It’s Monday’s precious metals update – and a look at the U.S. Dollar

Bullion.Directory precious metals analysis 6 October, 2014

Bullion.Directory precious metals analysis 6 October, 2014

By Terry Kinder

Investor, Technical Analyst

Rob Kirby thinks the U.S. Dollar may be about to go Supernova. Is he correct or does our precious metals update and look at the dollar say something different?

Image credit: ESA/Hubble

Morgan basically said that as the upper levels of the pyramid collapsed there would be a run to the dollar before the dollar also collapsed, leaving only gold and silver standing.

Kirby, made the analogy of a dying dollar being like a Supernova that, just before it collapses, gets brighter, then explodes. The implication being that current dollar strength will look solid right up until the moment the dollar, which unlike a Supernova, will collapse.

So, what do the comments of Rob Kirby and David Morgan have to do with this precious metals update?

Their comments on the dollar are quite relevant actually. Both, while perhaps not stating it outright, seem to imply that the U.S. Dollar may continue to run up strongly right before it collapses.

My opinion is that they are late to the party, as far as this run up is concerned, and the dollar is getting close to peaking. Rather than the current dollar rise being a sign of impending doom, it is instead just part of the normal cycle of prices seen everywhere in commodities, currencies, stocks, bonds, etc.

Precious Metals Update:

Last Friday, we took a look at the price of gold and the U.S. Dollar. Using the chart below we determined that the dollar was likely nearing its peak.

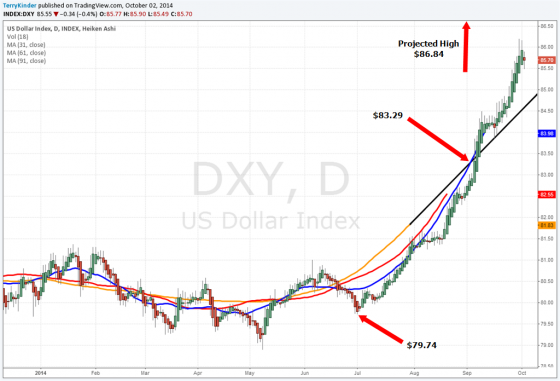

Precious Metals Update: The climbing US Dollar has acted to drag the silver price lower. However, by utilizing displaced moving averages, we can project what the dollar high will be. The projected high for the DXY is $86.84. Should this prove to be the point where the dollar reverses lower, it could allow a silver price trend reversal to occur.

So, $86.84 is our projected pivot high (or at least interim high) for the dollar. This value is very close to the high of $86.64 made on October 3rd. Since our calculations are not exact, we should make some allowance for error. If we allow a 3-5% allowance for error, then our projected price could be as high as $89.44 – $91.18.

As this is being written the dollar is now below $86.00 after having been as high as around $86.70 yesterday.

Precious Metals Update: The price of gold has fallen from $1,346.80 in July to around $1,200.00 on October 3rd. Using displaced moving averages, the projected pivot low (or interim low – we can’t really know until we’re able to look back in time) for gold is $1,168.80.

Moving on to the gold price, here is what we said:

So, $1,168.80 is our projected pivot low (or at least interim low) for the price of gold. This value is not too far from the $1,191.00 level reached on October 3rd. Since our calculations are not exact, we should make some allowance for error. If we allow a 3-5% allowance for error, then our projected price could be as low as $1,110.36 – $1133.74.

As this is being written, the spot price of gold is around $1,207.00, up over $16.00 for the day.

Silver has fallen from it’s pivot high at $21.52 to below $17.00. While predicting the low price can seem a bit like trying to catch the proverbial falling knife, there is reason to think that a silver price trend reversal might be in the cards.

The final piece of our precious metals update is silver.

In the case of silver, we estimated the pivot (or interim) low price of silver to be $16.46, although allowing for error said it was possible we could see $15.46 or $14.46.

Obviously, that is a big percentage difference if we’re looking at $16.46, $15.46, or $14.46. Given dollar seasonal trends, it seems reasonable that the dollar may be at, or very near its high level for now.

On Friday, silver hit $16.64 and has since moved higher.

Today’s Precious Metals Update Conclusion:

Despite talk of the U.S. Dollar going Supernova or Exter’s Pyramid collapsing and wiping out the dollar, it appears that what we may instead be seeing is an orderly dollar retreat much in line with the normal cycles of commodities, stocks, currencies, etc.

The dollar is currently moving lower after what looked like an unstoppable march higher. Gold and silver, left for dead once again, appear to be showing signs of life. However, we should probably be cautious and continue to watch the interaction between the dollar, gold and silver.

We might well be seeing light at the end of the tunnel for gold and silver. Let’s hope our luck is better than Wile E. Coyote’s and that what we’re seeing is light and not a train.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply