Lumber prices can be a leading indicator to economic outlooks.

Bullion.Directory precious metals analysis 17 March, 2015

Bullion.Directory precious metals analysis 17 March, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Senior FX and Commodities Analyst at FX Analytics

Earlier this month, the idea of lumber being a signal for economic data was brought to the table here. Lumber is not necessarily a trader’s first go-to for evaluating economic forecasts, but there is a striking resemblance in trend for lumber and the ISM manufacturing PMI data.

As lumber prices dive, manufacturing data tends to do the same (and vice versa). Lumber, reasonably so, is also correlated to housing; and the US cannot have a recovery without housing participating.

The housing data over the last few years has been lackluster, and today’s data is no exception. Housing starts contracted a whopping 17 percent. That’s 14.5 percent lower than general forecasts. Weather was cold, and it is always to blame.

However, analysts were already discounting the weather issue.

Wall Street’s best and brightest were looking for a drop of only 2.5 percent, so clearly it is not just the weather. According to the US Department of Housing and Urban Development, privately-owned housing starts were seasonally-adjusted at an annual rate of 897,000, or 17 percent below the revised January estimate. Single-family housing starts in February were at a seasonally-adjusted annual rate of 697,000, or 14.9 percent below the revised January estimate. Not good.

Housing completions of privately-owned housing fell came in at a seasonally-adjusted annual rate of 850,000, or 13.8 percent below the revised January estimate of 986,000.

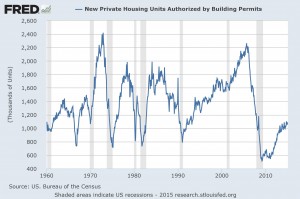

The “recovery” bulls will harp on the permits data which was three percent higher than the general consensus. But, let’s be objective. Permits do not particularly matter much because builders cannot sell permits. Building permits are also cyclical. They tend to rise to elevated levels on optimistic outlooks but then completely collapse right before the next recession.

Permits could continue to rise, but it is not indicative of a healthy housing sector, or economy for that matter.

Lumber has closed well-below the massive ascending channel created when prices bottomed in 2009. Currently trading at $270.90, lumber prices are down almost 14 percent since first bring more attention to lumber a month ago.

The basic assumption is that low prices are great for builders and the housing sector in general, and they are at the margin. However, a trend shift in prices indicate that homebuilders are not purchasing lumber. Homebuilder confidence fell for a third consecutive month in March.

Prices saw a bit of support at $265 but could easily hit $245 on trend continuation. To illustrate the correlation of lumber to housing, check out lumber prices relative to the iShares DJ Home Construction ETF (ITB) and the SPDR S&P Homebuilders ETF (XHB). It’s not a perfect match, but it grasps the overall trend quite well. Notice the prices of lumber, ITB, XHB leading into the housing crisis – they collapsed. This time should be no different.

The two popular ETFs now trade at a premium to lumber prices, but the upward trajectory is stalling; and this is far likely contributed to Fed-induced buying (similar to the XLE and future prices).

It is only a matter of time before housing ETFs begin to rollover, too.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply