Here’s something you don’t want to hear from your political leaders, especially in the federal government: “Our financial ship is sinking.” Yet that’s exactly how Tennessee Representative Tim Burchett recently described the situation. He made this statement because the U.S. government can’t reach a resolution that would keep its own operations funded.

Full Article →Everyone Would Buy Gold If They Knew This

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Investors under-educated on gold, an update on Russia’s gold dealings, and who owns the London Metals Exchange?

Full Article →Only One Thing Can Come from Ballooning Federal Deficits

Representatives in the U.S. House have raised the curtain on the latest round of budget theater in Washington DC. The actual conservatives in Washington can once again be seen fighting a futile rear-guard action to hold the line on spending. The only real question is whether they will relent before House Speaker Kevin McCarthy cuts another deal with Democrats

Full Article →Despite the global stock markets witnessing their steepest weekly drop in six months, gold has held its ground, maintaining a trading range that’s the tightest we’ve seen in five years. Shifting our focus to government bonds and interest rates, these elements act as the market’s pulse. We’ve observed a significant rise in interest rates,

Full Article →Paul Krugman Insists Inflation is in Your Imagination

Despite his accolades, Krugman has made some wildly inaccurate forecasts. For example, he claimed in 1997 that the Internet’s impact on the economy would be about the same as the fax machine. In 2012, he said the euro would collapse “in a matter of months, not years.” I can forgive him for failed economic projections, but this?

Full Article →Is Silver Undervalued Right Now?

Start talking precious metals, and the first image that typically pops into someone’s head is an image of a shiny piece of gold. It’s understandable. Gold always seems to have a certain allure that doesn’t always translate to silver. Maybe part of it’s the color of the metal. There’s an exoticism to gold’s appearance that doesn’t apply as readily to silver…

Full Article →Short-Term Gold Price Outlook Remains Bullish, But…

Whoever requested the extra portion of signs from gold and gold stocks certainly didn’t have to wait for long. Gold stocks severely underperformed gold once again, and this means that the end of the rally in gold is probably near. It might or might not be completely over just yet.

Full Article →Will Your Gold Transactions Be Reported to the Government?

Liberty Safe, the nation’s largest manufacturer of gun safes, recently fell into hot water. The company provided the access code for a customer’s safe to FBI agents who were executing a search warrant. Some were not happy to hear the company cooperated with the FBI’s request, particularly given that many perceive case as politically driven and illegitimate.

Full Article →Today, we are turning our gaze towards the East, focusing on the gold market in China, which has been a hub of activity recently. Gold prices in China, the world’s leading consumer and central-bank buyer of the precious metal, experienced a five-day run of new record highs before snapping back.

Full Article →Consumer Confidence Index tumbles in August

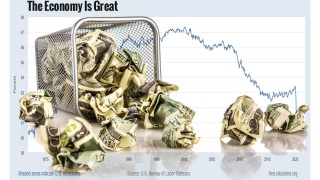

Did you know that Bidenomics is actually a thing? And that it’s supposed to be a good thing? It wasn’t always that way. Once upon a time, the term “Bidenomics” was a snide pejorative, used by the president’s political opponents as a sarcastic term for the economic “strategy” they like to say has produced, the highest inflation and fastest interest-rate increases in 40 years

Full Article →Inflation Burns Through “Safe” Sectors – What’s Next?

Since May 2021, inflation persistently above the Fed’s 2% target has devoured our purchasing power, day by day. Making the cost of living impossible to predict and planning for the future increasingly uncertain. After a short period of cooling off, inflation is heating up again on multiple fronts. One rather unexpected price surge will make budgeting a challenge…

Full Article →The Biggest Con Job in Banking: The Savings Account

Savings accounts today offer the highest yields in 15 years. Even so, they may not be the best way to protect your savings from inflation. When the Fed raises interest rates to curb inflation, ripple effects spread across the economy. Some of the impacts are negative (especially if you owe a lot of money), but others are positive for savers…

Full Article →Attacks on Rule of Law Point to Need for Off-Grid Money

The assault on individual rights is accelerating, and investors would be wise to think about the assets they hold in a world where the rule of law is failing. Last week, New Mexico Governor Michelle Lujan Grisham banned citizens from carrying firearms in Albuquerque, neither bothered nor slowed by recent U.S. Supreme Court affirmations of the 2nd Amendment.

Full Article →Insider Gold Buying Reaches New Record Level

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Global gold holdings rise to highest level since 2012, a one-way flood of gold from West to East and are we missing out on platinum’s comeback?

Full Article →Central Banks Decide It’s Time for Their Metals to Come Home

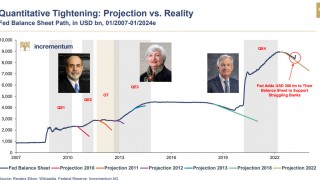

It remains to be seen if, in fact, interest rates start declining next year after what has been a year and a half of the fastest rate-tightening cycle in 40 years. But expectations are growing that Federal Reserve officials will be making a more dovish tilt in their application of monetary policy beginning at some point in 2024

Full Article →Threat of New Economic Lockdowns Grows

A late summer rise in COVID cases is triggering calls by control freaks across the globe for reimposing mandates and restrictions on the public. Civil liberties advocates are warning that crippling new economic lockdowns could be coming down the pike. Public health officials are talking up widespread masking yet again

Full Article →Here’s Why Everyone Will Need Gold Soon

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Investment firm sounds off on gold investment in a commodities era, gold standard and why we might have been here before, and did you notice gold hit another ATH in the Japanese yen?

Full Article →2023 Deficit Surge: A Concerning “New Normal”?

The day before signing the Fiscal Responsibility Act into law, President Biden said, “We’re cutting spending and bringing deficits down.” In the merely three months since the Fiscal Responsibility Act became law, the gross national debt already has risen by another nearly $1.5 trillion, suggesting that perhaps this promise remains elusive

Full Article →Bidenomics Has Failed In The Worst Way Possible

Corporate media headlines like Biden’s Economy Is the Best Ever or The Bidenomics Success Story leave one big question unanswered… Who is better off? (Lest we forget, “the economy” isn’t a citizen.) Are you better off than you were thirty months, two and a half years ago?

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold’s price holding up even though interest rates keep rising, the real story of inflation, and gold remains a key asset for the new global economy.

Full Article →Must-Know Facts About Precious Metals Insurance

Making an investment in physical gold and silver is easy. Insuring these new valuables stored at home is more difficult. It may be outright impossible in larger amounts. The standard homeowner’s insurance policy provides little, if any, coverage for precious metal coins, rounds, and bars…

Full Article →Recession Canceled? Not According to These Analysts

You know how it goes. Inflation comes barreling out of the gate. The Fed starts pushing rates upward. At some point, the cost of money ultimately gets so high that the economy starts to break. Next, consumers stop spending, stores and manufacturers have less business, and workers get laid off. Last stop: recession.

Full Article →At the beginning of the pandemic panic, American households hunkered down, slashed spending and deposited their stimmie checks. Ever since, thanks to a combination of high inflation and “revenge spending,” consumer spending exploded to what Wolf Richter calls “drunken sailors partying hard” levels.

Full Article →On 2023-08-25, the expected price range for the Silver Continuous Futures was projected to have a low of 23.83 and a high of 24.86. This forecast was based partially on the previous day’s data, where the opening price was 24.39, the highest point reached was 24.42, the lowest point was 24.12, and the closing price was 24.19.

Full Article →The U.S. dollar has enjoyed global reserve currency status for nearly a century now. If BRICS nations have their way, that privileged status won’t last much longer. The weakness of the U.S. dollar is top of mind for all BRICS countries, and plenty outside of BRICS too.

Full Article →On 2023-08-23, the expected price range for the Gold Continuous Futures was projected to have a low of 1,913.28 and a high of 1,939.95. This forecast was based partially on the previous day’s data, where the opening price was 1,923.30, the highest point reached was 1,933.20, the lowest point was 1,917.50, and the closing price was 1,927.30.

Full Article →On 2023-08-22, the expected price range for the Gold Continuous Futures was projected to have a low of 1,906.20 and a high of 1,934.23. This forecast was based partially on the previous day’s data, where the opening price was 1,919.00, the highest point reached was 1,927.90, the lowest point was 1,913.60, and the closing price was 1,923.30.

Full Article →2024 Gold Bull: Projections of Stronger Gold Next Year

Can anyone dispute that this has been one of the more challenging cycles of chronic inflation and higher interest rates in our history? For the past 2½ years, year-over-year inflation has remained stubbornly above the Federal Reserve’s 2% target, at one point reaching north of 9% – it’s highest rate in more than 40 years

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.