For decades, the nation basically ignored the national gold reserve. The only people who ever brought it up, were immediately dismissed as tinfoil-hat-wearing conspiracy-mongers. Whether out of concern for its existence, or just out of prudent asset management, we may soon get the first proper Fort Knox audit since the 1950s…

Full Article →It would be great if major institutions were trustworthy, competent, and efficiently run. But fixing these institutions first requires recognition of the problems. The people who spent all of their time marginalizing gold bugs as nutjobs and conspiracy theorists are starting to find themselves out on the fringe.

Full Article →The Saddest Recession Indicator I Ever Heard Of

All too often, when we talk economics and finance, we neglect the human side of the equation. GDP is about more than percentages – it’s about prosperity and confidence. Unemployment isn’t just a number, it’s real people who’ve lost their primary source of income. So, today, we explore the saddest recession indicator…

Full Article →Leasing vs “Leasing” Gold for a Return

In this article we compare conventional bank leasing with a true gold lease from Monetary Metals. So many questions surround gold markets and the financial products available, and we want to set the record straight. Gold markets are notoriously opaque. We can’t always understand what is happening in those markets and…

Full Article →How Much Gold Is Moving From London to New York?

A lot of gold has moved from London to New York in recent weeks. Mainstream analysts blame the dynamic on the threat of tariffs pushing the futures price of gold (and silver) higher in New York. There could also be a more fundamental issue at play: the fact that there is a lot more paper gold than physical metal.

Full Article →Why Is the Fed Afraid of a Fort Knox Audit?

Your News to Know rounds up the most important stories about precious metals and the overall economy. This week, we’ll cover: Why is Fort Knox at the center of a tornado of suspicion? How to increase the federal government’s revenue by $750 billion with this one weird trick. Gold sets new records, tops $2,900 as $3,000 becomes the target in view

Full Article →Will You Get a $5,000 DOGE Stimulus Check?

Love him or hate him, Elon Musk has some truly enormous plans for slashing government waste and cutting federal spending. Trump and Musk say DOGE could return 20% of its savings to taxpayers, too! Is your $5,000 DOGE stimulus check is on its way?

Full Article →News aggregator ZeroHedge tweeted at President Trump’s head of government efficiency, Elon Musk, “It would be great if @elonmusk could take a look inside Fort Knox just to make sure the 4,580 tons of US gold is there. Last time anyone looked was 50 years ago in 1974.” Mr. Musk responded, “Surely it’s reviewed at least every year?”

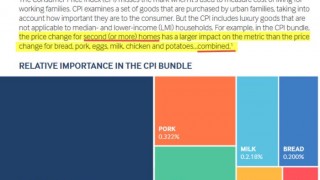

Full Article →Why Official Inflation Reports Are Dead Wrong

Recent official inflation reports are disheartening. What’s worse, they simply don’t reflect the reality faced by everyday American families. Today we take a deep dive into how inflation itself, the official headline CPI, is measured. What if we’ve been measuring the wrong things?

Full Article →Is the Shortage of Large Bars Temporary?

Traders with an obligation to deliver physical bars in the U.S. have found the available inventory is in short supply. They have been rushing to import supplies from London and/or paying hefty premiums to secure the bars they need. Others have been capitalizing on arbitrage opportunities.

Full Article →Global Scramble for Physical Gold Bullion Heating Up

We’re still seeing unprecedented flows of physical gold bullion worldwide, creating logistical challenges and causing not a little market chaos. The world’s biggest bullion dealer just accepted their second-largest delivery of gold since 1994 – what exactly is going on?

Full Article →Will Fed Waste & Abuse Finally Get Attention Too?

Americans got an eyeful of the waste and fraud which has been rampant in federal spending last week. A barrage of announcements by the Trump administration included putting the brakes on a $50 million program to buy and supply condoms to people in Gaza.

Full Article →Fifth Straight Significant Silver Supply Deficit for 2025

The silver market is forecast to record a fifth straight market deficit in 2025, with demand once again outstripping supply. Analysts at the Silver Institute call the projected market deficit “sizeable.” The Silver Institute projects record silver offtake this year, with overall demand coming in at around 1.20 billion ounces.

Full Article →3 Reasons Why 2025 Will Be a Bumpy Ride

Every new year starts off with hope – this year, hope that we’re on the road to a real economic recovery. That would mean lower prices, affordable housing and a better standard of living. Let’s take a look at a map, and see if we’re on the right track…

Full Article →Is Arizona Getting Gold & Silver-Backed Transactional Currency?

A well-meaning bill filed in the Arizona Senate seeks to establish a state-sanctioned transactional currency backed 100 percent by gold and silver, along with a state-operated bullion depository. Interestingly, the state would also issue physical gold and silver coins, even as such actions by a state are explicitly barred by the U.S. Constitution.

Full Article →These 3 Catalysts Could Fuel Precious Metals Markets

Longtime bullion investors have been evaluating whether to buy, sell, or hold in recent months. The change in leadership in Washington DC has prompted some searching as to the direction of the markets. Demand for precious metals tends to come in three broad categories: inflation hedging, safe-haven buying, and speculation.

Full Article →Will Trump Executive Orders Change Retirement Math?

It’s been an eventful few days since Trump was sworn into office for his second term. Right out of the gate, Trump issued quite a few executive orders and policy revisions, many with economic consequences. Let’s assess the long-term impact…

Full Article →Silver Historically Underpriced: Gold-Silver Ratio Over 90-1

The gold-silver ratio has surged to over 90-1. This indicates that silver is extremely underpriced from a historical perspective. In other words, silver is on sale. The last time we saw a gold-silver ratio over 90-1 was in the early days of the pandemic lockdowns. In the modern era, the ratio has averaged between 40-1 and 60-1.

Full Article →Gold & Silver Shortages – Unprecedented Demand

The global bullion market is seeing major dislocations amidst unprecedented demand for physical delivery. Some industry experts said these disruptions may be expediting a supply squeeze in the silver market that will lead to a spike in prices…

Full Article →Rich Gold, Poor Gold

Robert Kiyosaki defines an asset as anything that puts money in your pocket and a liability as anything that takes money out of your pocket. In other words, does this asset make my “cash flow” or my “cash go?” The problem with owning gold in Kiyosaki’s framework is that nearly all conventional gold investments do not generate income.

Full Article →Are Tariff Worries Setting Up a Gold Squeeze?

We could be setting up for a significant squeeze in the gold and silver markets. We’re seeing signs that tariff concerns are growing, creating an interesting dynamic in the London precious metals market. Owners of gold in London vaults can loan their metal on a short-term basis and last week, lease rates suddenly surged to over 3.5 percent.

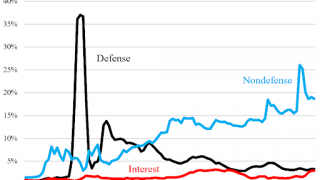

Full Article →Debt, Bonds and Gold: Has the Federal Reserve Overdone It?

Over the last four months, the Federal Reserve has cut interest rates by a full percentage point. It started with a supersize 50 basis point cut in September, followed by quarter-point cuts in November and December. But despite slashing rates, Treasury bond yields have risen sharply. What’s going on in the bond market?

Full Article →China Reports More Gold Buying, but…

China announced an increase in its official gold reserves in November. It was the first reported increase after a 6-month pause, and it appears it wasn’t a one-off event.

And by the way, the Chinese have a lot more gold than they admit.

Goldman Sachs Forecasts Huge Shift in Gold Prices

Gold’s already had six fantastic years – dare we hope for the bull run to continue? Goldman Sachs weighs in, forecasting another two years of growing gold prices (at least). Here’s why Goldman thinks the bull run may just be getting started…

Full Article →Gold Topped – But Did Silver?

Given today’s decline in gold, it appears that we took profits pretty much right at the top on Friday – at least in the case of gold – but… Was that the final short-term top? To clarify, we had gone long on Jan. 2, and I then moved the profit-take level for gold higher – to $2,733 on Jan. 3.

Full Article →Sound Money Would Check Government More Than DOGE Can

Many Americans are rooting for Donald Trump and his appointees to succeed in their herculean task of slowing or reversing government growth. There is much discussion about how runaway big government might be stopped. But there hasn’t yet been talk about how to keep it that way.

Full Article →ETF Gold Holdings Increase in December – First Time Since 2019

For the first December since 2019, gold-backed ETFs globally reported net inflows of gold. Asian funds drove the global increase in ETF gold holdings to close out 2024. On the year, ETF gold holdings dropped modestly by 6.8 tons, but assets under management rose 26 percent to a record high of $271 billion thanks to skyrocketing gold.

Full Article →Just How Good Was Gold in 2024?

Gold was one of the best-performing asset classes in 2024, outgaining the red-hot U.S. stock market. People who follow financial news know that gold had a great year. Despite its typical apathy toward gold, even the mainstream was forced to sit up and take notice. But you may not realize just how well gold did.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.