John Williams: When inflation is really this bad, you need physical gold

Bullion.Directory precious metals analysis 26 June, 2023

Bullion.Directory precious metals analysis 26 June, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

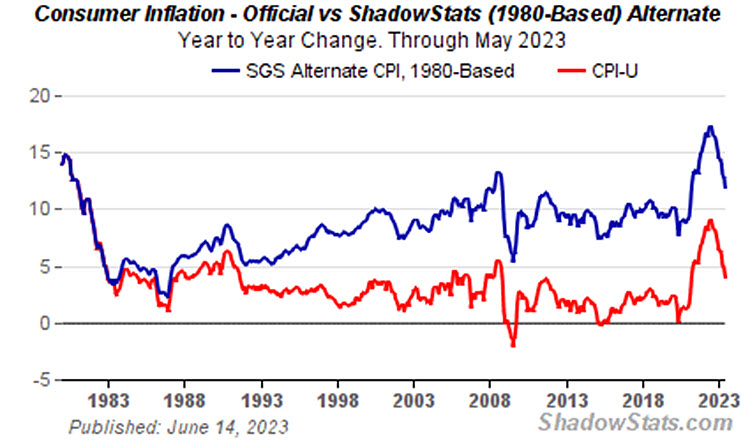

The result? Inflation is officially understated by a factor of 2-3…

“Official” inflation is under 5%, although the more accurate 1980s-based measure puts the actual rise in our cost of living closer to 12%. Courtesy of ShadowStats

(Ask Dr. Ron Paul, who’s seen the sausage made on the inside, and he’ll tell you official inflation reports are nonsense. )

This recent interview with John Williams discusses inflation, the U.S. economy and economic indicators, assets and more. It’s a great listen! Here are the highlights:

Williams explained the recent program of interest rate hikes by the Federal Reserve, and outlined the many layered problems with them. The hikes were intended to cool the economy a bit, under the presumption that a red-hot economy is inflationary in nature. This, Williams points out, is simply absurd. Corporate earnings have been in the red this year, the housing market has collapsed and most sectors aren’t growing.

In case anyone needed reminding, Williams notes that inflation came about only and solely due to the printing and pumping of trillions of dollars into the economy. Rate hikes aren’t just a temporary solution: they’re more psychological than anything. Both Williams and the host believe that the situation is far worse than that of the 1970s, a claim many analysts are increasingly comfortable making these days.

Williams advocates physical gold ownership for reasons past just wealth preservation: he likes the metal as a bartering tool, one that could very well become necessary down the line depending on how the situation unfolds.

He mentioned the Weimar Republic, citing accounts from people who lived there, that are downright bizarre. Yet Germany was a strong economy before and after Weimar. It bounced back, which means the U.S. can too, even if the U.S. dollar collapses. And that’s perhaps the most concerning prospect for U.S. citizens in all of this.

A Weimar period in the U.S. has been made conditional by observers with a total collapse of the U.S., more or less. That’s why nobody can believe it. But if we instead view hyperinflation as a come-and-go thing in the U.S., where we might suffer years or decades of neo-Weimar before bouncing back, it’s a far more plausible scenario. Let us also not forget that more quantitative easing is being mentioned already as a way to offset this hiking schedule in case there are still dollar optimists around.

Central bank gold buying update: Poland buys tons of gold (again); analysts ponder Hungary’s case

When Hungary and Poland bought tons of gold some years back, we weren’t where we are now. Poland’s government said it reaffirms the nation’s clout on the global stage, a message that was almost strange back then. Some five years ago, large gold buyers were countries like Russia with obvious motivations and reasons. That made Poland’s comments stand out.

Just a few years later, we find ourselves in an environment where central bankers are no longer trying to keep up appearances, so to speak. Buying the most gold since 1950 during a global inflationary period sent quite a few signals to the markets, but also to the average person. It was a flip from “gold is a thing of the past” to “whoever owns the most gold makes the rules” by the official sector. And it told currency holders that the paper bills might not have as much value as previously advertised.

Having been two of the “stranger” news stories about central bank gold buying back then, it’s quite fitting to have Hungary and Poland once again making headlines. In Hungary’s case, this analysis points out some curious numbers. The country had just three tons of gold in 2018, which became 94.45 tons by early 2021. Notably, these purchases came before the latest record-setting trend of gold buying truly started. Now 2023 is starting to look like a new record year for central bank gold buying…

Poland is doing its part, adding nearly 15 tons of gold to its stockpile in April. It’s the largest increase since 2019, when the central bank bought nearly 100 tons, and back then they said they planned to buy another 100 tons.

It’s quite the interesting detail that this quote by Bank of Poland President Adam Glapiński came in the fall of 2021, before we heard anything noteworthy about Russia’s invasion, U.S. dollar weaponization and BRICS:

Gold will retain its value even when someone cuts off the power to the global financial system, destroying traditional assets based on electronic accounting records.

Not only is this true, it’s possibly the best one-sentence description of the importance of diversifying with physical gold.

South Korean gold ATMs ignite new gold rush

We’ve previously covered how India introduced gold ATMs on a fairly small scale. Though very gold-favoring, India is large and highly rural, which perhaps made some wonder how much such an idea will take off.

South Korea is, in many ways, the opposite of India. Much smaller, highly industrialized and not exactly known for having gold as part of its culture. Yet GS Retail, the issuer of gold ATMs in Korea, revealed that it’s sold $19 million in gold bars (at just five locations!) since introducing the vending machines nine months ago.

Folks, that’s about $70,000 in gold sold every day – 18.3 million Korean won deposited daily in each of the five gold vending machines.

Logistics must be an issue! How often do they need to restock those machines?

Despite their popularity, these vending machines don’t offer much of a product selection, though: “five types of gold products ranging from 1.875 grams to 75 grams, along with commemorative coins” (that’s about 0.6 – 2 troy oz if you can’t be bothered to do the conversion).

Why so popular? Inflation is cited as the obvious reason — by itself, though, that’s not a satisfactory answer. South Korean inflation is at 3.3% currently after peaking at 6.3% in July 2022. This official statement by the company hints towards other motivations:

People in their 20s and 30s appear to be the main buyers, purchasing physical gold as an investment vehicle, especially in times such as these, when its value is continuing to rise.

The company believes that this kind of “gold delivery” isn’t just attracting investors with intent, but that some of the popularity is simply due to convenience. It’s a point that might be hard to argue, and GS Retail plans to have 50 vending machines in the country by year’s end.

With every passing day, failing fiat currencies have more and more competition… Any day now, I expect to see a vending offering 400 oz. gold ingots for the convenience of central bankers, too.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply