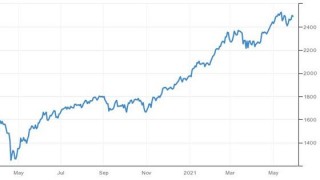

Gold to Test Major Uptrend; Fed to Remain Behind Inflation Curve. Battered gold and silver markets face a test of their bull market prospects. For gold, a bullish trendline has been in force since late 2018

Full Article →The economic shock of the COVID-19 pandemic has forced many retirement savers to reevaluate their plans. That isn’t surprising, because the global economy tanked in late February, and that’s bound to have financial consequences.

Full Article →The halfway point of the year is quickly approaching. Dwindling confidence and concern over the direction of the country along with rising inflation expectations continue to drive strong demand for physical gold and silver…

Full Article →The last time the Fed was noticeably hawkish was back in August 2018. Starting October 3 of that year, the market imploded (you might remember the Dow losing 5,000 points). Now there could be a “second verse same as the first.”

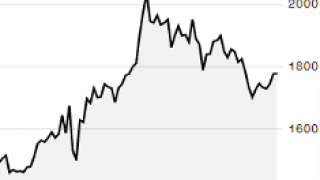

Full Article →GOLD and SILVER split on Friday, with the yellow metal failing yet again to hold above $1900 per ounce as its more industrially-useful cousin set its highest weekly close since last August’s 7-year high.

Full Article →Based on benchmark stock market index’s recent performance, all seems well and good for risk assets – but underneath the surface, however, warning signs are flashing for investors in financial markets. Over the past several weeks, significant selloffs have occurred that may serve as leading indicators of trouble ahead.

Full Article →Gold price holds onto bullish level as markets brace for data reports. After breaking out of its months-long trading range and heading off towards $1,900, many analysts believe that the bullish moves in the gold market are just beginning…

Full Article →Taper talk from the Federal Reserve is back in focus. But for now, it’s all talk and no action. Last week, former New York Fed President William Dudley said the central bank will begin the process of tapering – winding down its monthly asset purchases – by year end.

Full Article →One source revealed that as much as 1 million ounces of gold recently left the BoE’s vaults at a premium between 30 to 40 cents, a figure that normally doesn’t exceed 20 cents “during normal circumstances.” Elevated central bank buying seems to indicate some skepticism about economic recovery.

Full Article →The typical investor buys stocks for the long haul. It might be because financial advisors are just as unquestioning, knowing they are rarely criticized for following the herd. Sadly, mainstream advisors still snicker whenever a client brings up gold – even though the naysayers have been wrong about gold for 20 years.

Full Article →Heading into Memorial Day weekend, American motorists will see the highest prices at the pump since 2014, according to the AAA. Gas prices now average $3.04 a gallon nationally – reflecting a jump of more than $1.00 compared to the same time last year.

Full Article →Unless they secure a requested extension, European banks will have to comply with Net Stable Funding Requirements by the end of June. Along with other effects, these regulations could make trading in the gold and silver derivatives markets less profitable to them.

Full Article →As The Daily Reckoning contributor Jim Rickards notes on Zero Hedge, the worst-case scenario for gold appears to be running its course. It’s often stated that the stock market is gold’s primary competitor, but the inverse correlation between the markets has been absent for some years.

Full Article →This week has been truly brutal for the entire cryptocurrency sector, with the prices of major currencies like Bitcoin and Ethereum crashing at least 30%. The overall sector has shed trillions of dollars in value. The recent carnage for holders of digital currencies could be due to many factors including profit taking spurred by Elon Musk.

Full Article →The Pros and Cons of Diversifying Your Retirement Portfolio With Proof Coins: Even today less than honest bullion dealers are regularly sanctioned by the government for taking advantage of naive investors and selling proof coins far above market value…

Full Article →These “Fedcoins,” according to The Economist, “are a new incarnation of money. They promise to make finance work better but also to shift power from individuals to the state, alter geopolitics and change how capital is allocated.” But perhaps more importantly, “Fedcoins” could signal the beginning of an abandonment of the U.S. dollar

Full Article →GOLD PRICES hit and rallied from 1-week lows Thursday in London, falling within $10 per ounce of $1800 as crypto currencies sank and global stock markets extended yesterday’s steep drop on Wall Street following news of the strongest ‘core’ inflation in the USA for 25 years.

Full Article →As the Biden administration showers the nation in debt-funded handouts and federal bailouts, new concerns are emerging as to the likelihood of a “Great Reset” in the value of our currency. However, this potential dollar rout has been in the making for many years.

Full Article →There has been no shortage of stories of big-name investors touting or turning to gold over the past few years, and especially over the course of last year as the Federal Reserve sparked widespread inflation concerns with its multi-trillion-dollar stimulus.

Full Article →The yellow metal gained over $20 per ounce on the news. The jobs report was a major piece of economic data-possibly the most important of the month.

Full Article →Why do portfolio investors typically spread risk across different asset classes like stocks and commodities? This is the most basic form of building a diversified portfolio, with investor’s aim being to minimize risk and maximize gains.

Full Article →Is it a temporary blip… or the beginning of a long-term trend? That’s the key question facing consumers, investors, and retirees when it comes to inflation.

Full Article →Strong demand for bullion products amid tight market conditions and unprecedented “stimulus” measures from Washington have lots of people asking lots of questions. Here we will answer a few of the most pressing questions currently on the minds of precious metals investors.

Full Article →The simple rule is: Don’t listen to WHAT people say, but HOW they say it. Already 50 years ago the Mehrabian model concluded that words only convey 7% of a message, body language accounts for 55% and tone of voice delivers 38%. That is why you should never focus on the words of a speaker since they are the least important.

Full Article →Many traders, investors, and momentum players will closely examine the market trend to determine if and when to enter or exit the market. A market with a strong technical foundation can launch to dizzying heights, while a market displaying weak technicals will have a tough time putting together any sustainable upside.

Full Article →Ronan The Destroyer’s Fight Against Metals Market Manipulation

Ronan Manly – aka Ronan the Destroyer – is one of the industry’s most outspoken critics, regularly releasing in-depth research examining the institutional corruption, market manipulation and shady practices at the heart of precious metals trading.

Full Article →Is Bitcoin Losing its Luster?

Prices for the cryptocurrency have slid from a high of over $64,000 on April 14th to under $48,000 in trading this past weekend. The 25% sell-off would be akin to a crash in the S&P 500. But for crypto markets, that kind of volatility is fairly routine.

Full Article →Will Biden’s ‘Green Reset’ Be Great For Silver?

As top officials around the world convene this week for a “climate summit,” President Joe Biden’s administration is planning the most radical expansion of government’s role in the economy since FDR’s New Deal.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.