There is a lot of talk in financial circles about the shift in the U.S. economy toward a “cashless society.” Naturally, there are both benefits and drawbacks to such a radical change. Because of the required technological progress, many reports focus on the advantages of an economy that goes cashless. For example, the IMF claims…

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

4 IRA Mistakes That Could Destroy Your Savings

Once you receive a retirement plan distribution, then you have some planning to do. One part of that planning is deciding how you are going to roll over the funds into any new vehicle(s) and begin to enjoy the fruits of your labors. The IRS website nicely summarizes the main reason why many Americans who are saving for a stress-free retirement would do this…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: The not-so-hidden Chinese crisis, what we can expect from gold in the near-term, and a reminder on why only gold bullion cuts it: The Chinese economic slump and the accompanying rush to gold

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: The Costco gold rush, the indebted legacy of the modern statesman and unpacking IMF data surrounding the U.S. dollar’s global forex share. What we learned from Costco’s foray into gold bullion…

Full Article →How Much Will the Imminent Government Shutdown Cost You?

Here’s something you don’t want to hear from your political leaders, especially in the federal government: “Our financial ship is sinking.” Yet that’s exactly how Tennessee Representative Tim Burchett recently described the situation. He made this statement because the U.S. government can’t reach a resolution that would keep its own operations funded.

Full Article →Everyone Would Buy Gold If They Knew This

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Investors under-educated on gold, an update on Russia’s gold dealings, and who owns the London Metals Exchange?

Full Article →Paul Krugman Insists Inflation is in Your Imagination

Despite his accolades, Krugman has made some wildly inaccurate forecasts. For example, he claimed in 1997 that the Internet’s impact on the economy would be about the same as the fax machine. In 2012, he said the euro would collapse “in a matter of months, not years.” I can forgive him for failed economic projections, but this?

Full Article →Inflation Burns Through “Safe” Sectors – What’s Next?

Since May 2021, inflation persistently above the Fed’s 2% target has devoured our purchasing power, day by day. Making the cost of living impossible to predict and planning for the future increasingly uncertain. After a short period of cooling off, inflation is heating up again on multiple fronts. One rather unexpected price surge will make budgeting a challenge…

Full Article →The Biggest Con Job in Banking: The Savings Account

Savings accounts today offer the highest yields in 15 years. Even so, they may not be the best way to protect your savings from inflation. When the Fed raises interest rates to curb inflation, ripple effects spread across the economy. Some of the impacts are negative (especially if you owe a lot of money), but others are positive for savers…

Full Article →Insider Gold Buying Reaches New Record Level

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Global gold holdings rise to highest level since 2012, a one-way flood of gold from West to East and are we missing out on platinum’s comeback?

Full Article →Here’s Why Everyone Will Need Gold Soon

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Investment firm sounds off on gold investment in a commodities era, gold standard and why we might have been here before, and did you notice gold hit another ATH in the Japanese yen?

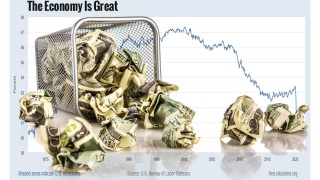

Full Article →Bidenomics Has Failed In The Worst Way Possible

Corporate media headlines like Biden’s Economy Is the Best Ever or The Bidenomics Success Story leave one big question unanswered… Who is better off? (Lest we forget, “the economy” isn’t a citizen.) Are you better off than you were thirty months, two and a half years ago?

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold’s price holding up even though interest rates keep rising, the real story of inflation, and gold remains a key asset for the new global economy.

Full Article →At the beginning of the pandemic panic, American households hunkered down, slashed spending and deposited their stimmie checks. Ever since, thanks to a combination of high inflation and “revenge spending,” consumer spending exploded to what Wolf Richter calls “drunken sailors partying hard” levels.

Full Article →The U.S. dollar has enjoyed global reserve currency status for nearly a century now. If BRICS nations have their way, that privileged status won’t last much longer. The weakness of the U.S. dollar is top of mind for all BRICS countries, and plenty outside of BRICS too.

Full Article →With all eyes on BRICS as it prepares for a meeting at the end of August that could see new members joining, the question is looming in the back of future-minded investors: will BRICS develop its own currency in a bid to challenge the U.S. dollar as the world standard?

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: U.S. credit rating and de-dollarization, China boosts official gold reserves for 9th consecutive month, and South Africa’s gold mines are under heavy stress.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Understanding why gold’s price rises despite higher interest rates, the trouble with “tokenized gold” and platinum might be the diversification asset you need.

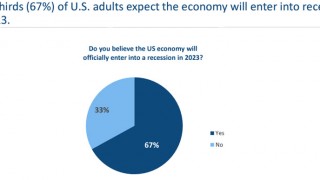

Full Article →Looking at every recession since December 1969, the economist David Rosenberg has calculated that, on average, the Leading Economic Index starts to decline 13 months before a recession begins and falls 4.6 percent before the recession begins. By that metric, we’re even deeper into the danger zone than

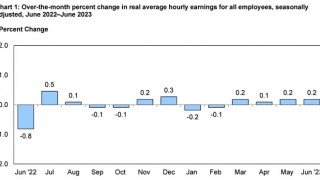

Full Article →Following the government’s panicked response to the Covid pandemic, the resulting economic devastation and two-plus years of historic inflation thus far… There is finally some good news! According to data released from the Bureau of Labor Statistics (BLS), wages are finally outpacing inflation… Or are they?

Full Article →This week, Your News to Know rounds up the latest top news stories involving gold and the overall economy. Stories include: The trend of central bank gold repatriation, analyzing gold’s headwinds, and man from Kentucky finds 700 Civil War era coins almost in his backyard.

Full Article →When you’re planning for retirement, one of the many decisions you’ll have to make is whether to contribute “pre-tax” or “after-tax” dollars. Each has its advantages, and here’s a general summary of maximizing your savings using a 401(k) plan…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Russia announces gold-backed BRICS, Larry Lepard predicts total fiat failure by 2030 and Zoltan Pozsar’s take on the new monetary world order.

Full Article →The speed at which a bank can be deemed insolvent has increased dramatically with improvements in communication and technology, which prompts businesses, institutions, and wealthy individuals to rethink ways to safely store their cash.

Full Article →Time to batten down the hatches, folks. That warning comes from HSBC Asset Management earlier this week. It could be a long recession, too. It’s not that surprising, once you take the highlights of HSBC’s into account. Even worse, chief strategist Joseph Little added a bit of context…

Full Article →If you can see beyond the mainstream media’s attempted glossing over of Biden’s failures, one topic stands out: Historic inflation since June 2021. Of course, Biden doesn’t deserve all the blame for inflation heating up. Powell’s Fed practically ignored it until the “inflation train” had already left the station.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: John Williams on why inflation is worse than presented, Poland wants more gold, and Korea introduces gold ATMs.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Five-figure gold in the long-term, the silver supply picture is worse than we know, and prices force Turkish couples to turn to imitation gold for their traditional wedding celebrations.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.