When people spend beyond their means, they increase the likelihood that they will suffer severe financial consequences – including foreclosure and bankruptcy. But when the U.S. government spends beyond its income, that doesn’t happen.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Shock: Raging Inflation Still Robbing Americans

It’s official: Inflation is easing up from the historic pace it reached back in June 2022. The latest report from December 2022 has it running at “only” 6.5%. But even that is still running hotter than any month since the early 1990s.

Full Article →Why Are Analysts Predicting Higher Gold Prices?

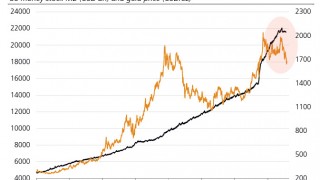

Strange as it might sound for a year when gold posted a new all-time high, many thought 2022 was a “tepid” or “disappointing” year for gold’s price. That makes the price gains so far in 2023 all the more promising…

Full Article →Gold’s price jumps over the past week were difficult to ignore. When gold rose past $1,800, there were some immediate concerns that its price might fall a bit in the coming weeks. Instead, it did the opposite. Closing Friday around $1,870, the next benchmark of $1,900 appears within easy reach.

Full Article →Gold ended an otherwise dull year by surging from $1,650 to $1,820 rather abruptly. Will 2023 include another rapid rise in price? A slow, steady climb? About the only consensus from the forecasts I saw was that gold will rise in price. The overall bullishness of these forecasts varies, but not the result.

Full Article →Why 2022 Was the Worst Year For Investors

We’re in for a rough start to 2023. Still-hot inflation, high mortgage rates, and rising personal debt can slow down even the most stable economy. (Let alone a volatile, teetering and still-frothy economy.)

Full Article →How American Millionaires Are Outsmarting the Collapsing Economy

According to a recent poll by the Wall Street Journal and Impact Research, 65% of voters say the economy is headed in the wrong direction. Financial strain was affecting more than half of respondents, with more suffering on the way if things keep getting worse

Full Article →Will Gold Shine Bright in 2023?

Investor Peter Schiff and politician Nigel Farage recently shared their thoughts on why gold is scheduled to emerge as an outperformer in 2023, and why it’s already doing what it’s supposed to. Both gold’s 50-day and 200-day moving averages show it outperforming inflation

Full Article →Wall Street Insider Shares His 2023 Gold Strategy

Gold’s whiplash couple of years have almost made everyone forget just how big of an outperformer it is. It has risen by 450% since 2000, having spent most of 1999 around $255. Still, even gold investors can perhaps fall prey to recency bias.

Full Article →When Did Less-Bad Become Good?

And Why the Media Is Desperately Hiding the Truth About the Economy? The idea that the bad news has ended is a dangerous illusion to support with your savings (“The Fed will pivot, rates will drop, stocks will surge and inflation will go away – better buy now!”).

Full Article →2 Reasons Why Social Security Is Anything but Secure

We’ve been reporting on the likelihood that Social Security will suffer from a series of setbacks in the 2030s for quite some time. Now, the Social Security Trustees are beginning to confirm the fears we’ve expressed since 2019. In this year’s report, they summarized the main problem…

Full Article →2023: Gold’s Best Year Ever?

Numerous analysts have said that commodities crashing is a kind of necessary ingredient in the current market fiasco – but just as gold was seemingly left out of massive gains that other commodities experienced, it’s likely to be one of the very few commodities not falling in the kind of recessionary environment we’re anticipating.

Full Article →Inflation Reprieve Won’t Last Much Longer

Inflation is still orders of magnitude too high, and not declining appreciably. (Should CPI continue to come in 0.2% lower every month, we’re still looking at over two and a half years of prices rising faster than the Fed’s targeted rate.)

Full Article →Inflation Down, but Gold Surges – Huh?

Gold’s $100+ rise to $1,760 from $1,650 last week wasn’t an intraday price move, but it feels so abrupt and rapid. And every time gold’s price surges like this, we expect there to be some crisis or calamity. After all, it was gold’s biggest weekly gain in 30 months. Remember what happened 30 months ago?

Full Article →The Best Way To Defend Your Savings

We are living through an economic crisis that will earn an entire chapter in introductory economics textbooks in the future… As of September, 63% of Americans were living paycheck to paycheck, according to a recent LendingClub report — near the 64% historic high hit in March.

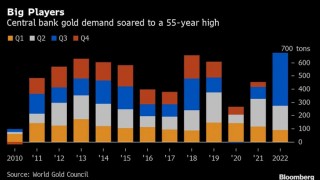

Full Article →What’s Behind the Central Bank Gold Buying Boom?

Central banks bought a record amount of gold last quarter as they diversified foreign-currency reserves, with a large chunk of the purchases coming from as-yet unknown buyers. The official sector has consistently been one of the main pillars of support for gold prices for more than a decade.

Full Article →Biden’s Gas Plans = Communism

Midterm elections are upon us, and Biden’s party seems poised for big losses. Inflation remains the #1 concern among American families. You can tell the President is a politician rather than an economist, because of his new idea for lowering fuel prices…

Full Article →Gold to Skyrocket When Fed Makes Announcement

All that gold needs is a cowardly Fed, current monetary supply levels suggest gold is undervalued, and what a gold standard would require in modern times. The consensus is in: gold can’t shatter its former all-time highs until the Federal Reserve does.

Full Article →Here’s Why Nouriel Roubini Recommends Gold & Precious Metals

Veteran Analyst Makes A Dire Prediction (Only Gold Investors Will Like This) – Nouriel Roubini’s recent feature in Time magazine tells us what we already know: inflation has become a trend word. It is no longer a term for resigned to economists, analysts, traders and speculators. These days…

Full Article →4 Best Reasons to Buy Gold Now?

It’s not that often that gold gets some exposure in the mainstream media, especially during a rout. So when it does, it’s almost our duty to mention it. This article breaks down and lists the primary reasons to buy gold today, specifically listing 4 things as the most important to the would-be gold investor. What are they?

Full Article →Last week, my friend Dr. Ron Paul told us about Ben Bernanke’s “gold confession.” That got me thinking about world central banks – why do they keep buying gold? I understand why everyday Americans want to diversify their savings with gold but why central banks?

Full Article →Biggest Mistake of Inflation Reduction Act?

Well, if you can’t afford a turkey AND a ham this Thanksgiving, just flip a quarter to help you decide. You — you don’t have a quarter? I guess you could use a nickel… For older Americans who are saving for retirement or have already retired, President Biden’s Inflation Reduction Act will have several potential impacts.

Full Article →How to Fight Inflation Like a Wall Street Pro

Investment bankers agree that central bank efforts to curb inflation are mostly proving fruitless. Interest rates are going up, but inflation rates aren’t going down. So what are some ways to protect oneself in this environment?

Full Article →The Fed Declares War on Wall Street

Official inflation at 8.3% year-over-year rate is either good news or bad news. Good news: it’s noticeably lower than June’s blistering 9.1% report. Bad news: it’s yet another painfully high report in ten consecutive months over 6%, continuing our most severe inflationary episode in four decades.

Full Article →New “Red Gold Standard” Threatens Dollar

As we know, sanctions have punished the West without stopping Russia’s invasion of Ukraine. This is not debatable – it’s simply fact. The U.S. has seen diminishing returns from levying financial sanctions against unfriendly nations for decades now.

Full Article →Proof that Precious Metals Are the Best Hedges

Now, this is counterintuitive if we think of gold exclusively as a safe haven investment. But it’s not. Gold is also historically one of the most desirable symbols of luxury and wealth. It’s like Wharton finance and economics professor Urban Jermann described in his new model of gold pricing…

Full Article →Powell Promises Pain, Biden Makes It Worse

Powell’s policies will bring pain to American families, one way or another. Now the Fed is openly rooting for stock and housing markets to crash – because that’s how they’ll know their rate hikes are finally deflating the “Everything Bubble.”

Full Article →During my career, I’ve watched three speculative financial bubbles inflate, and two of them pop (the dot-com bubble, the 2007-08 housing bobble and today’s Everything Bubble). These bouts of “irrational exuberance,” to use Robert Shiller’s trenchant description, are remarkably similar.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.