Inflation spiked 7.1% in December, and the Fed is likely to raise interest rates already in March. Still, gold remains uninterested.

Bullion.Directory precious metals analysis 18 January, 2022

Bullion.Directory precious metals analysis 18 January, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

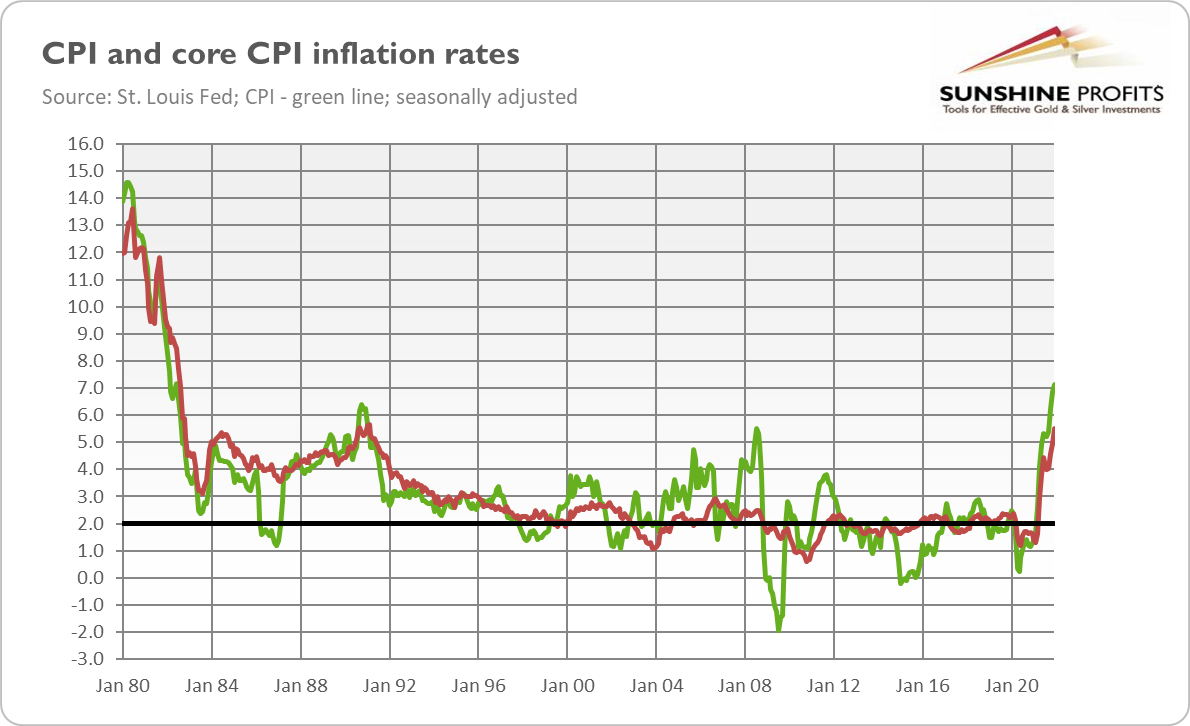

The situation is actually worse: inflation is not merely high – it’s high and still rising. As the chart below shows, the annual, seasonally adjusted CPI inflation rate spiked 7.1%, the highest move since February 1982.

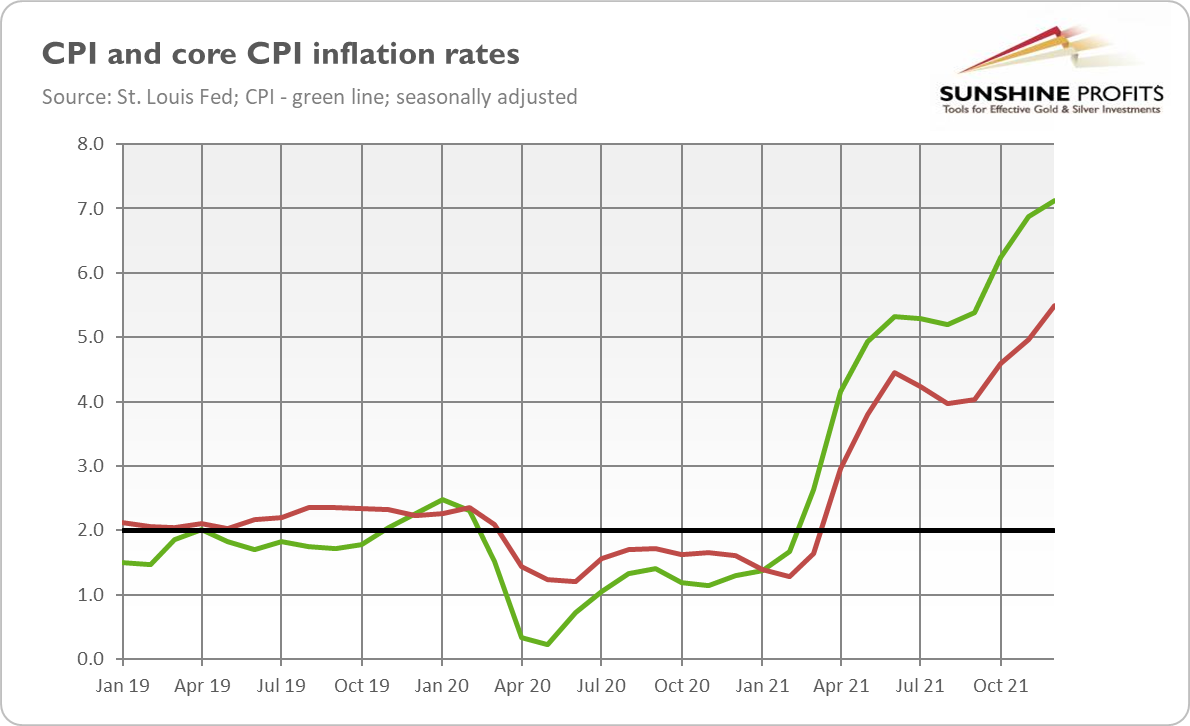

However, 40 years ago, inflation was coming down, and now, it is still accelerating. Inflation has been in a clear upward trend since May 2020, and getting worse month after month since August 2021 (practically, since November 2020, when we skip a short moderation in summer 2021), as the chart below shows.

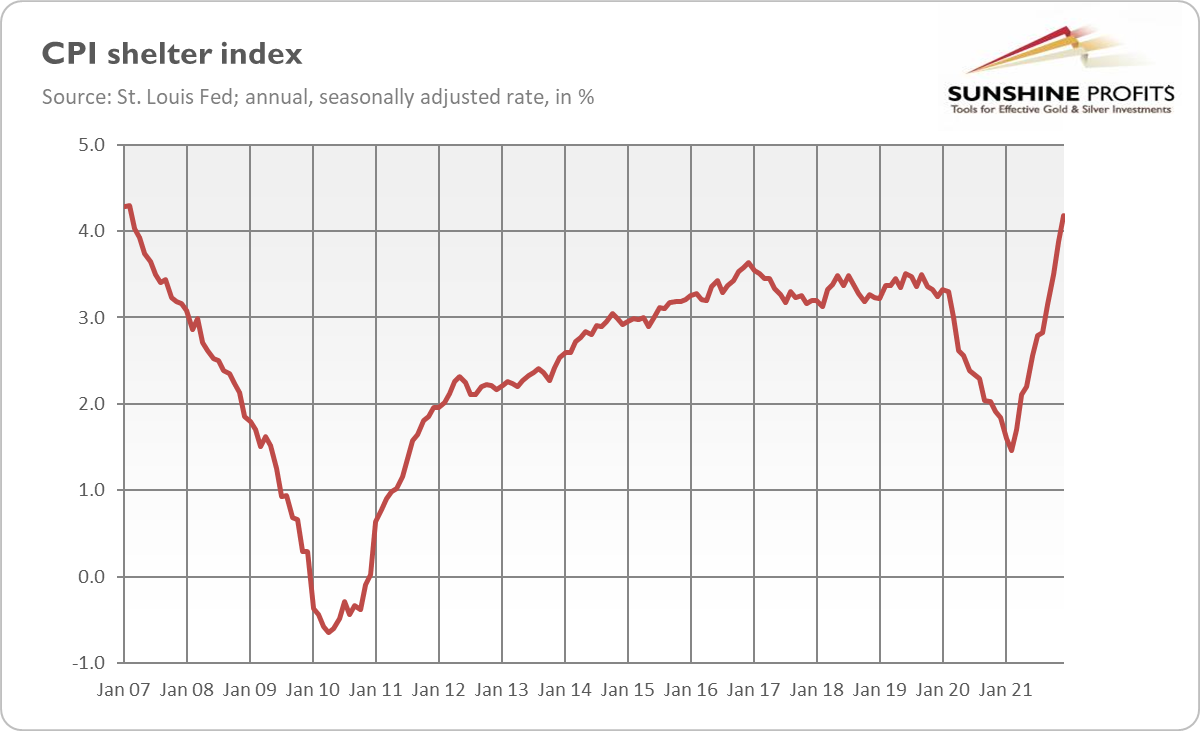

What is really disturbing is that core inflation, which excludes food and energy prices, spiked 5.5%, the highest since February 1991. It shows that inflation has moved deeply into the economy. It’s not a phenomenon caused merely by soaring energy prices – we are witnessing widespread, general inflation that covers practically all prices. For example, the shelter subindex, which is the biggest component of the CPI and is much less volatile than energy or food, rose 4.2% in December, the highest since February 2007, as the chart below shows.

Although inflation could calm down somewhat in the first quarter of 2022 or even peak amid the spread of Omicron and the recent peak in the Producer Price Index, it’s not likely to disappear quickly. Its negative impact on the economy is beginning to be felt more and more. For instance, retail sales plunged 1.9% in December, much worse than the forecasted decline of 0.1%. The drop was caused partially by surging prices that took a big bite out of spending.

Implications for Gold

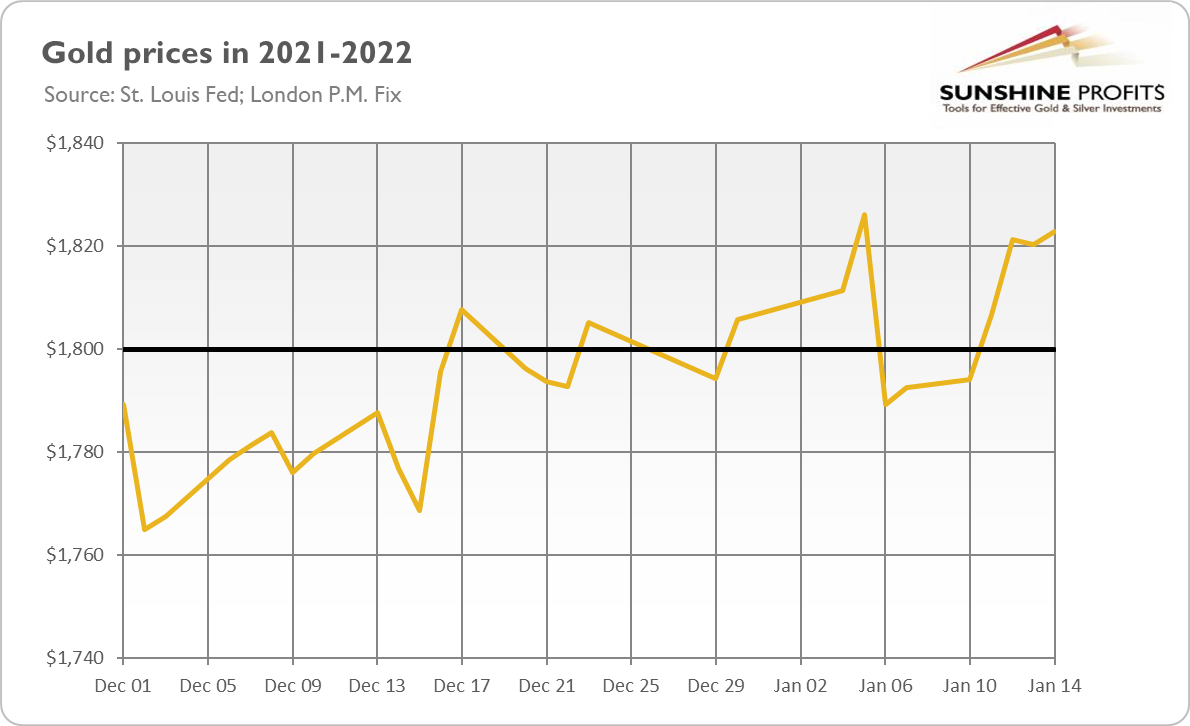

What does rising inflation imply for the gold market? Well, theoretically, the yellow metal loves high and accelerating inflation, so it should shine under the current conditions. Last year, gold didn’t perform spectacularly, but it has recently managed to rise above $1,820, as the chart below shows. I wouldn’t draw too far-reaching conclusions on this basis, but at least that’s something.

Inflation has been accompanied by an expanding economy last year and, more recently, also by the Fed’s more hawkish rhetoric. For a shamefully long time, the Fed kept refusing to deal with inflation. However, Powell and his colleagues have finally awoken. They’ve already accelerated the pace of tapering asset purchases and signaled successfully to the markets that they’ll likely start raising interest rates as early as March. According to the CME FedWatch Tool, the odds of a hike in the federal funds rate have risen from 46.8% last month to above 90% now. Hence, the lift-off is almost certain.

The prospects of more hawkish monetary policy and the sooner start of a tightening cycle should be negative for the yellow metal, but gold didn’t care too much about a more aggressive Fed. This is encouraging, but the risk of normalization of real interest rates remains.

It might also be the case that neither high inflation nor a hawkish Fed is able to shake gold out of the sideways trend right now.

Let’s be patient – it might be just the silence before the storm.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Leave a Reply