CACHE Gold’s gold-backed crypto tokens are causing quite a stir – so in this interview with Brian Hankey CACHE’s Co-Founder, I look at what’s making this particular ERC-20 token so appealing to gold’s biggest fans

Full Article →Anyone who is planning to buy bullion and waiting for premiums to drop might want to grab the opportunity now in case prices soon zoom higher.

Full Article →Gold is a BUY as Second Covid19 Wave Hits Stocks

GOLD PRICES dropped Monday in London as European stock markets and crude oil tumbled amid widening reports that a second wave of the deadly novel coronavirus pandemic is taking hold.

Full Article →GOLD and SILVER PRICES edged back from 1-week highs in London trade Thursday, but kept half of last night’s 1.7% and 3.4% spikes against a falling US Dollar after the Federal Reserve gave a dire forecast for the world No.1 economy’s recovery from the Coronavirus pandemic and shutdowns.

Full Article →David J Mitchell: Investing During a Crisis

We’re in the grip of a severe deflationary collapse, widely predicted ahead of time. This has been an ongoing development and has been picking-up speed since the major cycle turn of December 2015. Hard data actually points to the major cycle turns between 2002 and 2003 when data…

Full Article →GOLD PRICES recovered more of last week’s 2.6% plunge in Asian and London trade Tuesday, rallying to what was a new 7.5-year Dollar high in April at $1715 per ounce as industrial commodities fell back, longer-term interest rates fell, and world stock markets retreated after Wall Street’s S&P500 index of US corporations rose back to New Year 2020’s level

Full Article →Though the proposed program remains popular with collectors, the bill never gained much support in Congress. Just before the year ended, the Congress passed the Law Enforcement Commemorative Coin Act and earlier in the year it passed the Christa McAuliffe Commemorative Coin Act.

Full Article →The price of silver dropped to $12.02/oz on March 18th and gold bottomed at $1,473/oz. The bullion banks – notorious for their concentrated short positions – might have made a killing. But that isn’t what happened…

Full Article →GOLD PRICES sank to 4-week lows at $1681 per ounce in London trade Friday, losing over $45 for the week as major government bond prices also fell, pushing interest rates higher, following a shock jump in the US government’s employment estimate.

Full Article →Just when it seemed as though we were on a path to reopening and gradually returning to normalcy… just when the prospects of panic-induced social unrest seemed to be behind us… America’s cities erupted into flames.

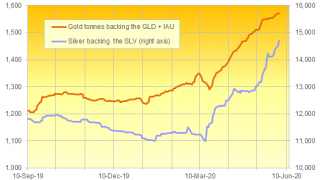

Full Article →GOLD and SILVER prices slipped and rallied in London trade Wednesday after the two precious metals’ largest New York-listed ETF investment trusts expanded for a 5th session running.

Full Article →Protests egged on by the legacy media quickly devolved into large-scale riots and looting over the weekend in more than a dozen U.S. cities. Some important institutions have betrayed the public trust, and Americans facing quarantine and staggering unemployment have arrived at the boiling point.

Full Article →GOLD PRICE gaps between London and New York whipped violently once more on Thursday, cutting what was a $100 premium for Comex futures contracts in March to a $10 discount per ounce as US warehouses continued to see fresh deliveries.

Full Article →The Virus, the economic lockdowns, and the multi-trillion-dollar rescue efforts of central bankers have dominated markets over the past three months – but as lockdowns gradually lift and the 2020 election draws nearer, investors will begin to focus more on political developments.

Full Article →Within 5 days of the assassination of President John F. Kennedy, U.S. Mint Director Eva Adams authorized work to begin on a new silver half dollar with a likeness of the slain president.

Full Article →From today, all user reviews added inside Bullion.Directory will create an automatic weekly entry into our new Review Rewards Prize Draw. Each week one reviewer will be drawn at random and win a 1oz Silver Britannia bullion coin!

Full Article →GOLD PRICES rallied on Friday in London, cutting the week’s earlier 1.5% drop against the US Dollar to just 0.5% as Western stock markets struggled again despite fresh government and central-bank stimulus to boost the world’s post-Covid recovery as relations worsened further between the top 2 economies, the US and China.

Full Article →Bullion Shark is proud to announce its sweepstakes for a 2020 (P) Emergency Issue Silver Eagle PCGS MS70 First Strike. One lucky winner will receive the most popular Silver Eagle of the year – with a $229 value!

Full Article →The silver market is on the move. In fact, it’s finally moving out ahead of other precious metals and showing some real leadership. The question for investors now is whether the recent rally in silver is fleeting or sustainable

Full Article →SILVER PRICES erased the last of this spring’s Covid Crisis plunge in London trade on Wednesday, very nearly recovering the US Dollar level of New Year 2020 as gold snapped 2 days of gains to fall back to last week’s closing price.

Full Article →GOLD ETF prices steadied with bullion quotes in London on Tuesday, trading at the equivalent of $1733 per ounce after dropping hard from fresh multi-year and new all-time record highs against the world’s major currencies on news of a potential medical breakthrough in stemming the global pandemic

Full Article →Next year, when the series turns 35, there will be a new reverse design on bullion versions of the American Gold Eagle that will also feature state of the art anti-counterfeiting measures that are being developed.

Full Article →Unfortunately, shady coin dealers are out in force, trying to capitalize on our current financial situation. We can see it in the proliferation of these dealers advertising on TV and radio with their celebrity spokesmen…

Full Article →Bleak Outlook Sees Gold Hit New Records

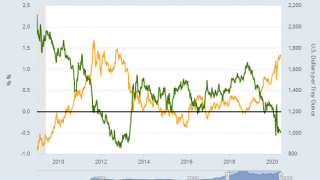

GOLD PRICES climbed to the highest US Dollar value in nearly 8 years and set fresh all-time highs against most other major currencies on Monday as central banks warned of a protracted economic slump from the Virus Crisis, with more ‘extraordinary’ monetary policy needed to offset it.

Full Article →GOLD BULLION headed for new record weekend finishes for Euro and UK investors on Friday, challenging 8-year highs in US Dollar terms as world stock markets rallied against new record lows in medium-term US interest rates.

Full Article →Foodflation is registering at the checkout lines of your local grocery store – and in a bigger way than has been seen in decades. Many bullion dealers are also struggling despite surging demand for their products…

Full Article →There are almost as many different ways to collect Silver Eagles as there are coins in the series, which now number over 100 different issues. So where do you start?

Full Article →Gold and silver markets are inching closer to embarking on new uplegs. Silver outperformed last week and appears to have the momentum behind it to lead a fresh precious metals breakout.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.