This month marks the five-year anniversary of Monetary Metals paying interest on gold.

Bullion.Directory precious metals analysis 22 July, 2021

Bullion.Directory precious metals analysis 22 July, 2021

By Keith Weiner

CEO at Monetary Metals

Ever since then we’ve been busy Unlocking the Productivity of Gold™ for the good of our clients, and the world. The five-year mark is a good time to pause and reflect on how far we’ve come. Let’s start with our clients.

Benefits of Investing with Monetary Metals

Interest on Gold – How much could I earn?

It’s the 1,000 oz question on everyone’s mind. How much would you have earned if you invested in Monetary Metals’ True Gold Leases five years ago?

The answer: Approximately 14.8%.

That means 100 ounces invested in year one, grew to 114.8 oz after five years. That’s almost 15 new ounces, imagine that! Setting aside our preference to measure the dollar in gold terms, at today’s gold price of ~$1,800, that’s an additional $27,000 worth of gold.

Note, this increase in gold has nothing to do with an increase in the price of gold. The price could have risen, fallen, or stayed the exact same over that five-year period and you would still have 14.8 more ounces. That’s the meaning of a true gold investment.

Your gold is working for you, regardless of price. Friends, this is what the gold standard looks like.

Breaking down the Interest on Gold

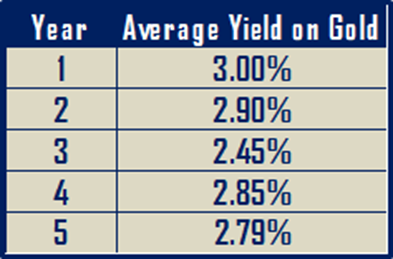

Here’s how the math breaks down for that 14.8% figure.[i]

To get to 14.8% after five years, we took the average annual interest on gold for leases and reinvested the gold interest earned on an annual basis.

Actual client accounts could be above or below that number.

Note, this analysis doesn’t include our gold bonds, which offer higher gold interest rates.

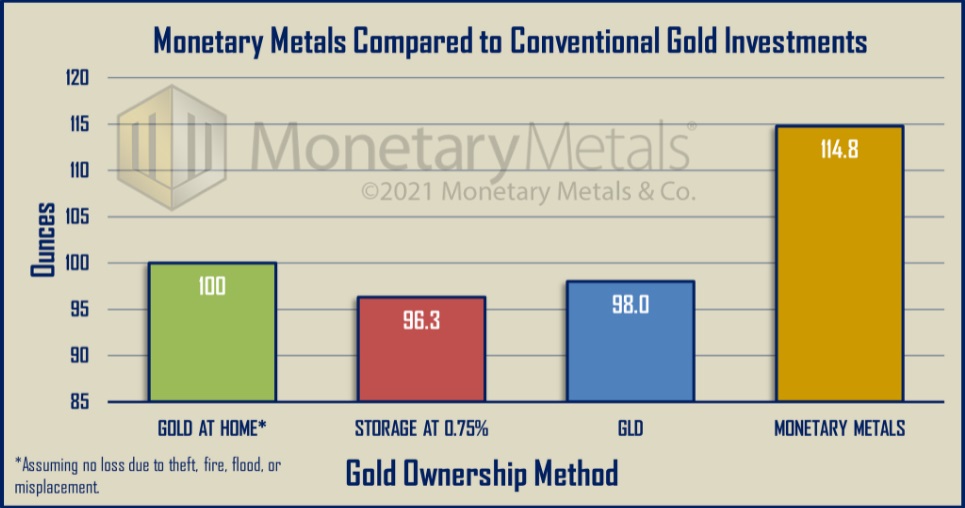

Before we move on, it’s worth comparing to a few conventional gold investments.

What other method of owning gold can increase your total holdings over time? Much less by 15%?

The most popular options either stay the same or decrease over time due to fees.[ii]

Cataloging the benefits of investing with Monetary Metals is one way to celebrate five years of interest on gold. Another is to look back on the major milestones we’ve achieved.

Timeline of Major Milestones over the Last 5 Years

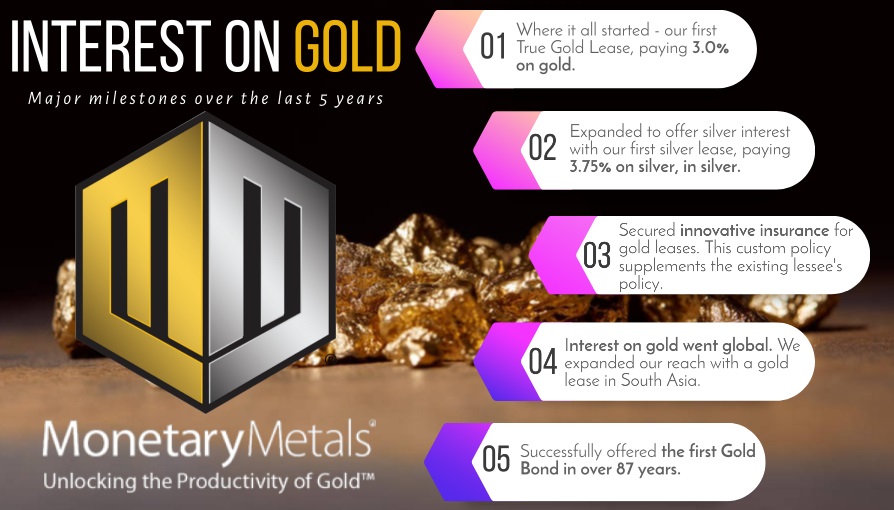

There’s a lot that goes into paying interest on gold. Here are the major milestones we’ve hit each year in our five-year history.

Year 1: Our First Gold Fixed Income – True Gold Lease

This is where it all began. The gold lease that kicked off the whole mission to pay interest on gold, in gold.

Year 2: Our first Silver Fixed Income Lease – Paying 3.75% interest on silver

Silver is money too. So we added silver leasing in year two. The first one-year lease paid 3.75% interest on silver, in silver. Monetary Metals First Silver Lease.

This was the first indication of differences in gold and silver interest rates. We wrote an article about it at the time – Will Gold or Silver Pay the Higher Interest Rate?

Year 3: Added Innovative Insurance to our True Gold Leases

Our responsibility is to de-risk gold leasing as much as possible. Adding an insurance policy from a leading London-based insurer was a huge step forward. The policy provides an extra layer of protection and supplements the lessee’s existing policy. Monetary Metals adds innovative insurance

Year 4: Monetary Metals Goes Global

Year four was when interest in gold went global. We closed our first international gold lease to Quantum Metal, the leading provider of retail gold bullion in Malaysia through the retail bank channel.

The lease was for one year and paid 4.5% per annum to investors. Monetary Metals leases gold to Quantum Metal

Year 5: Monetary Metals issues the first true gold bond in 87 years

The gold bond heard round the world (as we like to say). There have been a few investments that mention the word “gold”, but ours was the first proper gold bond—denominated in gold with interest and principal paid in gold—since 1933.

The bond was issued to finance Shine Resources, a gold mining company based in Western Australia. It closed on Christmas Eve, 2020. Monetary Metals Issues World’s First Gold Bond Since 1933

We rate these achievements as our most significant in our first five years, but it’s not an exhaustive list. Visit our press releases page to see everything.

Giving thanks and looking forward to more interest on gold

When celebrating it’s important to acknowledge and give thanks to the people that made the last five years possible: Thank you to all our Clients!

None of this would be possible without our amazing clients! Our growing community of investors is one of the best things about our business. People from all over the world (literally) coming together to earn interest in honest money—gold and silver.

Thank you for your continued support. It is an honor to partner with you to build real wealth in real money, and to offer the world a true alternative to the broken dollar system.

Of course, we couldn’t serve our clients without our incredible team. We love getting up every day to make interest on gold a reality for as many people as possible.

If you haven’t met us yet, we encourage you to get to know us a bit.

Whither Interest on Gold for the next five years?

In the last five years, we were just getting started to Unlock the Productivity of Gold™. And we plan to do a whole lot more of that! We have more opportunities coming soon.

Monetary Metals is the pioneer of gold investments—investing gold to earn more gold. We are building the Gold Yield Marketplace™.

We invite you to follow our progress, or join us and be part of something great.

Here’s to many more years (and to more interest in gold!) to come!

[ii]Storage fees of 0.75% annual based on rates we’ve seen in the industry. GLD has an expense ratio of 0.4% annual. Storage and GLD figures based on paying the fees/expenses out of the gold itself.

Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply