Given that not a single banker went to jail in the aftermath of the GFC, any actual time behind bars for the JP Morgan trio of Michael Nowak, Gregg Smith and Jeffrey Ruffo would send a powerful message to major commercials with heavy paper shorts on the COMEX.

Full Article →Bloomberg recently did a fairly comprehensive report on insider trading of precious metals by traders (most notoriously) at JPMorgan, and other large banks as well. JPMorgan pled guilty in 2019 and paid over $920 million to settle charges…

Full Article →“When will the US Fed pause or reverse and ease rates?” is quite simply most important question in global finance. This question is not simply one of US interest rate impacts, US inflation or US financial markets plunging off the back of all that liquidity being removed.

Full Article →March of this year, Merryll Lynch disclosed an investment thesis called FAANG 2.0. It’s a fascinating idea and gold plays a prominent role. Why is gold considered a safe-haven asset? The answer is simple but profound.

Full Article →After going essentially straight up for more than a year, the Dollar Index chart is now looking extremely overbought. The Federal Reserve note may be due for a retracement against its foreign counterparts. That will likely spark a rally in metals markets.

Full Article →Any discussion of gold’s price action must inevitably look at what’s happening in China, easily the worlds largest buyer of the precious metal. The softness of the metals price of late has many scratching their heads amid rampant inflation and a war.

Full Article →Bears Mauled Market But Not Gold

The bears awoke from their winter sleep and took control of Wall Street. However, they haven’t conquered the gold market yet! It’s official: there is a bear market in equities! We can firmly state that bears took control of Wall Street for the first time since the pandemic crash.

Full Article →Households Sacrifice Retirement Contributions to meet Cost of Living Increases. As inflation has forced Americans to slash retirement plan contributions, trillions of dollars have been wiped from 401(k)s and IRAs.

Full Article →Something has happened which has not occurred since 2009. The silver basis—our measure of abundance of the metal to the market—has gone way under the gold basis. This means silver is less abundant to the market than gold.

Full Article →New technology has shown billions of dollars worth of gold perfectly preserved on the floor of the Caribbean Sea. Some experts believe there to be at least 200 tonnes of gold, silver and emeralds in the legendary San Jose galleon shipwreck

Full Article →Fed Afraid of Inflation and Tightens Hawkish Stance

Yesterday the FOMC published the minutes from its last meeting, held in mid-June. Although the publication reveals no major surprises about US monetary policy, it shows rising worries within the Fed and also strengthens its hawkish rhetoric.

Full Article →Goldman Sachs raises year-end gold forecast to $2,500; why gold shines bright even after a losing Q2; and Zimbabwe rediscovers gold as a cornerstone of economic stability. Interestingly enough, Goldman’s lofty forecast for gold excludes possibility of hyperinflation…

Full Article →First off, bitcoin is not a Ponzi scheme. A Ponzi is a fraud, in which the sponsor promises a yield. Bitcoin is closer to a pyramid scheme. A pyramid is not necessarily a fraud, and not necessarily illegal. Like a Ponzi, the gains come from new investors…

Full Article →It may come as a major relief to Australians that we still have a lot of gold in the ground, because neither the RBA nor, the Australian government, nor many Australian citizens for that matter, hold very much gold. Australia’s gold reserves sit at 80 tonnes, unchanged since 1997…

Full Article →All presidents make mistakes, whether it’s failing to limit the growth of the federal budget or being unable to anticipate turns in the economic cycle. But the Biden administration has been unique in consistently getting just about everything wrong while stubbornly refusing to change course.

Full Article →For years, we’ve been told there’s a retirement crisis in America. Survey after survey reveals that Americans don’t have enough money to get by in what is supposed to be their golden years.

Full Article →Powell Stagflation Could Make Gold Investors Happy

There are many terrifying statements you can hear from another person. One example is: “Honey, we need to talk!” Another is: “I’m from the government and I’m here to help.” However, the scariest English word, especially nowadays, is “stagflation.” Brrr!

Full Article →Fed Projections Say Economy in for a Hard Landing In this video, director of education Devlyn Steele shares data from the Fed’s own economic models that points to a rough landing ahead.

Full Article →By the time you read this, the U.S. economy will likely be officially mired in what could be a long and deep recession. Ark Invest CEO Cathie Wood said Tuesday we’re already there: ‘We think we are in a recession. We were wrong on one thing and that was inflation being as sustained as it has been.’

Full Article →Unlike Gold, The Fed Doesn’t Want a Recession…

Last week, Powell testified before Congress. He reiterated many things he said during his recent press conference, but I believe that a few issues deserve our attention. First, Powell repeated that the Fed is strongly committed to additional rate hikes coming.

Full Article →Headlines abound overnight as H1 of 2022 closed at the worst in 60 years for the world’s biggest share index, the S&P500, down 21.2% so far this year. The NASDAQ had its worst H1 ever, down 30% and eclipsing the dot.com bubble’s 25% for the same period.

Full Article →Two weeks ago, the heavily-watched Michigan consumer sentiment index dropped to its lowest level ever. But in spite of “achieving” that remarkable record, it turns out the index had still more room to fall.

Full Article →With China, India, Brazil and South Africa fearing sanctions, the BRICS nations are forming a viable alternative to the US Dollar. Putin stated Wednesday “The matter of creating the international reserve currency based on the basket of currencies of our countries is under review.”

Full Article →Over the weekend, leaders of the G-7 nations announced formal sanctions on the import of gold from Russia. That move is expected to be largely symbolic because the LBMA and Western refiner volunteered to ban imports shortly after the war began.

Full Article →Fed Desperately Wants to Postpone Return to Reality – But It’s Not Going Well. Today, we’re seeing multiple signals of economic stress flashing simultaneously. Historically, that implies a near-term economic recession…

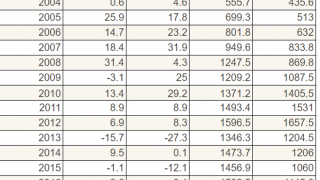

Full Article →Since 2001, Gold has outperformed any other mainstream asset class, although that’s not what you are likely to hear from the mainstream. While gold lagged in 2013 and 2015, for long term investors, the yellow metal is up 553% in USD terms and 360% in AUD.

Full Article →It’s worth remembering the Federal Reserve is not looking out for your wellbeing. They’re looking at statistics, not individuals. They see surges in food and energy prices as “normal volatility.” Chairman Powell doesn’t care it cost you nearly $100 to fill your gas tank.

Full Article →In a Capitol Hill hearing Powell was asked yesterday: “Would you say that the war in Ukraine is the primary driver of inflation in America?” Fed Chair Jerome Powell responded: “No. Inflation was high before, certainly before the war in Ukraine broke out.”

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.