American household debt hit an all-time high in the second quarter of 2017, with increases in every major category, from credit cards, to student loans, to mortgages.

Bullion.Directory precious metals analysis 16 August, 2017

Bullion.Directory precious metals analysis 16 August, 2017

By Peter Schiff

Chairman at SchiffGold

The level of household indebtedness in the US now stands at 69% of US GDP.

No wonder US Global Investors CEO Frank Holmes calls debt “the mother of all bubbles.”

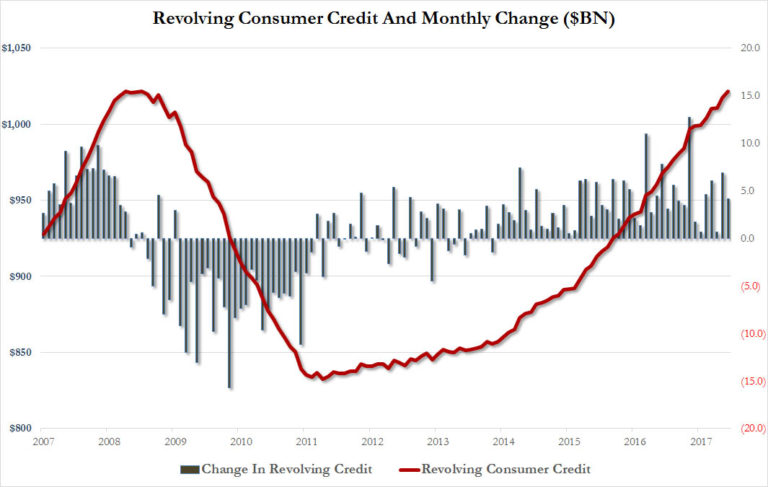

Credit card debt eclipsed a record set during the summer of 2008. Americans carry $1,021.7 billion of revolving debt. Overall, credit card balances went up $4.1 billion in the month of July alone.

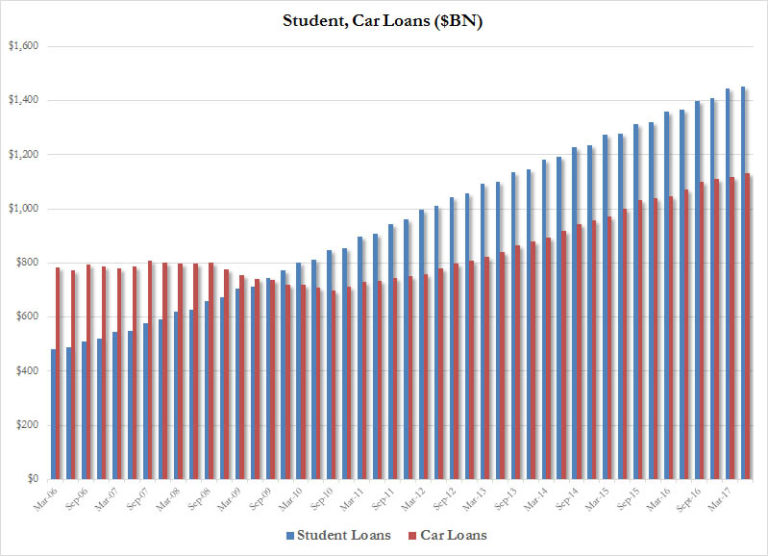

Both student loans and auto loans also hit record highs in Q2. Student debt increased to $1.45 trillion. Auto loan debt pushed up to $1.131 trillion.

Mortgage balances make up the largest component of household debt. Mortgage debt rose again during the second quarter to $8.69 trillion, an increase of $64 billion from the first quarter of 2017.

Not only is the level of debt increasing, the “quality” of that debt appears to be on the decline, as reported by Zero Hedge.

In a troubling development, the distribution of the credit scores of newly originating mortgage and auto loan borrowers shifted downward somewhat, as the median score for originating borrowers for auto loans dropped 8 points to 698, and the median origination score for mortgages declined to 754.”

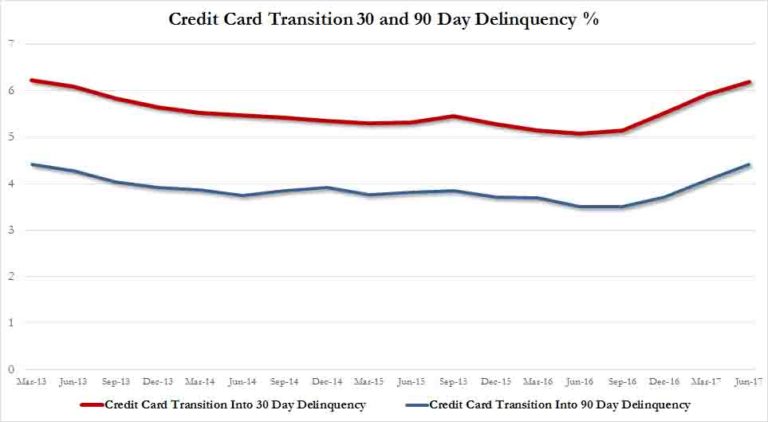

The New York Fed issued a red flag warning on credit card delinquency. The bank said both early and serious delinquencies went up from last year, and called it “a persistent upward movement not seen since 2009.”

While relatively low, credit card delinquency flows climbed notably over the past year. This is occurring within the context of loosening lending standards, as borrowers with lower credit scores recover their ability to access credit cards. The current state of credit card delinquency flows can be an early indicator of future trends and we will closely monitor the degree to which this uptick is predictive of further consumer distress.”

Zero Hedge called this “the first official warning by the Fed that the US consumer is sick.”

The Fed has no reasonable explanation for this troubling jump in delinquencies. Timestamp it, because this will certainly not the be the last time the Fed warns about the dangerous consequences of all-time high credit card debt. As for the ‘further uptick in consumer distress,’ we are just guessing but the fact that credit card defaults are jumping at a time when sales at fast food and other restaurants have declined for 17 consecutive quarters, and when $250 billion in US household savings was just ‘revised’ away, may all be connected.”

During a recent interview, an Australian economist who predicted the housing crisis said another crash is “almost inevitable” because of massive debt levels. He pointed out debt is not just a problem in the US. Household debt in the UK stands at 160% of GDP. It doesn’t appear it would take much to pop this massive bubble.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply