The FOMC finally raised interest rates and signaled six more hikes this year. Despite the very hawkish dot plot, gold went up in initial reaction. It’s also worth mentioning that the Fed deleted all references to the pandemic from the statement. Instead, it added a paragraph related to the war in Ukraine,

Full Article →Gold Falls Despite Ongoing War and Inflation Surge

It seems that the stalemate in Ukraine has slowed down gold’s bold movements. Will the Fed’s decision on interest rates revive them again? Bullion.Directory precious metals analysis 15 March, 2022 […]

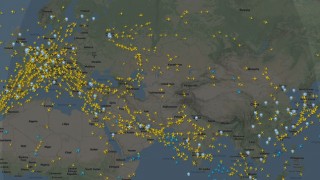

Full Article →Recent news has been full of ominous developments for the dollar; Russia and China have already established trade without need for U.S. dollars signing a treaty in 2019 which provides for using their national currencies in trade. U.S. sanctions on Russian exports will only increase non-dollar trade between those Eastern powers.

Full Article →Hearing more about gold on your favorite financial news channels in recent weeks? Experts say that the principal energy behind gold’s recent price surge has been Russia’s invasion of Ukraine – but they also say renewed fears of stagflation are providing additional buoyancy to the metal’s price.

Full Article →As Gas Prices and Ukraine Conflict Help Gold Rise – Many experts agree that all the fundamentals are there for gold to have outstanding price performance. Gold often captures all the headlines which can lead to silver’s potential being ignored.

Full Article →Gold Likes Recessions – Will High Interest Rates Lead Us There?

We live in uncertain times, but one thing is (almost) certain: the Fed’s tightening cycle will be followed by an economic slowdown – if not worse. There are many regularities in nature. After winter comes spring. After night comes day. After a Fed tightening cycle comes a recession.

Full Article →Can they do it? How would the world react? The Russian central bank reportedly has over 2,000 tonnes of gold. We have seen three arguments repeated many times, both in finance/economics articles and on social media.

Full Article →Two Weeks and Counting – How Does War Affect Gold?

With each day of the Russian invasion, gold confirms its status as the safe-haven asset. Its long-term outlook has become more bullish than before the war. Two weeks have passed since the Russian attack on Ukraine. Two weeks of the first full-scale war in Europe in the 21th century, something I still can’t believe is happening.

Full Article →The term inflation is used by many people to mean rising consumer prices, regardless of the cause. Though most are aware of non-monetary causes, there is a tendency to scrutinize the quantity of dollars whenever prices are rising.

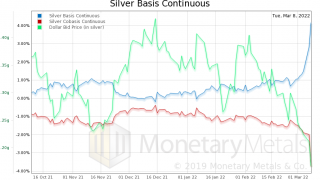

Full Article →Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Full Article →After rallying over the $2,000/oz milestone this morning, the gold market may now be poised to run to new record highs. A major technical breakout out of last year’s consolidation pattern had already been established in February. A trend change of this significance can be expected to last not days or weeks, but months… perhaps years.

Full Article →Ukraine’s Defense Shines – As Does Gold

Russian forces have made minimal progress against Ukraine in recent days. Unlike the invader, gold rallied very quickly and achieved its long-awaited target – $2000! Russian troops continued their offensive and – although the pace slowed down considerably – they managed to make some progress

Full Article →After a steady week of gains, gold has had a volatile Friday, of the kind that is very much to the gold bug’s liking. Bullish forecasts for $2,000 gold this year were expedited with force by the Russia-Ukraine conflict. We’re now thinking $2,000 will be the price that could define the long-term trajectory of gold’s price.

Full Article →These are uncertain times for long-term savers. That statement is accurate even if all you think about is the Russian invasion of Ukraine. As you likely know, global financial markets have demonstrated significant volatility during this time of Ukranian strife…

Full Article →Fighting Continues: Good for Ukraine… and GOLD

What does the ongoing war in Ukraine mean for the precious metals market? Well, the continuous heroic stance of President Volodymyr Zelenskyy and Ukrainian defenders is not only heating up the hearts of all freedom-lovers, but also gold prices.

Full Article →Last week has been a volatility showcase that is rarely seen in the gold market. Russia’s invasion of Ukraine sent gold flying past its 2011 high and up to $1,976, the highest level in a year and a half. The next day gold posted considerable losses and ended Friday’s trading session around $1,890

Full Article →As Ukraine Resists Will Gold Withstand Bear Invasion?

What does the war between Russia and Ukraine imply for the gold market? Initially, the conflict was supportive of gold prices and the price of gold soared on Thursday. However, the rally was very short-lived, as the very next day, gold prices fell and gold’s performance looked like “buy the rumor, sell the news.”

Full Article →Do We Prepare for the Worst and Buy Gold?

As the COVID-19 pandemic has shown, it is worth being better prepared for a possible crisis. Does that mean it pays to have some gold up your sleeve? I have to confess something. I always laughed at preppers. C’mon, who would take these freaks seriously?

Full Article →Inflation: “Greatest Long-Range Danger Apart from Nuclear War”

I’m not encouraging you to believe U.S. inflation this time around could lead to the collapse of America. But I think it is good to take the words of Charlie Munger to heart and recognize the potential of inflation to have a significant impact on economies and personal savings.

Full Article →Energy Shock: Ukraine Crisis to Push Inflation Higher

Fuel costs have already been soaring due to oil and gas supply constraints and inflationary pressures. The national average for a gallon of regular unleaded is $3.55 – some parts of the country are paying closer to $5.00 per gallon. Now the threat of full-scale war in Ukraine is sending risk premiums in futures markets even higher.

Full Article →Gold a Shelter as Russia Invades Ukraine

The war has begun: after a few weeks of tense situation, Russia has taken a radical step and started an invasion of Ukraine. How will this affect gold? Well, risk aversion has soared amid the conflict. Equities are plunging while safe-haven assets are soaring.

Full Article →Can Gold Outperform – Even During a Rate Hike Cycle?

One good thing that can be said about this is that rate hikes get priced in far ahead and in succession. As far as the markets are concerned, three rate hikes have already happened. But that’s where speculators stop doing gold any favors.

Full Article →The Zugzwang Position

It’s a funny bull market, this gold thing. Unloved by the mainstream commentariat, who desperately cry “barbarous relic”, and by the bitcoin bettors, who call it an “ugly yellow rock”, its price is now with a hair’s width of the all-time high. $1,905, as this Report is being written…

Full Article →When The Russian Bear Roars Will It Wake Gold Bulls?

The current military tensions and the Fed’s sluggishness favor gold bulls, but not all events are positive for the yellow metal. What should we be aware of? It may be quiet on the Western Front, but quite the opposite on the Eastern Front. Russia has accumulated well over 100,000 soldiers on the border with Ukraine

Full Article →Warning From Canada: Financial Freedom Under Attack

In an unprecedented move sidestepping normal due process guarantees, Trudeau ordered banks, insurance companies, and even cryptocurrency exchanges to close the accounts of anyone deemed to be involved in the Freedom Convoy.

Full Article →High Inflation or Recession: Analyst Says Gold’s Got You Covered Either Way

A funny thing is happening on the way to higher interest rates: The price of gold and silver also is moving higher. Since the beginning of the month, the spot gold price has increased by 4% and silver has jumped by about 4.5%. And this is amid all the talk of rate increases coming faster and in larger quantities…

Full Article →Gold is Going Up On Fed Interest Rises

There are many who believe that when interest rates go up, gold gets weaker. The truth is, that gold can rise with interest rates and can also rise with the markets. What’s important to remember is that beyond all the economic fundamentals, asset prices go up or down based on the inflows and outflows of money.

Full Article →Inflation Peak: High Risk or Golden Opportunity?

If only you weren’t in a coma last year, you would have probably noticed that prices had been surging recently. For instance, America finished the year with a shocking CPI annual rate of 7.1%, the highest since June 1982

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.