The Real Reason the U.S. Is So Slow to Fight Inflation

Bullion.Directory precious metals analysis 20 January, 2023

Bullion.Directory precious metals analysis 20 January, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

But when the U.S. government spends beyond its income, that doesn’t happen. It’s a mistake to think about government spending the way we think about our own household spending. The primary difference is a concept known by economists as modern monetary theory (MMT):

monetarily sovereign countries (such as the U.S., U.K., Japan, and Canada) which spend, tax, and borrow in a fiat currency that they fully control, are not operationally constrained by revenues when it comes to federal government spending.

The shorter and simpler version:

Sovereign governments that print their own money essentially never go bankrupt, no matter how much they spend. When you control the supply of money, bankruptcy is impossible.

…well, technically, you could run the printing presses at full-throttle and still need more currency than you can make– but even that’s a solvable problem, as Argentina proved a couple of years ago:

As government spending soared to cope with the crisis, and revenue plummeted, the Central Bank of Argentina cranked up its printing presses. But even working at 100% capacity, the presses can’t print enough money, so Argentina is using its foreign reserves to ship in banknotes from abroad.

See, paper and ink aren’t expensive! So when Argentina needed more money than it could crank out itself, they simply hired overseas printers to take up the slack!

Now, obviously there’s a cost associated with all this, and I don’t mean the expense of fancy paper or shipping container-loads of fresh banknotes across the ocean.

Here’s the issue: all that newly-printed currency dilutes the money supply. More cash in circulation means the price of goods and services rises, just based on simple supply and demand.

I’ve said it before and I’ll say it again:

Printing money doesn’t create wealth – it just devalues money.

Okay, everything we’ve discussed so far is pretty obvious, Econ 101 stuff. I appreciate your patience in sticking with me.

Now I’m going to explain exactly why “monetarily sovereign countries” who control their nations’ money supplies pursue these reckless and economically destructive policies.

The truth is, what’s bad for citizens like me and you is actually great for the government.

Why governments love inflation

Inflation is a tax that no one votes for. “Tax” is not an inaccurate word here! Because inflation redistributes wealth from ordinary citizens to the federal government.

Let me explain. Actually, I’ll let Paul H. Kupiec, a resident scholar at the American Enterprise Institute, a specialist in systemic risk and banking regulations do the explaining:

Because the federal government is a massive borrower, unexpected inflation causes a large transfer of wealth to the federal government from the households and businesses that provide it credit. [emphasis added]

How, exactly does this work?

Well, two ways.

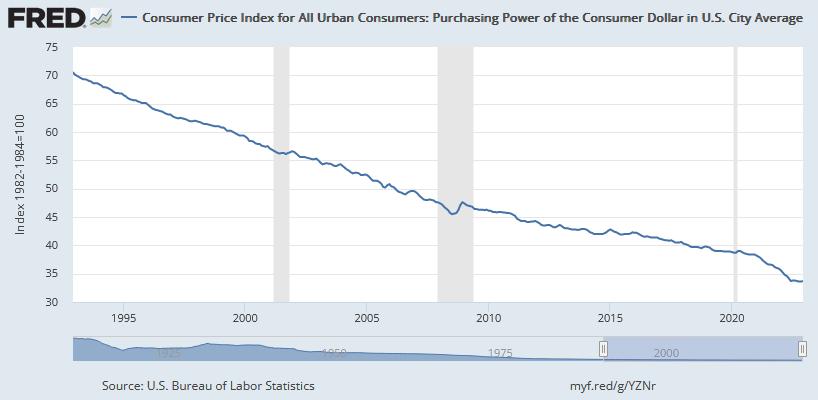

First, printing new dollars lowers the value or purchasing power of every other dollar. That means the government can pay off a 30-year Treasury loan with new dollars that have significantly lower purchasing power than when the loan was made. Take a look:

This chart illustrates a cruel fact: when you loan the government money by buying a Treasury bond, you get repaid in depreciated currency. Every dollar today buys less than half as much as it did in 1992.

Second, and much simpler – as Kupiec points out, the IRS taxes “nominal income and historical-cost-based capital gains without adjustments for the impact of inflation.” (“Nominal” here means in name only, in other words, based simply on quantity of dollars rather than the purchasing power of those dollars.)

Imagine your employer automatically gives you a cost-of-living increase every year, based on inflation. Do you have more money? Yes, you do. Do you have more purchasing power? Does this larger quantity of cash enable you to acquire more goods and services? No, it does not.

The IRS doesn’t care! Should that cost-of-living adjustment push you into a higher tax bracket, guess what? You’ll owe more taxes – even though your purchasing power hasn’t increased.

While we’re stuck paying 40% more at the pump and twice as much for a dozen eggs, the government gets a break on the debt racked up through reckless borrowing and spending.

Here’s how Wolf Richter describes this dynamic:

Inflation means that government tax receipts are spiking, thereby lowering the burden of paying for the existing debt, thereby allowing the government to borrow more because the burden of the old debt gets extinguished by surging tax receipts due to inflation, which is why governments love inflation.

Essentially, as citizens of a sovereign country that can borrow and print an infinite amount of dollars, we’re trapped in a Catch 22 situation.

Heads we lose, tails we lose

Here’s a quick recap of the last few years…

While rates were near zero, as they were for pretty much the last 14 years, the Fed was trying to “stimulate the economy.” This effort cost American savers $4 trillion, as Ron Paul explained back in August.

Eventually, the combination of an over-$30 trillion debt, money-printing and suppressed interest rates caused inflation to spike. Once prices breached 7% year-over-year increases every single month from December 2021 to June 2022, the government could no longer get away with ignoring inflation.

By May 2022, inflation had become the “top problem facing the country today,” according to voters.

Something had to be done.

So President Biden wrote an op-ed for The Wall Street Journal. And the Fed launched its too-little-too-late baby-steps inflation rate hikes – not fast enough. Why such a slow pace?

Now you know why! Because inflation increases government revenues and makes debts less expensive.

This also explains why governments around the world, from such culturally diverse nations as Japan, Turkey and the U.S. are in love with Modern Monetary Theory. They want to believe that racking up infinite debt is a good idea! That “spend all you want, we’ll print more” is a reasonable way to run an economy!

Who pays the price? I do. You do. Every saver and taxpayer, everyone who has a dollar pays the price.

But don’t call it a “tax” – oh no, that’s politically unpopular. Instead, call it “the economic policy choices we make today” to create “a sustained recovery that benefits all Americans,” like the President did.

And if you find yourself asking, “Am I better off today than I was two years ago? Five years ago?” Well, you have a choice.

You can trust the government knows what it’s doing, and will take care of you.

Or you can take matters into your own hands.

Money the government can’t meddle with

Whether or not the government actually wants inflation to continue for the reasons we outlined above, it’s very likely, based on historical precedent, that inflation will stay high for much longer than anyone acknowledges. The Fed seems incapable of raising rates fast enough to combat it.

Remember, Paul Volcker had to raise rates to twice the level of inflation to finally get it under control. Compare to today: 6.5% inflation and a Fed funds rate of 4.33% – that’s a big gap to close, isn’t it?

Meanwhile, those of us saving for retirement are stuck. We face both devaluation of our savings (with even the best rates on money market funds, CDs and savings accounts yielding less than inflation destroys) and higher taxes.

Personally, I’m not one to have faith that the government will figure out a way to navigate this mess. If you share my perspective, there are a few things you can do to create a more stable financial future for yourself and your family.

- Investigate inflation-resistant investments.

- Ensure your savings are well-diversified, and whether a safe haven like physical gold would help you meet your goals.

As you might expect, I’m a big fan of investing in physical gold and silver. The idea of knowing that my savings are secure in a tangible, historically-recognized and universally-accepted form of money – better still, a form of money the government can’t debase – has provided a great deal of security over the years.

After all these years of writing about the economy, I’d probably have ulcers or worse if I didn’t know for sure that part of my savings are completely safe from government meddling.

Listen: if you’re also stressed about the economy and taxes and incompetent politicians (and the debt ceiling, and recession…) maybe you could also benefit from diversifying your savings with physical precious metals. If you’re interested, you can learn more here.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply