Gold and silver futures speculators began selling contracts in anticipation of a Trump victory. Thus far, the selling continues after his win. The markets may have simply been overbought after big moves higher in October. However, the impact of the election cannot be discounted.

Full Article →Biden Administration Kicks Off 2025 With Another Big Deficit

After running the third-largest budget deficit in history in fiscal 2024, the Biden administration kicked off fiscal 2025 in a similar manner. The federal government ran a $257.45 billion budget shortfall to start the new fiscal year, with revenue down and spending up, according to the latest statement from the Department of Treasury.

Full Article →How Much Will It Cost to Make America Great Again?

With Trump’s election victory and a GOP-controlled Congress, significant economic changes are on the horizon. While these policies aim for long-term prosperity, they come with significant short-term costs. Here’s a discussion of just how much these plans will affect your finances…

Full Article →What a Week in Gold! Wait, It’s Just Tuesday…

Gold plunged by almost $80 yesterday… And it doesn’t look like the decline is going to end (!) anytime soon. Sure, there will be corrections, but the bearish train appears to have finally left the station, as I’ve been expecting it too previously. Gold broke below its rising support line, which is a strong sign that the trend has changed.

Full Article →Presidents and Debt: The Worst of the Worst

We’re currently cursed to the tune of $35.9 trillion and counting. To make matters worse, the size of the debt is exacerbating the debt. Uncle Sam paid $1.13 trillion in interest expense in fiscal 2023. In fiscal 2024, the federal government paid more for interest expense than national defense and Medicare.

Full Article →India Repatriates More Gold From UK for ‘Safe Keeping’

India has brought more of its gold home. Last spring, the Reserve Bank of India repatriated 100 tons of gold, moving it from the UK to vaults within India’s borders. According to a report by the New Indian Express, the RBI recently moved another 102 tons of gold home.

Full Article →Is Inflation Alternative Actually Worse?

Inflation is a controversial topic among economists. They can’t always agree on the best ways to measure it, or even what causes it. They all agree on one thing, though. You’ll never believe why the so-called experts think inflation is a necessary evil… But you can take steps to counter the Fed’s wealth destruction

Full Article →As Things Change, Some Things Will Stay the Same

The votes are counted, and the results are in! Donald Trump will occupy 1600 Pennsylvania Avenue for the next four years. The GOP will also control both houses of Congress. Much will change in the next four years. But it’s also important to consider the things that will almost certainly stay the same…

Full Article →As the United States braces for the aftermath of a decisive Trump victory, the principles of sound money seem destined to take a backseat to what is politically expedient – because national political campaigns, often promise more spending, that erodes the purchasing power of the U.S. Federal Reserve Note, AKA the U.S. dollar.

Full Article →Gold & Silver Best-Performing Investment Assets in 2024

Gold and silver have been on a tremendous run in 2024. In fact, they are the two best-performing assets this year. As of the end of October, silver was up by 42.4 percent, and gold was up by 33.7 percent. This compares to a 24 percent gain in the NASDAQ, the best-performing stock index.

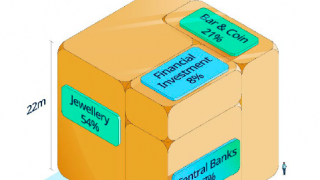

Full Article →Why Has Global Gold Demand Never Been Higher?

After shattering 30 all-time high price records, global demand for gold also hit an all-time high this year. Is massive demand causing record high prices? Or are high prices causing fear of missing out? Let’s dive into the forces behind record gold demand…

Full Article →Retail Stores Closing at Pace Not Seen Since Pandemic

While President Biden and talking heads in mainstream media talk about the amazing robust economy, retail stores are closing at a frenetic pace. According to Coresight Research, 6,189 stores have already closed in 2024. That puts retail store closures at the fastest pace since 2020, when government shutdowns decimated the retail sector.

Full Article →Third Quarter Gold Demand Breaks Record

Gold demand set a third-quarter record, driving the price to a series of record highs. Including over-the-counter (OTC) sales, gold demand came in at 1,313 tons in Q3, a 5 percent year-on-year increase. Gold averaged a record $2,474 an ounce in the third quarter. That represented a 28 percent year-on-year increase.

Full Article →The Universe Seems to Know the Dollar is in Trouble.

