hike in interest rates is already priced in, but the fresh dot-plot and Powell’s press conference could bring us some unexpected changes in US monetary policy. Stay tuned!

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Leave a Reply