The ongoing battle over the debt ceiling is likely to continue for some time this year. According to Treasury Secretary Janet Yellen, the government can use accounting tricks to keep the government running and meet principal obligations until around early June.

Full Article →We’re Just One Step Away from $5,700/oz Gold

MoneyWeek’s Dominic Frisby is an analyst to watch. His precious metals analyses are full of insights, and his latest observation on gold’s price is fascinating. Frisby shows off his decades of experience by reminiscing about gold’s price trajectory from the late 1990s to now.

Full Article →What Would Early Biden Departure Mean For Markets?

Joe Biden entered the Oval Office with relatively low approval ratings. The botched withdrawal from Afghanistan, an economy in decline, rising consumer prices, and potential scandals simmering in the background haven’t helped his approval ratings over the past two years.

Full Article →Will Silver Leave Gold Behind in 2023?

Not only are there sound fundamental reasons why silver can outperform gold during metals-favorable climates, but there have been several notable periods during which silver has done just that.

Full Article →Revealed: The Secret Reason Governments Love Inflation

When people spend beyond their means, they increase the likelihood that they will suffer severe financial consequences – including foreclosure and bankruptcy. But when the U.S. government spends beyond its income, that doesn’t happen.

Full Article →Shock: Raging Inflation Still Robbing Americans

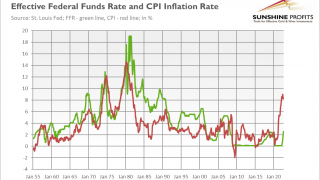

It’s official: Inflation is easing up from the historic pace it reached back in June 2022. The latest report from December 2022 has it running at “only” 6.5%. But even that is still running hotter than any month since the early 1990s.

Full Article →Why Are Analysts Predicting Higher Gold Prices?

Strange as it might sound for a year when gold posted a new all-time high, many thought 2022 was a “tepid” or “disappointing” year for gold’s price. That makes the price gains so far in 2023 all the more promising…

Full Article →Elite’s Masterplan Revealed

The bureaucratic assault on the First Amendment is part of a larger movement to end personal liberty. The ultimate goal may be to assume financial control over the populace through implementation of a central bank digital currency

Full Article →Gold’s price jumps over the past week were difficult to ignore. When gold rose past $1,800, there were some immediate concerns that its price might fall a bit in the coming weeks. Instead, it did the opposite. Closing Friday around $1,870, the next benchmark of $1,900 appears within easy reach.

Full Article →As the Dollar Falls, Metals Will Rise

Precious metals did well compared to other assets in 2023, but not as well as many goldbugs expected given the highest price inflation in decades. The anemic price action was another indication of artificial forces in the markets and broken price discovery.

Full Article →What Triggered Silver’s January 5 Hiccup?

Fed officials flexed their muscles during the last FOMC meeting. Silver tripped and fell in response, but that didn’t last long – why? The hawkish force was strong with this FOMC!

Full Article →2022’s Economic Forecasts Were Way Off

Back in 2021 practically no one foresaw the economy that ultimately came to pass in 2022. Not the level and persistence of inflation, not the severity of the interest-rate increases, and certainly not the resulting volatility that wiped tens of trillions from the real net worth of U.S. households last year.

Full Article →The life of an entrepreneur is not what most people would call “normal”… I don’t refer to the guy who buys a fast-food franchise. Nor to the folks who have law or accounting firms. I don’t know a lot about how these businesses work, but I do know one thing. They should reach cash-flow positive very quickly; if not, something is wrong.

Full Article →Gold ended an otherwise dull year by surging from $1,650 to $1,820 rather abruptly. Will 2023 include another rapid rise in price? A slow, steady climb? About the only consensus from the forecasts I saw was that gold will rise in price. The overall bullishness of these forecasts varies, but not the result.

Full Article →Pay Less Tax in 2023

Among the top New Year’s resolutions investors can make is to pay less in taxes. Without doubt, taxes can be one of the biggest drains on realized investment returns. Fortunately for holders of physical precious metals coins, rounds, and bars generate no tax consequences…

Full Article →Why 2022 Was the Worst Year For Investors

We’re in for a rough start to 2023. Still-hot inflation, high mortgage rates, and rising personal debt can slow down even the most stable economy. (Let alone a volatile, teetering and still-frothy economy.)

Full Article →How American Millionaires Are Outsmarting the Collapsing Economy

According to a recent poll by the Wall Street Journal and Impact Research, 65% of voters say the economy is headed in the wrong direction. Financial strain was affecting more than half of respondents, with more suffering on the way if things keep getting worse

Full Article →Will Gold Shine Bright in 2023?

Investor Peter Schiff and politician Nigel Farage recently shared their thoughts on why gold is scheduled to emerge as an outperformer in 2023, and why it’s already doing what it’s supposed to. Both gold’s 50-day and 200-day moving averages show it outperforming inflation

Full Article →Avoid Silver Eagles – Save Big!

The dysfunctional U.S. Mint makes tens of millions of them each year. But unlike well-run private mints, these government bureaucrats are incapable of or unwilling to address their production and sourcing stumbles, so demand for silver Eagles continues to outstrip supply.

Full Article →Wall Street Insider Shares His 2023 Gold Strategy

Gold’s whiplash couple of years have almost made everyone forget just how big of an outperformer it is. It has risen by 450% since 2000, having spent most of 1999 around $255. Still, even gold investors can perhaps fall prey to recency bias.

Full Article →Bullion’s Most Under-Appreciated Feature?

Physical gold and silver will never become worthless. This fact does not make for much of a marketing pitch. But given recent events, this is a more important feature than it looks: Americans, and investors around the world, live in an age of collapsing confidence in institutions.

Full Article →Asset Managers See Stagflation as New Normal

Stagflation is a rare beast, which is why we don’t see it very often. What makes it so rare is that its two principal ingredients are high inflation and low economic output – conditions that tend to exist in opposition to one another.

Full Article →When Did Less-Bad Become Good?

And Why the Media Is Desperately Hiding the Truth About the Economy? The idea that the bad news has ended is a dangerous illusion to support with your savings (“The Fed will pivot, rates will drop, stocks will surge and inflation will go away – better buy now!”).

Full Article →Household Debt Continues to Surge Alongside Inflation

Americans have been relying on credit for some time to do their spending. And based on data recently compiled by the Federal Reserve Bank of New York, they seem to be relying on it more than ever.

Full Article →Stagflation: the Worse for Us, the Better for Gold

Stagflation is coming – and it could make the 1970s look like a walk in the park. As you’ve probably noticed, I expect a recession next year, and I’m not alone, as this has become the baseline scenario for many financial institutions and analysts

Full Article →2 Reasons Why Social Security Is Anything but Secure

We’ve been reporting on the likelihood that Social Security will suffer from a series of setbacks in the 2030s for quite some time. Now, the Social Security Trustees are beginning to confirm the fears we’ve expressed since 2019. In this year’s report, they summarized the main problem…

Full Article →2023: Gold’s Best Year Ever?

Numerous analysts have said that commodities crashing is a kind of necessary ingredient in the current market fiasco – but just as gold was seemingly left out of massive gains that other commodities experienced, it’s likely to be one of the very few commodities not falling in the kind of recessionary environment we’re anticipating.

Full Article →10 More Years of High Inflation?

Prices could remain elevated well after acutely high inflation subsides. One report says that inflation above the Federal Reserve’s 2% target could be with us for another decade

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.