Eerily Symbolic: Treasury Seal Falls Off Podium as Yellen Is Asked About Dollar’s Status! The universe seems to know the dollar is in trouble. During a recent news conference, a reporter asked Treasury Secretary Janet Yellen, “How concerned are you about the potential impact of the dollar’s status as the world reserve currency?” And the seal fell off…

Full Article →Major International Bank Joins Chinese Payment Global System

HSBC Hong Kong announced it will formally join China’s Cross-Border Interbank Payment System (Cips). The move is yet another body blow to dollar dominance. According to the Financial Times, it will give “the world’s biggest player in trade finance a key role in Beijing’s push to expand use of the renminbi.”

Full Article →Why Governments Have No Incentive to Help You

Many people around the world have the idea that their governments are there for their benefit, to help them, especially when times get tough. But the fact of the matter is that governments actually have no incentive to help you, not today and not tomorrow…

Full Article →JP Morgan: “Debasement Trade” Increasing the Gold Price

Gold’s price is rising so quickly that analysts, forecasts and headlines are scrambling to keep up. JP Morgan has identified this new trend as the “debasement trade,” and explains why we’re still in the early days of record gold prices…

Full Article →Gold Long-Term Returns Better Than You Thought!

Gold is typically seen as a store of value. Over time, investors expect its price to keep pace with inflation. We find gold’s returns are tightly correlated with the general price level as measured by the consumer price index. Using this assumption, the long-term expected return for gold generally ranges between zero and 1 percent. However…

Full Article →Today’s Housing Bubble Could Sink Your Retirement

You may be surprised to learn that housing is now “the civil rights issue of our time” according to some activists. The problem with activists like this is how they want the problem solved. They want more government involvement and control – which could wreck more than just the housing market…

Full Article →“Doom Spending” Trend Casting Shadows Across Economy

You’ve probably never heard of “doom spending,” but it’s important. Doom spending is clearly a warning of an economic nosedive. Learn what it means and how to prepare now, so the consequences don’t take you by surprise…

Full Article →Poland Now Holds More Gold Than Great Britain

According to National Bank of Poland Governor Adam Glapiński, the county holds 420 tons of gold “on behalf of all Poles,” noting that Poland “has thus entered the exclusive club of the world’s largest gold reserve holders.” Only 10 countries hold more gold than Poland – Poland now holds more gold than Great Britain.

Full Article →How the Election Could Impact Precious Metals

Donald Trump is picking up steam in recent polling. Bullion investors are tuned into presidential politics, this year perhaps more than ever. They wonder what the November election might mean for markets. Absent some radical development, either Trump or Harris will be president come January. And Gold investors better be ready!

Full Article →Credit Card Spending Tanked in August; Are We Tapped Out?

How close are Americans to hitting their credit card limits? Based on the latest consumer credit data from the Federal Reserve, they may be getting closer. American consumers have been yo-yo-ing between slowing credit card spending and going on spending sprees. But in August, credit card balances contracted significantly.

Full Article →The spreading Middle East conflict is now one of the dominant forces driving gold and silver higher – alongside thriving central bank demand and the growing deficit of silver production. The path to $50 silver seems clear – here’s what’s next…

Full Article →Fake News on Economy Driven by Fake Money

The mainstream financial media is hailing Friday’s surprise “blowout” jobs report. According to the Labor Department, employers added 254,000 jobs in September, much more than had been forecast. President Joe Biden joined Federal Reserve Chairman Jerome Powell in taking a victory lap for the supposedly strong economy.

Full Article →Gold Shines as Middle East Tension Surges

Markets fell and gold jumped during recent Middle East hostilities. Strategist says “instinctive safe-haven buying” drove the price of gold. Some analysts expect geopolitical risk to stay “elevated for years.” Multiple strategists forecast $3,000 gold in 2025 in part on geopolitical outlook.

Full Article →Gold Boost from “Debasement Trade”

Gold is being boosted by a “debasement trade,” and according to JPMorgan analysts, this dynamic “may have legs.” According to a team of JPMorgan strategists led by Nikolaos Panigirtzoglou, the gold price has climbed above what should be expected, given these factors.

Full Article →Gold Topples Euro…

According to Bank of America, gold has overtaken the euro to become the world’s second-largest central bank reserve asset. With the central bank gold buying spree over the last several years, along with the rapid rise in price in 2024, the yellow metal now makes up about 16 percent of total reserve assets, just ahead of the euro.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.