Precious Metals Market Report

Friday 10 March, 2017

Fundamentals and News

Gold Slides Below $1,200 in Longest Losing Run Since October

Gold dipped below $1,200 an ounce in its longest losing run since October as positive U.S. economic figures reinforce expectations that yields on other investments will rise this year.

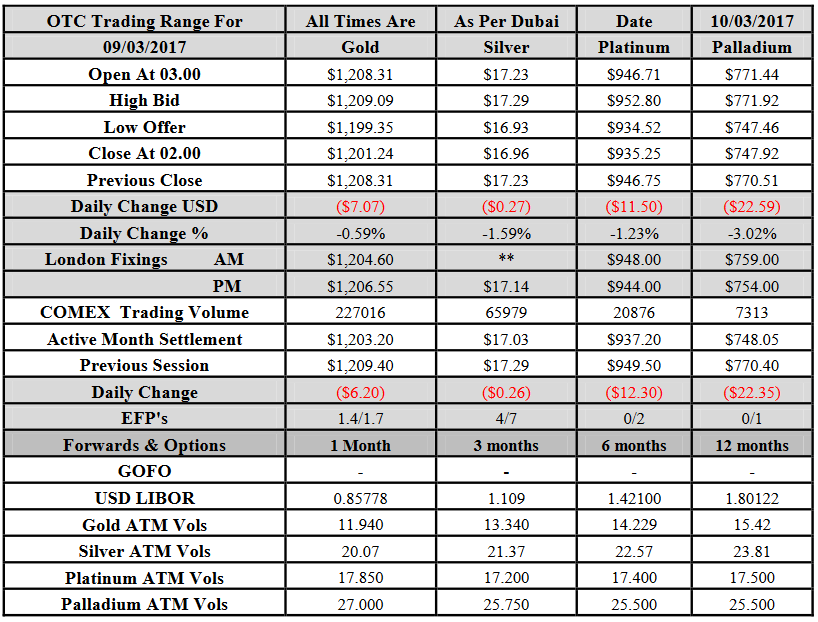

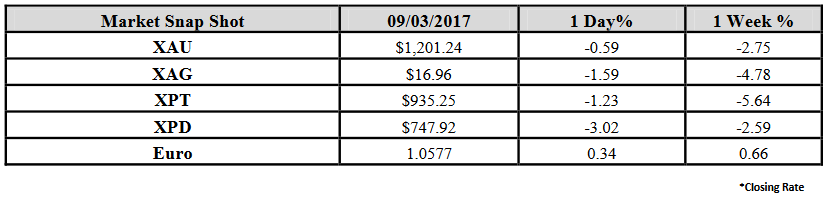

Bullion for immediate delivery fell as much as 0.7 percent to $1,199.35, the lowest since Feb. 1, and settled at $1,201.24, according to Bloomberg generic pricing. The metal slid Thursday for a fourth day as yields on 10-year Treasuries extended gains.

The precious metal has been hit by Federal Reserve officials including Chair Janet Yellen talking up the prospect of higher rates this month. Better than expected U.S. private jobs data this week also boosted the dollar before official payrolls figures on Friday. A stronger dollar makes gold costlier for those with other currencies.

“If the data continues to be as good as it was, or improves, we could see the Fed move toward further hawkishness,” said Brad Yates, head of trading for Elemetal, one of the biggest U.S. gold refiners. “That could hurt gold.”

After the Fed raised rates once in 2015 and again in 2016, the pace may quicken this year.

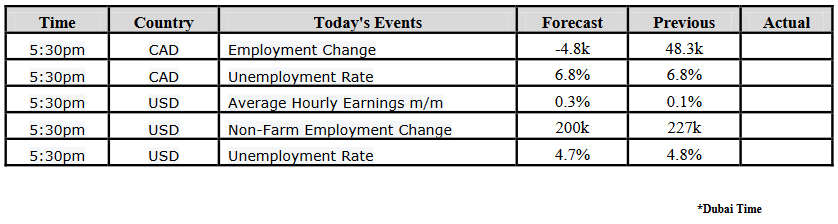

The so-called dot plot illustrating policy makers’ projections suggests three increases this year. While economists see U.S. non-farm payrolls declining, possibly supporting gold, their projections have underestimated employment growth in February for five years in a row.

In other precious metals:

Gold and silver futures fell on the Comex, while platinum and palladium slid on the New York Mercantile Exchange.

The World Platinum Investment Council raised its 2017 platinum supply deficit to 120,000 ounces from 100,000 ounces on a resilient car market. The metal is used in auto catalysts that help remove pollutants from vehicle exhaust.

(*source Bloomberg)

Data – Forthcoming Release

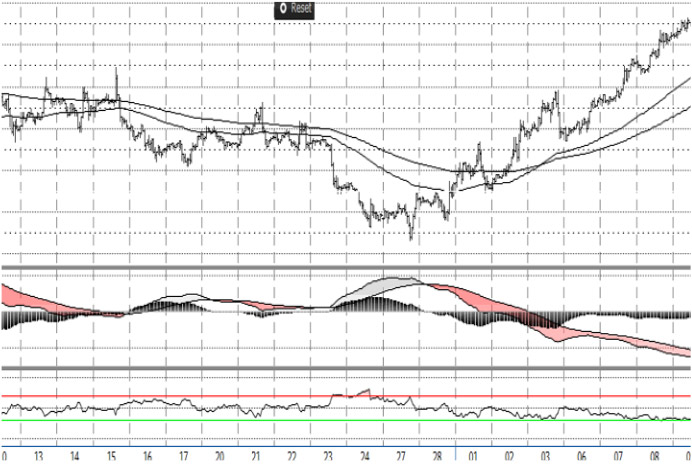

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1201.24 an ounce; with loss of $7.07 or 0.59 percent at 2.00 a.m. Dubai time closing, from its previous close of $1208.31

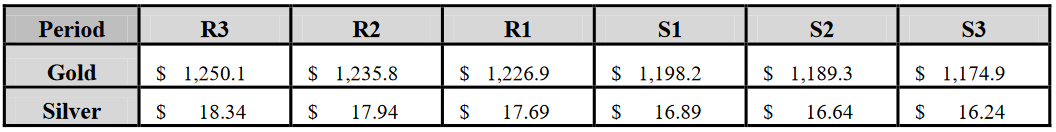

Spot Gold technically seems having resistance levels at 1226.9 and 1235.8 respectively, while the supports are seen at $1198.2 and 1189.3 respectively

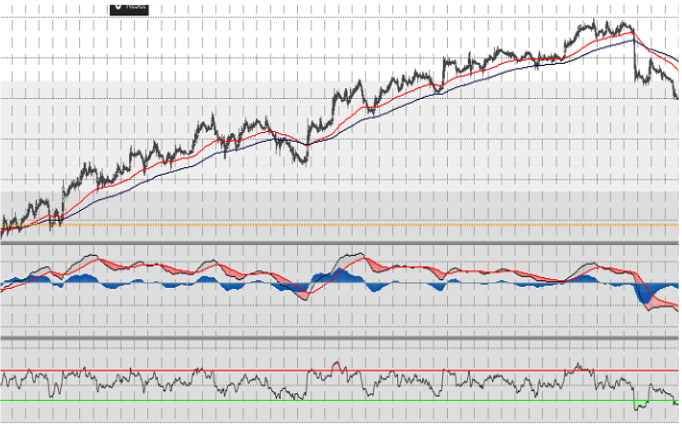

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.96 an ounce; with loss of $0.27 or 1.59 percent at 2.00 a.m. Dubai time closing, from its previous close of $17.23

The Fibonacci levels on chart are showing resistance at $17.69 and $17.94 while the supports are seen at $16.89 and $ 16.64 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply