From China’s buying spree to dollar devaluation fears, gold’s surge past $3,000 may be just the beginning. As global demand explodes and trust in fiat currencies crumbles, is $4,000 gold just the new floor of a multi-year bull market? Gold’s new normal: $3,000 to $4,000 range doesn’t sound bad…

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

$3,500 gold is just the beginning. Some experts are predicting $6,000… others say $55,000 is “fair value.” What’s fueling these extreme predictions – and how reasonable are they, really? Here’s what you need to know before the next big move… Is it time to entertain some of the more extreme gold price forecasts?

Full Article →Gold just hit another all-time high, silver demand keeps breaking records, and Judy Shelton wants to bring back the gold standard. Some say it’s a rally. Others say it’s only the beginning of a historic trend… Are we ready for the next phase of monetary history? Your News to Know rounds up the most important stories about precious metals…

Full Article →One of Donald Trump’s big campaign promises had to do with bringing back manufacturing jobs to the U.S., and for a big portion of the working aged population, maybe especially in the rust belt, that is hugely important. We all saw steel, auto, and other manufacturing and related industries struggling over the last few decades.

Full Article →President Trump just declared “Liberation Day” and launched sweeping new tariffs. Investors panicked worldwide as corporations published dire predictions of the bumpy road ahead. Today we examine the pros and cons of Trump’s “Liberation Day” strategy – and reveal the secret back door to the financial bomb shelter the President left unlocked specifically for us…

Full Article →Already off to a breathtaking start this year, gold’s price continues to climb. Amid fears of a trade war and the global dedollarization drive, here’s how much higher analysts think it will go… Axel Merk, CEO of Merk Investments, said a lot in a recent (brief) segment on the relationship between the price of gold and the U.S. dollar.

Full Article →Ever since Paul Volcker took the helm at the Federal Reserve back in 1979 and ended the decade of stagflation, the Federal Reserve has played a key role influencing the American economy. Now Fed chair Jerome Powell is saying that he thinks Trump’s policies will cause prices to rise steeply.

Full Article →In his crusade against waste, fraud and abuse, Elon Musk has made some extreme claims. Earlier this week he really crossed a line, though, when he said, “Social Security is the biggest Ponzi scheme of all time.” What exactly did he mean? And, more importantly, what are we going to do about it?

Full Article →For decades, the nation basically ignored the national gold reserve. The only people who ever brought it up, were immediately dismissed as tinfoil-hat-wearing conspiracy-mongers. Whether out of concern for its existence, or just out of prudent asset management, we may soon get the first proper Fort Knox audit since the 1950s…

Full Article →The Saddest Recession Indicator I Ever Heard Of

All too often, when we talk economics and finance, we neglect the human side of the equation. GDP is about more than percentages – it’s about prosperity and confidence. Unemployment isn’t just a number, it’s real people who’ve lost their primary source of income. So, today, we explore the saddest recession indicator…

Full Article →Why Is the Fed Afraid of a Fort Knox Audit?

Your News to Know rounds up the most important stories about precious metals and the overall economy. This week, we’ll cover: Why is Fort Knox at the center of a tornado of suspicion? How to increase the federal government’s revenue by $750 billion with this one weird trick. Gold sets new records, tops $2,900 as $3,000 becomes the target in view

Full Article →Will You Get a $5,000 DOGE Stimulus Check?

Love him or hate him, Elon Musk has some truly enormous plans for slashing government waste and cutting federal spending. Trump and Musk say DOGE could return 20% of its savings to taxpayers, too! Is your $5,000 DOGE stimulus check is on its way?

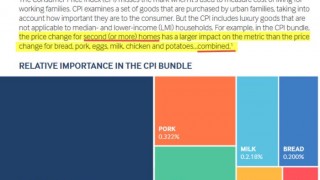

Full Article →Why Official Inflation Reports Are Dead Wrong

Recent official inflation reports are disheartening. What’s worse, they simply don’t reflect the reality faced by everyday American families. Today we take a deep dive into how inflation itself, the official headline CPI, is measured. What if we’ve been measuring the wrong things?

Full Article →Global Scramble for Physical Gold Bullion Heating Up

We’re still seeing unprecedented flows of physical gold bullion worldwide, creating logistical challenges and causing not a little market chaos. The world’s biggest bullion dealer just accepted their second-largest delivery of gold since 1994 – what exactly is going on?

Full Article →3 Reasons Why 2025 Will Be a Bumpy Ride

Every new year starts off with hope – this year, hope that we’re on the road to a real economic recovery. That would mean lower prices, affordable housing and a better standard of living. Let’s take a look at a map, and see if we’re on the right track…

Full Article →Will Trump Executive Orders Change Retirement Math?

It’s been an eventful few days since Trump was sworn into office for his second term. Right out of the gate, Trump issued quite a few executive orders and policy revisions, many with economic consequences. Let’s assess the long-term impact…

Full Article →Gold & Silver Shortages – Unprecedented Demand

The global bullion market is seeing major dislocations amidst unprecedented demand for physical delivery. Some industry experts said these disruptions may be expediting a supply squeeze in the silver market that will lead to a spike in prices…

Full Article →Goldman Sachs Forecasts Huge Shift in Gold Prices

Gold’s already had six fantastic years – dare we hope for the bull run to continue? Goldman Sachs weighs in, forecasting another two years of growing gold prices (at least). Here’s why Goldman thinks the bull run may just be getting started…

Full Article →The Hardest Retirement Math Is Also the Most Crucial

Inflation – we’re all tired of hearing about it, plenty tired of thinking about it, too. But we have to consider exactly how big a difference inflation makes in our future cost of living. And it seems like nobody knows exactly how to figure out how much today’s dollars will be worth tomorrow…

Full Article →The Secret Connection Between Bitcoin and Gold Prices

Bitcoin’s record ascent beyond $100k captured headlines worldwide. But what does this so-called digital gold have to do with the real thing? If you take a closer look, it’s plain to see that the forces driving the crypto market higher are very similar to those driving the gold market…

Full Article →How Will Trump’s Tariffs Affect Your Finances?

Trump’s Tariffs Are Coming. President-elect Donald Trump loves them. I’m not just saying that. He has literally said that he “loves” tariffs. He’s spent the last couple weeks promising steep tariffs on day one of his presidency. Here’s how much that will cost us…

Full Article →Red States Are Taking Action Against Dollar Devaluation

Lawmakers in the Lone Star State are so fed up with dollar devaluation that they’re taking matters into their own hands. Outlining a bold proposal to reinvent money – and it’s certain to have the Federal Reserve in an uproar. Here’s the opening shot in the battle of Texas versus the Fed…

Full Article →Latest Gold Survey Found Something Very Interesting

Despite two volatile weeks, $3,000 gold in 2025 is starting to seem inevitable. Meanwhile, everyday Americans are finally starting to catch on to gold’s role in diversifying their savings. Then we investigate the increasingly popular opinion that leaving the gold standard was the worst decision our nation ever made. Could we go back?

Full Article →The Jaw-Dropping Math Of Federal Government Spending

Trump’s bold economic vision seeks to return the nation to a golden age of economic opportunity. But nearly every economist will tell you that tariffs raise prices. Trump has vowed to put tariffs in place. Prices will go up – so what’s the point? Cutting $2 trillion from the federal budget may not be feasible

Full Article →Musk’s Wrecking Ball and Your Financial Future

Discover how the Department of Government Efficiency’s bold plans could reshape your financial future. With huge cuts to government spending, will inflation subside? Will prices finally fall? Or will Bidenomics prices stick around even longer? Some are scared Trump could include Social Security cuts in efforts to reduce government wastage…

Full Article →What Separates Smart Gold Owners from Speculators?

Gold sold off after Trump’s victory and the red wave – but why? What changed, even before the President-Elect takes office? There are plenty of explanations, but they’re mostly fact-free hand-waving. So what’s going on? In the short-term, same as all markets, sentiment drives gold. Greed and fear, to paraphrase Warren Buffett.

Full Article →Inflation Fire Not Extinguished Yet, Far From It

We’ve been through a lot over the last four years – and some things have gotten better. Some things are getting worse again. Inflation has been smoldering for months now, so why is the Fed suddenly fanning the flames? It’s a good question to ask, and we all want something hopeful to look forward to… but…

Full Article →How Much Will It Cost to Make America Great Again?

With Trump’s election victory and a GOP-controlled Congress, significant economic changes are on the horizon. While these policies aim for long-term prosperity, they come with significant short-term costs. Here’s a discussion of just how much these plans will affect your finances…

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.