This is significant, as it’s what one expects to see if the post-Covid bull market in silver is still intact. Leveraged speculators are just trying to front-run whatever move they expect next. They do not move and hold the price durably.

Full Article →It is often excruciating to own metal when the short run price action is completely disconnected from fundamentals. The price smash in the last couple trading days is a case in point. Nobody can make a coherent fundamental case for the move lower. It is best to simply remember there are very good reasons to own physical metal…

Full Article →Gold and Silver Rebound From ‘Flash Crash’

GOLD AND SILVER PRICES stabilised from a flash crash to hit 4 and 8-month lows respectively at the start of Asian trading today due to low liquidity and Fed tapering fears, while oil slid further on concerns over new coronavirus related restrictions in Asia.

Full Article →What’s Going to Happen When the Debt Comes Due?

How they decide to answer it – or evade it, as the case may be – will have profound implications for investors and anyone who holds U.S. dollars. For months, the financial media has been running stories about how the pandemic led to a surge in savings…

Full Article →Bond yields are telling us gold should sit at $2,000: A recent analysis by Credit Suisse suggests that gold’s price is quite a ways off from where it should be. According to the bank’s analysts, gold’s current fair value is around $1,914 when taking into account market conditions.

Full Article →Going For Gold: Building a Winning Portfolio

In a yield-starved environment where bonds and cash are returning less than inflation, there are no guarantees. But there are certainly opportunities outside of fixed income instruments. Investors who try to sprint their way to success risk hurting themselves in the process. Going for fast-moving penny stocks or cryptocurrencies can lead…

Full Article →The government’s liabilities are the assets of everyone else: individuals, pension and insurance funds, commercial banks, and the Federal reserve. All of these parties lend to the government, though often without knowing.

Full Article →One thing is certain, we sure are living in strange times and for retirement savers, that can also mean levels of anxiety that rise a lot faster than IRA balances. From mistakes anyone can make that could derail their retirement, to ongoing market volatility that the media claims is a “good thing,” there are…

Full Article →We’re seeing the argument, again, that silver stocks are being consumed in solar panels, medical applications, and of course, electronics. This argument has a certain temptation. After all, the standard assumption is that value is inversely proportional to quantity…

Full Article →Despite the effort to “squeeze” the bullion banks, silver has yet to push through the $30 barrier, and gold remains below the high put in nearly a year ago. The effort has been valiant. Demand for physical bullion is unprecedented. However, the paper markets, where price discovery is purportedly done, remain untethered…

Full Article →Financial media headlines were absolutely schizophrenic. We saw everything from “Dow Plunges on Covid Resurgence” and “Speculators Flee Suddenly Volatile Market” to “Wall Street Ends Higher, Powered by Strong Earnings, Economic Cheer.”

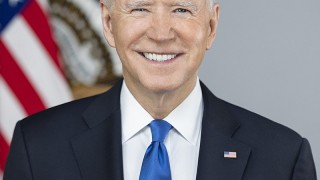

Full Article →This week Biden superficially addressed the problem by admitting the obvious – that prices have been rising rapidly this year – while denying that the inflation surge represents anything out of the ordinary. Trust the experts! After all, when have they been wrong about anything…

Full Article →Reddit’s silver “apes” expect 100% to 1,000% gains on their new silver push. Whoever thought that the Reddit-fueled attempt to squeeze silver and expose big bank manipulation of the metal’s prices was done is in for a surprise, via Fox Business

Full Article →In decades past, income instruments such as government bonds and bank certificates of deposits provided decent yields. Today, with a 10-year Treasury note yielding just 1.3%, that is not the case.

Full Article →Goldman Sachs has said Gold is underpriced at $1,800 and ready to move back to $2,000. Even though gold met many bullish expectations last week by consistently closing above $1,800, Goldman Sachs analyst Mikhail Sprogis thinks the move could be the start of a much larger uptrend.

Full Article →There is sometimes a tendency to confuse ends and means. For example, in traveling through an airport there is extensive inspection of passengers. Before you are allowed to board an airplane, you must go through a process that is intrusive and increasingly invasive.

Full Article →“We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability…

Full Article →On June 24, the Champlain Towers South condominium building fell, killing at least 24 people. The collapse of this building provides a surprising number of insights into the collapse of a currency. The following discussion is based on information that is emerging about the incident.

Full Article →With negative real interest rates and the ongoing drop in the dollar’s buying power, it’s becoming more and more difficult to hold onto one’s savings (let alone make sound investments). The well-known stockpiling of gold bullion by nations around the world, especially Russia and China, offers hints of a possible solution

Full Article →The U.S. economy is at a fork in the road – one route leads to the return of market fundamentals and sane stock valuations, at the cost of a historic market correction. The other route leads to runaway hyperinflation that eats up the debt almost as fast as it devours the dollar’s buying power.

Full Article →Recent collapses of bridges and a Florida condo building highlight what can go wrong when basic structural and foundational elements are neglected and allowed to deteriorate. As corrosion and cracking spread, they may go little noticed at first, with repairs and upgrades put off.

Full Article →Transitory Inflation Takes Hold of the Economy – How Long Will It Last? Just a couple of weeks ago, Bloomberg reported that Federal Reserve Chairman Jerome Powell sold investors on the idea that rising inflation wasn’t going to last. Officially, as of May 2021, inflation had risen 5%, the highest since August 2008.

Full Article →Last week the spot price of gold declined 6%, which was its steepest drop since March 2020, when news of the extent of the COVID-19 pandemic caused global markets, including gold, to get hammered. The main reason was comments from Federal Reserve Chairman Jerome Powell…

Full Article →Is the entire financial system currently in a massive bubble? That is the question that astute investors may now be asking. According to Nouriel Roubini, CEO of Roubini Macro Associates and professor at NYU Stern School of Business, now is the time to be overweight gold as more bubbles pop up.

Full Article →Social Security Under Pressure Thanks to These 3 Economic Trends: The Social Security Administration (SSA) is in enough trouble on its own. But now, there are three big cultural and economic forces that appear to be taking their toll on the program.

Full Article →Gold to Test Major Uptrend; Fed to Remain Behind Inflation Curve. Battered gold and silver markets face a test of their bull market prospects. For gold, a bullish trendline has been in force since late 2018

Full Article →The economic shock of the COVID-19 pandemic has forced many retirement savers to reevaluate their plans. That isn’t surprising, because the global economy tanked in late February, and that’s bound to have financial consequences.

Full Article →The halfway point of the year is quickly approaching. Dwindling confidence and concern over the direction of the country along with rising inflation expectations continue to drive strong demand for physical gold and silver…

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.