Central bankers and bureaucrats are seizing on recent turmoil in cryptocurrency markets to push aggressively for central bank digital currencies (CBDCs). They made their case to other global elites gathered in Davos on Monday…

Full Article →No doubt Biden administration officials are urging the Fed to assure Americans their central bank is taking decisive action. So far, however, there isn’t much reason to believe Esther George and her comrades are planning to do much more than talk.

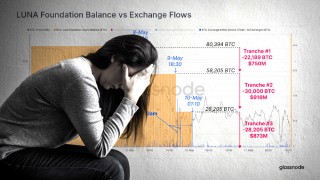

Full Article →After the industry-wide sell-off alongside the collapse of LUNA and UST last week, markets have entered a period of consolidation. In the shorter term, we can also see that the Monthly Return profile for Bitcoin has been underwhelming. In effect, Bitcoin has lost 1% of its market value every day over the last month.

Full Article →Its now official. After the NASDAQ long since crossed the rubicon, the world’s biggest equities index, the US S&P500 officially turned to bear market having crossed the 20% loss line on Friday night.

Full Article →While a first glance at the latest inflation figure may indicate improvement, a second look at the numbers raises the possibility it actually could be getting worse. And as bad as that news is for all Americans, it may be especially troubling for seniors.

Full Article →Gold Demand Rising While Inflation Remains High: Inflation has been rising – and so has physical gold demand. World Gold Council’s latest report shows a 34% jump in Q1 2022. Amazing!

Full Article →More red on Wall Street last night on growing concerns about the US economy and its ability to handle higher rates. Whilst ending the session lower the S&P500 again miraculously bounced off the -20% bear market line in the sand without crossing it.

Full Article →Although we set up the Dubai company several months ago now, it’s taken quite a while to get set up personally with residence visas and government IDs – but today after more than a few delays and roadblocks – we’re here, we’re official and we’re open!

Full Article →At this point, it has almost become cliché to say that “inflation is accelerating,” and that it’s taking a bite out of retirement savers income. But just how big is that bite? According to this Moody’s analysis, that bite amounts to hundreds of dollars a month consumed by the tax nobody voted for

Full Article →Sri Lanka is running out of petrol. Citizens are being implored not to line up, that petrol will be available within the next two days. Sri Lankan news channels warn power cuts may rise to 15 hours per day, and there are numerous reports of Sri Lankans struggling to find essentials

Full Article →Economists agree both gold and silver share many virtues: Easily accessible and redeemable, highly liquid, historically money, intrinsically valuable and free of counterparty risk. The parallels lead some to call silver “poor man’s gold.” That’s not a helpful description…

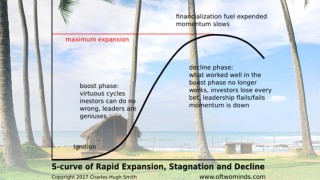

Full Article →At a time of monumental change in our global economic and geopolitical setup, financial commentator and author Charles Hugh Smith yesterday looked back at his calls on what he sees as the 5 ‘long-wave cycles’ that he first posited in 2007.

Full Article →The globalists are preparing to roll out Central Bank Digital Currencies. If they can convince people to adopt this next evolution of fiat money, they will attain a level of information and control that prior generations of central bankers only dreamt of.

Full Article →The cryptocurrency markets experienced a week of historic volatility and chaos, with the exchange rate for two stablecoins, UST and USDT taking centre stage. Over just a few days, two top 10 digital assets by market cap (LUNA and UST) erased nearly $40 Billion in investor value.

Full Article →The consumer price index (CPI) for April registered at 8.3%. That’s a slight improvement in the headline number over March’s 8.5%, but only slight. Notably, core CPI – the “underlying” CPI that excludes volatile food and energy prices – rose 6.2% year-over-year

Full Article →Its hard to pick up a paper or read the news without headlines around plummeting auction clearance rates, stalled house sales, predictions of big house price falls, and then late last week we got the ABS stats showing new home and construction finance commitments literally halved…

Full Article →On Thursday May 12, the price of silver fell about a buck. But… As with every one of these big price moves, the question is: what really happened? There is a theory which is often touted in the precious metals community. According to this theory, the banks sell futures to manipulate prices.

Full Article →If you pay any attention to financial news (or if you’re a regular reader of my columns), you’re probably familiar with the term “bubble.” We’ve seen the 2008 housing bubble, the dot-com stock bubble, some are referring to the recent collapse in bonds as the end of a bond bubble and so on…

Full Article →“We’ll see a recession in 2023.” That’s what more than half of the economists, fund managers and strategists surveyed by CNBC said they believe. But that pales in comparison to the number of small business owners who say what they’re going through right now suggests to them that we’re in for a recession this year.

Full Article →Never a dull night on global markets lately… Last night was again a sea of red. The only green was yet again the US dollar (at near 20 year highs) and big cap crypto (coming off massive falls).

Full Article →Bonds are generally considered a conservative investment vehicle. Corporate bond-holders get paid before shareholders, and even in the worst-case scenario of a bankruptcy, bond owners are likely to recoup some of their investment, while shareholders are usually wiped out.

Full Article →While the annual consumer price reading slowed to 8.3% from 8.5%, both headline and core CPI rose 0.3% and 0.6% respectively in April, both higher than consensus expectations and still some of the highest on record.

Full Article →The times ahead will likely be radically different from those we’ve experienced in our lifetimes—but similar to those that have happened many times before. Studying history lets us find recurring patterns that determine likely future developments.

Full Article →Good news for gold holders is that the safe-haven metal is holding up better than conventional financial assets. Stocks are breaking down at the same time as purportedly “risk-free” Treasury bonds are collapsing in value at a rate never before seen

Full Article →A lot has been written and speculated of late about the Russia’s moves to back the rouble with gold, the weaponization of the US dollar and reckless printing of it starting some kind of reset of global fiat currencies. None of this is without historical precedence of course.

Full Article →In response to the recent Fed announcements, on Thursday the Dow Jones tumbled almost 1,100 points. The NASDAQ also lost 5% of its value. Both losses completely erased their relief-rally gains from the day before – when stock bulls were excited the Fed didn’t raise rates higher.

Full Article →On Wednesday, six hours before the Fed interest rate announcement, the price of silver began to drop. It went from around $22.65 to a low of $22.25 before recovering about 20 cents. We wonder a bit about how they keep privileged traders from peeking at such announcements before the rest of the world gets to see it…

Full Article →Soaring prices have been the big economic story for quite a while. But there are signs that inflation could be on the verge of getting pushed off the front pages – or at least further down on the front page – to make room for another ominous economic condition: recession.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.