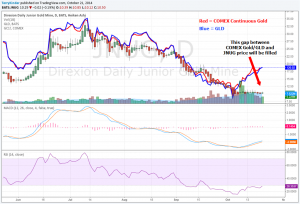

A big gap forming between the gold price and the JNUG ETF price will be filled, plus I will make a bold prediction on where my JNUG position will be sitting at the end of the week.

Bullion.Directory precious metals analysis 21 October, 2014

Bullion.Directory precious metals analysis 21 October, 2014

By Terry Kinder

Investor, Technical Analyst

Typically, the JNUG ETF price and the gold price, represented in this case by GLD and COMEX Continuous Gold, track each other fairly closely. However, this month a very wide gap has opened up between the gold price and the JNUG price. This gap, of course, could resolve with the price of gold moving lower to be more in line with the JNUG price. However, that doesn’t really make much sense does it? Wouldn’t you expect the price of junior gold miners, as represented by the JNUG ETF, to eventually rise as the price of gold moves higher? Of course, JNUG doesn’t always go up when the price of gold moves up because mining companies don’t always go up as precious metals prices go up.

The price of gold has been running away from the JNUG ETF price. That likely won’t continue for much longer.

The GLD chart shows that gold is overbought, but that doesn’t mean that the price of gold won’t go higher. There are reasons, in fact, to think that the gold price will move higher based on the chart.

Taken together, the widening gap between the JNUG ETF price and gold price, plus the strong momentum in gold as represented by GLD, it would not be surprising to see GLD continue to $121.83 or above. The continued strong momentum upward in the gold price should help lift the JNUG ETF price which is coming off extremely oversold levels.

In addition, the late day pattern of JNUG falling in price seems to be moderating or even reversing over the past few days, which could mean the price tug-of-war is beginning to be won by the longs. The recent change in the daily JNUG ETF price pattern, combined with JNUG’s price cycle, leads me to believe that by Friday the 24th my JNUG position should be net positive. Currently the position is down a little more than 8.5%, which is still better than the 11% plus it was down this past Friday.

The gap between the JNUG ETF and gold price will close, most likely with the JNUG ETF price rising rather than a decline in the gold price. I expect this to happen by the end of this week to make my position net positive. Hopefully by the end of the week I can report to you that I finally got to be the windshield rather than the bug.

Links to other investor’s diaries in this series:

Part 1

Part 2

Part 3

Part 4

Part 6

Part 7

Part 8

Part 9

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply