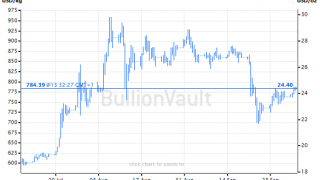

GOLD PRICES crept higher against a rising US Dollar in Asian and London trade Friday, halving the week’s earlier $50 drop to reach $1910 per ounce as European stocks markets rose over 1.3% despite the collapse of UK-EU trade talks in Brussels.

Full Article →US Mint Not Raising Prices But…

The word on the street was that a hefty $13 price increase was coming, and many wanted to get their coins before prices rose. The news of a price increase isn’t wrong. It’s just that it won’t directly impact anyone except those people buying high-priced coins in specialty packaging directly from the U.S. Mint.

Full Article →GOLD and SILVER held onto yesterday’s gains in London trade Tuesday, consolidating as news of mergers and acquisition activity among mining companies continued to accelerate.

Full Article →What Biden and Trump SHOULD Have Been Asked

Tuesday night’s presidential debate between Donald Trump and Joe Biden won’t go down as a great moment in the annals of American democracy. That much both camps, as well as independent observers of the chaotic spectacle, can agree upon.

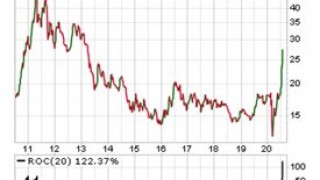

Full Article →The Silver Price is Headed Towards All-Time Highs

In 1980, the U.S. bull run saw gold prices reach $850/oz and silver prices leap to $50/oz. But that was a relatively limited affair when you compare it to the global phenomenon that we bear witness to today.

Full Article →DOJ Soft On JPMorgan Chase Wrongdoers

Gold and silver investors may have little in common with Jeffrey Epstein’s teenage victims or violent “Black Lives Matter” rioters, but there is one issue upon which they might all agree. Our system of justice often fails

Full Article →Gold Down Fourth Day as Fed Urges Fiscal Stimulus

GOLD PRICES slipped for the 4th day running in London on Thursday, dipping through $1850 per ounce as the US Dollar rose, inflation expectations fell, and world stock markets extended yesterday’s plunge in New York.

Full Article →Gold & Silver Locked and Loaded – Don’t be Out of Ammo

In military terms, the phrase “locked and loaded” refers to “locking” a magazine or cartridge into a firearm and loading a round into the gun’s chamber. A variant is to “lock the safety” and then load a magazine into the weapon.

Full Article →Gold Rebounds as UK Readies Military Support for New Lockdown

GOLD PRICES held above $1900 per ounce Tuesday in London, rallying to $1916 from yesterday’s $70 plunge as world stock markets also bounced from a 4-day losing streak despite weak economic data and the tightening of social restrictions aimed at slowing the global ‘second wave’ of Covid-19.

Full Article →Beware These Faulty “Inflation Protected” Investments

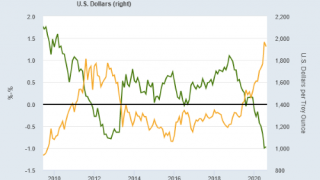

The Federal Reserve last week reiterated its commitment to an unprecedented inflation-raising campaign – specifically, the Fed aims to push the inflation rate above 2% for an extended period.

Full Article →‘Dovish’ Central Banks ‘Bullish for Gold’

GOLD BULLION recovered from 1-week lows against Dollar in Asian and London trade today, edging 0.4% higher from last Friday’s finish as global interest rates slipped and equities headed for 0.8% gains on the MSCI World Index after dovish policy comments.

Full Article →Pistol Pete: Old School Precious Metals Dealer

Peter Thomas – One Mans’s Journey From Silver Pit to Silver Screen – to Silver Shot. Once voted the most interesting man in the world, Pete has been in the business for 4 Decades and it looks like he is not leaving anytime soon.

Full Article →Will Markets Melt Down If No One Concedes the Election?

As pundits weigh in daily on who has the edge in this year’s political horse race, investors want to know how the election will affect their pocketbook.

Full Article →China Unloads Dollars as Gold Tests Support

Holders of low-yielding U.S. dollar-denominated debt instruments should be quite concerned about the prospect of losing purchasing power. The Chinese government apparently is.

Full Article →Gold Up in GBP as Brexit Crisis Scares Markets

GOLD PRICES slipped against a rising US Dollar Monday in London as the British Pound fell amid a new crisis in the UK’s Brexit negotiations, and traders looked ahead to this week’s monetary policy decision from the 19-nation European Central Bank.

Full Article →Fed Return to ‘Inflation Nation’ Could Increase Retirement Risk

Think of retirement savings like a football team: Making money is your offense and protecting your savings is your defense. Despite the potential for much higher price inflation (no matter how high it actually goes), gold and silver are looking good as potential hedges against the future of “Inflation Nation.”

Full Article →The Canadian Guy Who Builds Gold Refineries

Corey Kelly needs little by way of an introduction. Many of us in the precious metals industry know him personally, everyone else either knows of him or have heard the legends…

Full Article →Terrified Pension Funds Turn to Gold

The agency tasked with backing up pension programs, the Pension Benefit Guaranty Corporation, is itself underfunded and could quickly become insolvent in the event of a rise in pension failures.

Full Article →A very risky stock market and ballooning government debt should all keep investors close to gold, especially as the latter issue grows worse amid efforts to stimulate the economy in the wake of the pandemic

Full Article →How Will US Election Impact Bullion Markets?

SPOILER ALERT: Anyone who thinks Biden has a good shot at becoming president should definitely stock up now.

Full Article →The New ‘Red Peril’ Represents a Golden Opportunity

China may be actively swaying voters in the run up to November’s election – and they’re NOT pro-Trump. The Chinese Communist Party is playing a long game. Even as conflicts with the administration of President Donald Trump escalate on multiple fronts, Chinese officials are looking ahead to a post-Trump world order.

Full Article →Bullion Markets Catch Their Breath

After months of frenetic activity in the bullion markets, physical buying and selling slowed a bit last week. The respite, if it persists, could be welcome news for investors frustrated by scarcity and higher premiums.

Full Article →Gold Rises as Dollar Falls

GOLD PRICES gained this Monday lunch time as the dollar declined while global stocks rallied as the US Food and Drug Administration (FDA) approved a therapeutic treatment for Covid-19 patients and central bank speculation rose ahead of the Jackson Hole Symposium.

Full Article →The US FedCoin Takes Another Step Closer to Reality

How far in the future FedCoin will launch remains to be seen, but it sure seems like the U.S. is closer to the first major overhaul of the monetary system (and your private life) in decades.

Full Article →Buffett has been the dam, holding back the great flood of investment dollars into the gold bull market. As long as Buffett steered clear, the lemming institutional money managers would avoid the sector as well. The dam broke on Friday afternoon

Full Article →Yes, maybe you’ll have another six weeks to get your metals’ shopping done before we see gold above $2,000 again and silver above $30. But then again, maybe not…

Full Article →Silver Might Be Overextended – But It’s STILL Cheap

Investors who are eying a multi-year silver bull run ahead should view any decent pullback from here as a buying opportunity.

Full Article →The opportunity is that silver’s major bull market likely has much further to go. The possibility of a major top shouldn’t even be considered until after silver has joined gold in hitting all-time highs.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.