This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: What to watch out for in the coming financial crisis, Citi thinks $30 silver is a lowball forecast, and how to solve the debt ceiling stand-off with a single platinum coin…

Full Article →What a Week in Gold Price! What an Invalidation!

Did last week’s market plunge below the $2,000 level provide the final confirmation? And why is this big news? I wrote in number of occasions that the gold price was unlikely to hold the breakout above the $2,000 level. Last week provided the final confirmation.

Full Article →There’s little dispute that the turmoil we saw upsetting the financial system a month ago has subsided. But have we really seen the last of it? A number of expert observers, including former Treasury Secretary Larry Summers, have been saying it’s a little too soon to give the “all clear” on the turbulence…

Full Article →Depending on the source you check, the U.S. debt ceiling has been lifted or modified approximately 102 times since its inception in 1917. By June of this year, that number is likely to increase by one, and that means the U.S. debt is poised to skyrocket after it happens. But what if things don’t go according to plan?

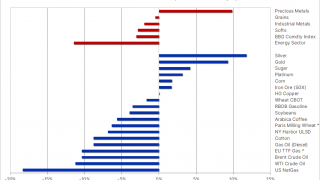

Full Article →Spend any time in the gold market and you will be bombarded with all kinds of theories about what drives gold and silver prices. It’s the money supply dummy! No, it’s “real” interest rates! No, no, it’s mine production! Then there are the non-theories…

Full Article →Why Gold is a Must in a Banking Crisis

There are many reasons to buy and hold physical gold. The lack of counterparty risk, the diversification, and the hedge against inflation are among the top reasons to own the monetary metals. The public is only in the early process of figuring out why gold ownership is an absolute MUST during a banking crisis.

Full Article →Boom! There Goes the Gold Breakout Above $2,000!

Looks like we just saw the first small “boom” in a controlled demolition on the markets. The only reason it’s “controlled” is because the prices are likely to fall in a specific pattern (in tune with how they declined previously) and not crumble instantly.

Full Article →In what has been a close-fought race to qualify, the finalists in the 2023 Bullion Dealer of the Year have been selected, with new categories and some new faces reaching the finals for the first time.

Full Article →What XAU Index Tells Us About Gold & Silver Stocks

The XAU Index is great for assessing what’s really happening in the precious metals market. One of the most important (and one that we have the longest dataset for) indices present on the precious metals market is the XAU Index.

Full Article →Despite all of the risk-management protocols in place for the banking industry, this most prominent of threats to Silicon Valley Bank – and the one that ultimately flattened it – was either missed or ignored by risk-management professionals at all levels.

Full Article →There has been some incredibly strong voting to shortlist companies for our 2023 Bullion Dealer of the Year and with only two days remaining until the shortlisting vote closes we’re seeing some very close races being fought to be within the top-5 in each category

Full Article →Steve Forbes demands a return to the gold standard, gold’s fair value is closer to $3,000 than its current price, and U.S. states aren’t waiting for a national gold standard – they’re busy authorizing their own.

Full Article →Gold & Silver Stocks are Still… Stocks

I’ve recently written much about the link between now and 2008, and it has profound implications not just on gold and silver stocks but also on other stocks.Based on what happened in 2008, it seems that stocks are about to move much lower in the following months. Let’s take a look at the markets from a more short-term point of view…

Full Article →Absent a complete reversal in monetary policy and a push back toward zero percent interest rates, the banks are going to have a very hard time competing. Another wave of bank failures may not be far away.

Full Article →Owning physical gold and silver outside the banking system makes sense to me, not so much because I’m concerned about the imminent collapse of the global financial system. Because it’s smart protection. I have a fire extinguisher in my kitchen, but not because I think the oven is about to burst into flames.

Full Article →Think Gold Mining is Difficult, Dangerous and Harmful to the Environment? Think Again. International gold mining legend Corey Keller has announced what he describes as being a global solution to some of the biggest problems inherent in gold mining

Full Article →First, it was the crypto-focused Silvergate Bank. Then it was Silicon Valley Bank. And immediately after, Signature Bank. Silvergate and Signature could be dismissed because, well, crypto. But Silicon Valley Bank is something entirely else.

Full Article →Markets are now pricing in a 1.5% cut in Fed funds rates in the next 15 months. It’s an interesting forecast on the markets’ part. Can the Fed really hold off so long? And when the Fed throws in the towel on the inflation fight and cuts rates, will the U.S. dollar have anything left in the tank anymore?

Full Article →As the Federal Reserve has hiked rates from 0% to over 4.75%, the average interest rate on bank deposits has remained low, around the FDIC’s national average for savings accounts of 0.37%. This has led many to ask the simple question…

Full Article →Banking-Crisis Unpredictability Highlights Importance of Staying Ready for Trouble Bullion.Directory precious metals analysis 27 March, 2023 By Isaac Nuriani CEO at Augusta Precious Metals Precious metals have been on a […]

Full Article →There isn’t a vestige of the free market left when it comes to the country’s financial sector. Central control goes way beyond the fact that the Federal Reserve has been fixing the price of money (interest rates) for the past few decades.

Full Article →After almost 15 years of Fed-fueled cheap money offered at near-zero rates that was leveraged into overinflated speculative bubbles, the lights are on, the crowd is dispersing – and the party might finally be over.

Full Article →A stable gold price over $2,000/oz means that something has gone wrong. Either the greenback crumbled further, or there is some kind of issue that isn’t going away and that is driving haven demand. So often investors see asset prices rising and, fearful of missing out on a new bull market, buy in and drive prices even higher.

Full Article →The crisis in banks is front and center. Americans are watching a demonstration on how to take a crisis in confidence and make it worse. Many Americans have already lost trust in the FBI and DOJ. They don’t trust Janet Yellen and other bureaucrats in Washington, and they don’t trust Wall Street bankers.

Full Article →When it comes down to it, the primary appeal of precious metals for savers is their perceived capacity to act as safe-haven assets. That is, as assets with the tendency to strengthen during conditions that are unfavorable to economies,

Full Article →Over 95% of Silicon Valley Bank’s deposits are not insured by the FDIC (due to being over the $250,000 limit) That is over $160 billion in uninsured customer deposits. About half of all venture capital-funded startups in the U.S. are customers of SVB. That’s 65,000 startups.

Full Article →Silicon Valley Bank (SVB) collapsed and was then seized by the California Department of Financial Protection on Friday, March 10. This came after a frenetic two days, when the bank announced a big loss, tried to raise capital, and then faced an accelerating run-on-the-bank.

Full Article →You may have heard there’s a looming retirement crisis in America. In a nutshell, the term refers to the sizable difference between the amount Americans have saved for retirement and the amount they actually need to retire comfortably.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.