How American Millionaires Are Outsmarting the Collapsing Economy

According to a recent poll by the Wall Street Journal and Impact Research, 65% of voters say the economy is headed in the wrong direction. Financial strain was affecting more than half of respondents, with more suffering on the way if things keep getting worse

Full Article →Will Gold Shine Bright in 2023?

Investor Peter Schiff and politician Nigel Farage recently shared their thoughts on why gold is scheduled to emerge as an outperformer in 2023, and why it’s already doing what it’s supposed to. Both gold’s 50-day and 200-day moving averages show it outperforming inflation

Full Article →Avoid Silver Eagles – Save Big!

The dysfunctional U.S. Mint makes tens of millions of them each year. But unlike well-run private mints, these government bureaucrats are incapable of or unwilling to address their production and sourcing stumbles, so demand for silver Eagles continues to outstrip supply.

Full Article →Wall Street Insider Shares His 2023 Gold Strategy

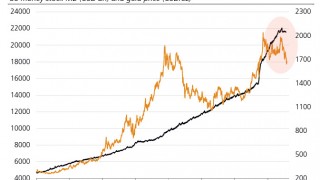

Gold’s whiplash couple of years have almost made everyone forget just how big of an outperformer it is. It has risen by 450% since 2000, having spent most of 1999 around $255. Still, even gold investors can perhaps fall prey to recency bias.

Full Article →Bullion’s Most Under-Appreciated Feature?

Physical gold and silver will never become worthless. This fact does not make for much of a marketing pitch. But given recent events, this is a more important feature than it looks: Americans, and investors around the world, live in an age of collapsing confidence in institutions.

Full Article →Asset Managers See Stagflation as New Normal

Stagflation is a rare beast, which is why we don’t see it very often. What makes it so rare is that its two principal ingredients are high inflation and low economic output – conditions that tend to exist in opposition to one another.

Full Article →When Did Less-Bad Become Good?

And Why the Media Is Desperately Hiding the Truth About the Economy? The idea that the bad news has ended is a dangerous illusion to support with your savings (“The Fed will pivot, rates will drop, stocks will surge and inflation will go away – better buy now!”).

Full Article →Household Debt Continues to Surge Alongside Inflation

Americans have been relying on credit for some time to do their spending. And based on data recently compiled by the Federal Reserve Bank of New York, they seem to be relying on it more than ever.

Full Article →Stagflation: the Worse for Us, the Better for Gold

Stagflation is coming – and it could make the 1970s look like a walk in the park. As you’ve probably noticed, I expect a recession next year, and I’m not alone, as this has become the baseline scenario for many financial institutions and analysts

Full Article →2 Reasons Why Social Security Is Anything but Secure

We’ve been reporting on the likelihood that Social Security will suffer from a series of setbacks in the 2030s for quite some time. Now, the Social Security Trustees are beginning to confirm the fears we’ve expressed since 2019. In this year’s report, they summarized the main problem…

Full Article →2023: Gold’s Best Year Ever?

Numerous analysts have said that commodities crashing is a kind of necessary ingredient in the current market fiasco – but just as gold was seemingly left out of massive gains that other commodities experienced, it’s likely to be one of the very few commodities not falling in the kind of recessionary environment we’re anticipating.

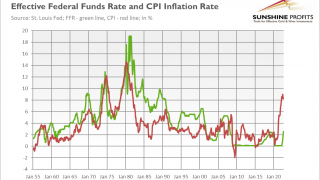

Full Article →10 More Years of High Inflation?

Prices could remain elevated well after acutely high inflation subsides. One report says that inflation above the Federal Reserve’s 2% target could be with us for another decade

Full Article →Bitcoin NOT the ‘New Gold’

Bitcoin has potential, but not as a substitute for gold. And not as a government-regulated get-rich-quick asset for people to gamble on in Wall Street’s rigged casinos…

Full Article →Sam Bankman-Fried FTX’ed Up

This disaster is sad because it taints an entire industry that was at first, built upon the premise of providing an alternative to centrally planned money and credit. That would be the one thing cryptobugs have in common with goldbugs – they both agree there needs to be a monetary alternative to fiat currencies.

Full Article →Inflation Reprieve Won’t Last Much Longer

Inflation is still orders of magnitude too high, and not declining appreciably. (Should CPI continue to come in 0.2% lower every month, we’re still looking at over two and a half years of prices rising faster than the Fed’s targeted rate.)

Full Article →Inflation Down, but Gold Surges – Huh?

Gold’s $100+ rise to $1,760 from $1,650 last week wasn’t an intraday price move, but it feels so abrupt and rapid. And every time gold’s price surges like this, we expect there to be some crisis or calamity. After all, it was gold’s biggest weekly gain in 30 months. Remember what happened 30 months ago?

Full Article →Fed Note Suffers Pivotal Breakdown

While investors continue to await a possible Federal Reserve pivot toward monetary easing, the pivot has already occurred in major asset markets, including precious metals. Last week was indeed pivotal for multiple asset classes.

Full Article →The Best Way To Defend Your Savings

We are living through an economic crisis that will earn an entire chapter in introductory economics textbooks in the future… As of September, 63% of Americans were living paycheck to paycheck, according to a recent LendingClub report — near the 64% historic high hit in March.

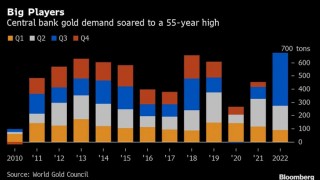

Full Article →What’s Behind the Central Bank Gold Buying Boom?

Central banks bought a record amount of gold last quarter as they diversified foreign-currency reserves, with a large chunk of the purchases coming from as-yet unknown buyers. The official sector has consistently been one of the main pillars of support for gold prices for more than a decade.

Full Article →Is Powell Planning a Pivot?

Currency traders may be looking ahead – specifically to the likelihood of a U.S. economic downturn in 2023. The potential of another housing-led Great Financial Crisis also looms. The full effects of the Fed’s latest rate hike won’t be known for months, but higher borrowing costs will hit struggling consumers

Full Article →Biden’s Gas Plans = Communism

Midterm elections are upon us, and Biden’s party seems poised for big losses. Inflation remains the #1 concern among American families. You can tell the President is a politician rather than an economist, because of his new idea for lowering fuel prices…

Full Article →Retirement Crisis Update

Inflation has been significantly elevated for a year and a half. And since the end of 2021, it’s been stuck at or near four-decade highs. Many of the consequences you’d assume would result from high levels of persistent inflation have indeed come to pass.

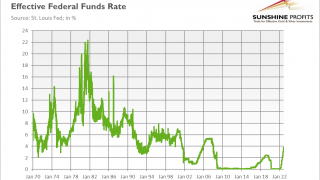

Full Article →The Fed has a Hammer, and You’re a Nail

Our present moment is precarious. Like it or not—we don’t—we live in the age of Central Banks. And as we witness, and alas participate in, the global drama to create or destroy wealth, there is a great and tragic irony at work.

Full Article →Another Jumbo Rate Hike, Another Gold Decline

The Fed delivered another 75-basis points hike. Gold didn’t like the FOMC meeting and declined further. Bullion.Directory precious metals analysis 03 November, 2022 By Arkadiusz Sieroń, PhD Lead Economist and […]

Full Article →Why Gold’s Set to Turn Around

As long as silver continues to trade above its low from late August, it will continue to show a positive divergence versus gold. When silver leads, that generally a bullish a sign for the precious metals space. A strong close above $21 would point to a new uptrend.

Full Article →Gold to Skyrocket When Fed Makes Announcement

All that gold needs is a cowardly Fed, current monetary supply levels suggest gold is undervalued, and what a gold standard would require in modern times. The consensus is in: gold can’t shatter its former all-time highs until the Federal Reserve does.

Full Article →A Recession Is Coming, But Gold Feeds on Fear

I know that people can get fed up with recession warnings at some point, as they did with the boy who was constantly crying wolf. But there are more and more disturbing signals about black clouds gathering over the economy, despite the fact that the American GDP rose 2.6%,

Full Article →How to Destroy a Pension Fund in 22 Easy Steps

Our interest rate system is like a wrecking ball. It swings to one side of the street and destroys one side of town. Then when it swings to the other side of the street, it destroys the other side of town), without repairing any of the infrastructure it previously destroyed.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.