“Money is a matter of functions four: a medium, a measure, a standard and a store.” Or at least so says an old rhyme once used in economics books. And let’s face it, three of these functions are clear. A medium of exchange is what people use to pay for goods.

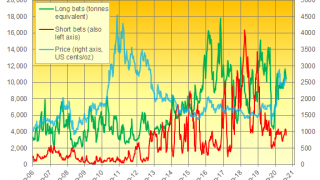

Full Article →Backwardation + Evidence of Silver Supply Squeeze

In recent months, the numbers of people standing for delivery of the metal on their futures contracts has spiked. If that trend continues in March, which is the next delivery month, it may be a bigger “Come to Jesus” moment than the shorts had in March of 2020.

Full Article →Where Precious Metals Meet FinTech

For this weeks Q&A I’m talking with Mike Greenacre. Mike’s initial career was in the geophysical exploration industry, working in Africa, US, Middle East and Asia, beginning his trading and brokerage career in Switzerland, with an initial focus on steel and iron ore.

Full Article →Near-Zero Rates Sound Good (Until This Happens)

In some cases, the idea of a “near-zero interest rate” is a good thing. For example, if you qualify for 0% interest when you buy a car, you save money…

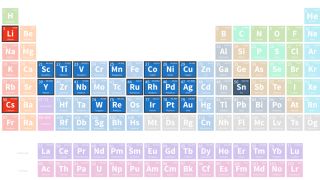

Full Article →Energy Metals Leading the Charge

What’s driving these “energy” metals? Besides ongoing currency depreciation and the risks of higher inflation, which will help boost all hard assets over time, rising demand for electricity in general and electric vehicles in particular.

Full Article →Silver Situation Update

In the last two weeks, there has been a greater awakening about the silver story – its growing industrial uses, its growing investment demand, and the pre-existing bullish posture of the silver market itself.

Full Article →Weekly News: US Mint All Out of Silver and Gold

Stories include: U.S. Mint can’t keep pace with demand again, Goldman chief calls silver a supercharged version of gold, and amateur prospector unearths a long-lost golden treasure from Medieval times.

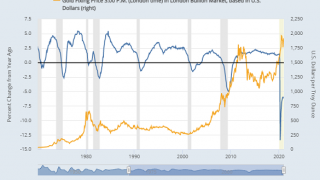

Full Article →How Precious Metals Generate Positive Real Returns

One of the most bullish backdrops for precious metals is an environment of negative real interest rates – that is, when bonds and cash yield less than the inflation rate. […]

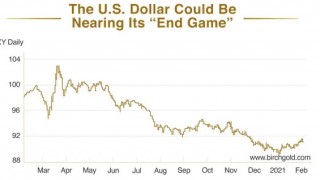

Full Article →Is the U.S. Dollar Nearing the “End Game”?

Jim Rickards said back in 2016: “The dollar won’t lose its reserve currency status overnight” — and he was right. But a new and disturbing signal could finally be revealing the end game.

Full Article →WILD Silver Market Swings… What Next?

As extreme market conditions drive tremendous volatility in silver spot prices, buyers are exerting unprecedented pressures on retail physical bullion products.

Full Article →Georgette Barnes: Meet the Woman Striking Gold in West Africa

This week’s TalkMining interview is with Georgette Barnes Sakyi-Addo Executive Director at Georgette Barnes Limited, Volunteer President at Women In Mining, Co-Founder of the Accra Mining Network and volunteer Elected President of the Association of Women In Mining In Africa.

Full Article →Weekly News: Silver Skyrockets on Retail Thrust

Stories include: Day traders piling into silver as analysts predict $50 price, gold’s reign as the top asset, and $400 million of civil war gold buried in Pennsylvania might have come to the surface.

Full Article →Having been reading about the great WallStreetBets #SilverSqueeze all weekend and watching zoom call after zoom call of excited precious metals experts getting ready for Silver’s moonshot this week I started to get a strange sinking feeling…

Full Article →SILVER surged Monday morning towards 8-year highs at $30 per ounce after “the call-to-arms” on Reddit brought record new interest to precious metals

Full Article →Potentially Catastrophic Inflation Surge Slips Under Radar (Until Now)

You’ve read about housing market bubbles, stock bubbles, and even credit bubbles. But the next bubble you’re about to discover could be even more dangerous, and may have even more far-reaching consequences.

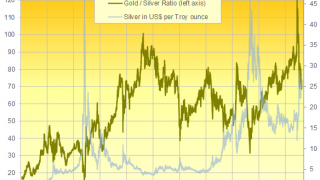

Full Article →GOLD PRICED in terms of sister metal silver fell near its cheapest in 4 years in London’s bullion market Friday, despite rising near 3-week highs of its own in the aftermath of silver’s dramatic jump after users of the Reddit chatroom called on other readers to buy shares in the cheaper precious metal’s largest ETF trust.

Full Article →Does America REALLY Have a Retirement Crisis?

Because no matter what the headlines say, tangible physical assets can act as a hedge against inflation and diversification helps protect your savings no matter which direction the stock market heads. Take the steps you need to keep your retirement on track with a “sleep well at night” savings strategy.

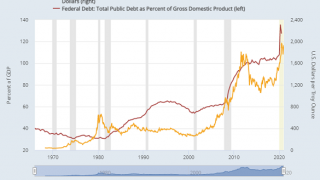

Full Article →Biden Will Preside Over Another Financial Crisis

As Treasury Secretary Yellen together with her protégé Jerome Powell at the Fed prepare to pursue “weak dollar” policies and coordinate globally with other central planners, investors may find that the world’s strongest currencies are physical precious metals.

Full Article →Demand for Physical Bullion Surges…

America will face an increasingly authoritarian federal government ruling over a largely apathetic populace… Gold bugs aren’t betting on bridges being built any time soon – demand for physical metal ratcheted up to a new all-time high in January.

Full Article →The recent explosion of money printing and debt-funded spending by the U.S. in response to the Covid-19 pandemic has sparked a renewed interest in the key role gold and silver play in hedging against systemic risks.

Full Article →Anyone who owns precious metals, mining shares or metals’ ETFs knows the drill. First, gold and silver begin to establish an uptrend on the charts. Analysts (like us) start writing about how prices are getting ready to make an upside run…

Full Article →Investors Prepare for the Incoming Regime…

Last year provided extraordinary challenges to Americans as well as people around the world. Hundreds of thousands of deaths were attributed to the Chinese coronavirus. The economic carnage and the attendant death and suffering along with the loss of civil liberties was grossly underreported.

Full Article →What’s Next For Internet Censorship?

On Wednesday, the Democrat-controlled U.S. House of Representatives voted to impeach President Donald J. Trump for a second time – this time with just a few days left in his term. It was a mostly symbolic rebuke. Financial and precious metals markets barely budged on the news.

Full Article →Gold is Not the Only Precious Metal – Matt Watson’s pick of metal investments for the next decade includes some less well-known choices with enormous upside potential…

Full Article →New Tightness Looms on Minted Gold & Silver

It’s happening again. Even before the conflagration occurred in Washington DC last week, retail demand for gold and silver had been rising sharply since late last year.

Full Article →GOLD PRICES fell Friday in London even as infections, deaths and economic lockdowns in the winter wave of Covid-19 worsened worldwide and new US data said the world’s largest economy shed jobs last month rather than expanding as Wall Street expected.

Full Article →GOLD PRICES slipped further on Thursday, extending yesterday’s 2.1% plunge from new 9-week highs even as US interest rates lagged inflation forecasts by a wider margin – usually a driver of higher gold prices – and US President Donald Trump was condemned worldwide for inciting angry supporters to storm the Capitol in a violent and failed attempt to stop Democrat Joe Biden taking over at the White House in 2 weeks’ time.

Full Article →2021: Time For a Portfolio Reset?

If global elites have their way, 2021 will be the year of the “Great Reset.” They believe now, after the coronavirus and lockdown policies have inflicted a heavy toll on the public, is the perfect opportunity to implement their technocratic vision.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.