First, it was the crypto-focused Silvergate Bank. Then it was Silicon Valley Bank.

Bullion.Directory precious metals analysis 01 April, 2023

Bullion.Directory precious metals analysis 01 April, 2023

By Keith Weiner

CEO at Monetary Metals

Then they were gone, in a New York Minute.

Credit Suisse and the BTFP

Just when everyone starting to seek answers, and people were assuming this was a uniquely American problem, a bank failed in Old Europe. Credit Suisse, which had been wobbling for a while, fell over. In America, more specialty banks like First Republic Bank, and regional banks look like they are in trouble.

Government officials are starting to roll out fixes, like an early-stage software company releasing patches to its buggy software. The first one is the Bank Term Funding Program v7.373a from the Federal Reserve. This fix addresses the crash bugs reported by users of Silicon Valley Bank.

Like a software developer who thinks that the crash is caused by having the wrong data, the Fed thinks that the problem is that the bank has the wrong assets. It was encouraging banks to load up on long-dated Treasurys and mortgages back in 2020, because back then, it was trying to patch the previous bug in the economy, which was lack of demand due to covid lockdown. Now, it is trying to patch the bug of having too much demand, which is due to the previous patch.

Fed Bug Fix

So the Fed is offering banks to lend them cash, in exchange for collateral. This feature has been there since the OG Fed 1.0 in 1913. What’s new in v7.373a is that the Fed will lend more than the collateral is worth. It will give the banks what the collateral was worth back when the banks were buying it, under v7.29b way back in 2020.

It will charge them interest, and it says the banks will have to repay the loan and get their bonds back, but this is a big gift. Like when a software company begs users to download its latest patch and offers a free lifetime supply of coffee so bitter, that only diehard caffeine junkies would mainline it. Which is rather the real feature.

Over in Switzerland, details have not yet emerged how the government will patch the monetary system. However, they did patch the Rule of Law by offering, like a software company switcheroo of epic proportions, a patch to the Rule of Law v2022 called Rule of Men v2023. In the Rule of Men, shareholders are taken care of before creditors.

Oh well, sometimes a patch is good for some users and bad for others. Like a one-night-stand, really. Or an upgrade from Apple, which adds one feature but drains your battery.

It’s curious that the authorities were quicker to issue patches, than they were to understand the root cause. Like, well, almost any software company headquartered in Redmon, WA whose founder was notorious back in the day for his bowl haircut. Speaking of buggy patches to buggy software, the head of the US Treasury seems hell-bent on the government moving fast, and not worrying about breaking things.

The True Cause

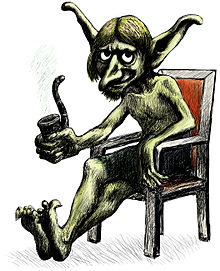

So we will go there. We will delve to the depths beneath the banks, to see what insidious, pernicious, mischievous creatures may lurk there. Yes, we said creatures.

And they are not natural creatures, either. It’s only common sense, that to cause this many bank failures all over the world, that unnatural if not supernatural forces must be at work.

Here is a picture of what we found.

Source: Wikipedia

Yes, it’s that serious. The kobolds are digging under the banks, undermining them. If they are not stopped, they will undermine the entire banking system.

The King is therefore calling a quest. Seeking a fighter and a mage, plus a thief and a cleric. All must be at least Level 12. If successful, you may keep whatever treasure and magic items you find in the kobolds’ lair, plus 1,000 gold pieces.

Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply