In a rare moment of honesty, Federal Reserve Chairman Jerome Powell admitted he and his fellow central bankers don’t know what they’re doing as they wrapped up the May Federal Open Market Committee (FOMC) meeting. As was expected, the Fed held interest rates steady at the meeting, taking a “wait and see” attitude.

Full Article →From China’s buying spree to dollar devaluation fears, gold’s surge past $3,000 may be just the beginning. As global demand explodes and trust in fiat currencies crumbles, is $4,000 gold just the new floor of a multi-year bull market? Gold’s new normal: $3,000 to $4,000 range doesn’t sound bad…

Full Article →Demand for physical gold surged in the first quarter. But not in the United States. Asian investors primarily drove demand for gold bars and coins as American investors continued to sit on the sidelines. Chinese investors gobbled up 126.7 tonnes of gold bars and coins. That was a 47 percent increase from Q4 ’24 and a 12 percent rise year-on-year.

Full Article →Gold has outperformed most asset classes for the last 25 years. If you think about it, that is a pretty remarkable run. Economic conditions varied widely, but gold held up better in tough times as well as during periods of growth. In all likelihood, no one who held gold through the past couple of decades regrets it. Why has gold done so well?

Full Article →The LBMA gold price hit multiple record highs in Q1, with the average price coming in at $2,860 an ounce. That was a 38 percent year-on-year increase. The gold price was driven by multiple factors, including the specter of a trade war, geopolitical turmoil in the Middle East and Ukraine, stock market volatility, and dollar weakness.

Full Article →$3,500 gold is just the beginning. Some experts are predicting $6,000… others say $55,000 is “fair value.” What’s fueling these extreme predictions – and how reasonable are they, really? Here’s what you need to know before the next big move… Is it time to entertain some of the more extreme gold price forecasts?

Full Article →Lessons for Gold Investors from USDX, Bitcoin and Gold Stocks

The markets are relatively calm today, but don’t let that fool you. They are about to MOVE. There are multiple clues as for the way in which the markets are likely to move next, and I’m going to discuss three of them in today’s free analysis. One of them is about the USD Index, the other is about bitcoin, and…

Full Article →Trump’s sweeping tariffs are shaking global markets and stoking inflation fears. As investors rush to safety, gold keeps breaking records – and experts warn the real surge may still be ahead. Here’s why gold’s role as financial insurance has never been more critical…

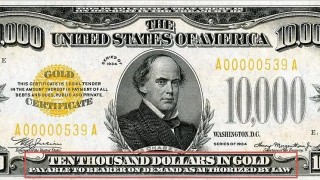

Full Article →Gold just hit another all-time high, silver demand keeps breaking records, and Judy Shelton wants to bring back the gold standard. Some say it’s a rally. Others say it’s only the beginning of a historic trend… Are we ready for the next phase of monetary history? Your News to Know rounds up the most important stories about precious metals…

Full Article →China ranks as the world’s largest gold market. The price of gold climbed 8.4 percent in yuan terms in March. It was the strongest month for the yellow metal since March 2024. The RMB gold price recorded its strongest Q1 since 2002 when the Shanghai Gold Exchange (SGE) was established.

Full Article →Gold, Silver, USDX: The Key April Analogies and Key Factors

“Nearly half of the fund managers surveyed (49%) see long gold, or bets that gold prices will rise, as the most crowded trade in the market right now. This marks the first time in two years that fund managers did not see the Magnificent Seven as Wall Street’s most crowded trade, according to the survey.”

Full Article →As gold marches ever higher, silver continues to lag. Don’t get me wrong. Silver hasn’t done horribly so far this year. It is up a little over 12 percent. However, it has failed to close the gap with gold, and that has many investors questioning what’s going on with the white metal.

Full Article →Analysts keep raising gold price target — even after it hit almost 70 record highs in 16 months. UBS says calling gold bull over “doesn’t make sense” just because metal shot higher than expected. Goldman Sachs: gold risks still “very much skewed to upside.” One analyst says price peaks don’t apply to “evergreen” asset like gold (he has a point).

Full Article →When a gold company asked to buy the #1 spot on our rankings page – and then demanded removal when we refused – we decided it was time to speak out. In this post, I expose the pressure behind the scenes and why we believe integrity still matters in an industry full of pay-to-play schemes.

Full Article →The American economy is a bubble. The thing about bubbles is that they eventually pop. All they need is a pin. Tariff policy might be the pin that pops this bubble, but even if it isn’t, there is a pin out there with this bubble’s name on it. I’ve been calling this a “debt-riddled, bubble economy” for months (years, really), but…

Full Article →One of Donald Trump’s big campaign promises had to do with bringing back manufacturing jobs to the U.S., and for a big portion of the working aged population, maybe especially in the rust belt, that is hugely important. We all saw steel, auto, and other manufacturing and related industries struggling over the last few decades.

Full Article →After plunging for several days, stocks soared Wednesday afternoon after President Trump announced a tariff pause. The S&P 500 rocketed 9 percent, charting its third-largest single-day gain since World War II. Gold also whipsawed, having dipped below $3,000 an ounce, the yellow metal regained much of its loss and closed over $3,100.

Full Article →If you wonder why so many central banks continue to load up on gold, Russia’s experience with the yellow metal provides the answer. Russia launched a gold buying spree beginning in 2014. Over the next six years, the Bank of Russia increased its reserves by around 40 million ounces (1,244 tonnes).

Full Article →Silver prices dropped 12% in the final two trading days of last week. Gold lost 2.6%. While gold has held up relatively well, silver fell in tandem with the general stock market after President Trump announced reciprocal tariffs against nations that impose a levy on goods from the U.S. – Bullion was exempted – coins, rounds, and bars will not be subject to the tariff.

Full Article →President Trump just declared “Liberation Day” and launched sweeping new tariffs. Investors panicked worldwide as corporations published dire predictions of the bumpy road ahead. Today we examine the pros and cons of Trump’s “Liberation Day” strategy – and reveal the secret back door to the financial bomb shelter the President left unlocked specifically for us…

Full Article →Already off to a breathtaking start this year, gold’s price continues to climb. Amid fears of a trade war and the global dedollarization drive, here’s how much higher analysts think it will go… Axel Merk, CEO of Merk Investments, said a lot in a recent (brief) segment on the relationship between the price of gold and the U.S. dollar.

Full Article →Indian investors are turning to gold as the domestic stock market tanks. This isn’t a surprise, but there is a twist. Indians are increasingly turning to ETFs to gain exposure to the yellow metal. Indians have a long love affair with gold. The yellow metal is highly valued as a store of wealth, especially in poorer rural regions.

Full Article →Washington D.C. is still a prime breeding ground for bad ideas. One of the dumbest, and more dangerous, is the idea of swapping U.S. gold reserves for Bitcoin. Bitcoin and gold may share some of the honest money fanbase, but that is about as far as any similarities go. One is tangible and time tested. The other…

Full Article →Gold has broken above $3,000 and appears poised to push even higher. So far, platinum has not followed gold’s lead but seems to be watching from the sidelines. What is causing this divergence? To put the platinum price into perspective, the metal hit an all-time high of $2,213 an ounce in March 2008.

Full Article →The Federal Reserve lost $77.6 billion in 2024. And by the way, a Fed loss is ultimately your loss. The central bank began bleeding red in late 2022. In 2023, it reported an operating loss of $114 billion. On top of its operating loss, the Federal Reserve reported unrealized losses totaling $1.06 trillion.

Full Article →In 2024, the S&P 500 delivered a total return of 25%, while gold finished the year up 27% – The first time in recent history in which gold and stocks achieved gains exceeding 25% within the same calendar year. This rare state of affairs has sparked intense interest among financial commentators. Investors want to know – is this a new normal?

Full Article →Ever since Paul Volcker took the helm at the Federal Reserve back in 1979 and ended the decade of stagflation, the Federal Reserve has played a key role influencing the American economy. Now Fed chair Jerome Powell is saying that he thinks Trump’s policies will cause prices to rise steeply.

Full Article →The Federal Reserve loosened monetary policy significantly during the March FOMC meeting that wrapped up Wednesday. “But wait,” you say. “The Fed held interest rates steady, right?” Yes. Yes, they did. The Federal Reserve ALSO make a BIG move during the March meeting… but it largely flew under the radar.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.