Well, that didn’t take long. In April, Zimbabwe introduced a gold-backed currency in an effort to stabilize the country’s financial system. Less than six months later, the Reserve Bank of Zimbabwe has already devalued the new money. I hate to say, “I told you so,” but, well, I told you so.

Full Article →Scammers Using Gold to Fleece Americans for Everything

One of the primary reasons that investors turn to physical gold and silver is to eliminate counterparty risk. Bullion.Directory precious metals analysis 30 September, 2024 By Clint Siegner Director of […]

Full Article →Did Fed just send gold over $2,600/oz?

This might be the most thrilling time in the gold market since 1971. You could argue the 2008-2011 Great Financial Crisis compares, but I beg to differ. The pandemic panic and lockdowns were the much more like the GFC for gold. Besides, if gold’s current run was similar to the GFC, we’d already be two years into a sideways market.

Full Article →Americans Have Spent Their Pandemic Savings (and Then Some)

Talking heads and politicians laud the “resilience” of American consumers. They managed to keep spending despite rapidly rising prices thanks to post-pandemic price inflation. But they rarely talk about how Americans have weathered the inflationary storm. When you look hard, it’s not a story of resilience but one of desperation.

Full Article →Why Your Social Security Is in Danger

Social Security has long been promised to be a way for the average worker to retire in comfort and maintain their standard of living even after they stop earning, but can you really depend on it, or any other government run program, to keep you and your family out of the poor house and away from soup kitchens when you retire?

Full Article →It’s hard to believe we’re about to hit week four already and the 2025 public vote is seeing continued strength across all 6 categories. We did sadly see our first bout of at-scale jiggerypokery but my team was on it like a hawk. Gold eh? The main public vote will be running until October 23 with winners announced November 6.

Full Article →Powerful Forces Behind Gold’s Latest All-Time High

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold hits $2,600 in another massive jump, the Bank of France’s views on gold, and why now is the time to watch what central banks are doing.

Full Article →Russians Using Gold to Skirt Sanctions

According to the Russian website Russia’s Pivot to Asia, Russian businesses are buying physical gold in Russia and then transporting it to Hong Kong via courier. There, the gold is sold, and the cash is deposited into the bank accounts of Chinese suppliers to pay for goods and services.

Full Article →Nassim Taleb: People Not Seeing Real De-Dollarization

Nassim Taleb, best known for his book The Black Swan, said on X that “people are not seeing the real de-dollarization in progress.” He pointed out that global transactions are still generally labeled in dollars “as an anchor currency. But central banks (particularly BRICS) have been storing, that is putting their reserves, in Gold.”

Full Article →Top Banker Confesses He’s Deeply Concerned

Jamie Dimon, head of one of the biggest banks in the world, expressed concerns that what many people think could be almost the worst possible scenario for the U.S. economy is, in fact, a very real possibility. Most people, when they’re trying to find reliable information, look to experts in a given field. Jamie Dimon IS that expert…

Full Article →Tech Stocks, Return to “Normalcy” and Gold Stocks

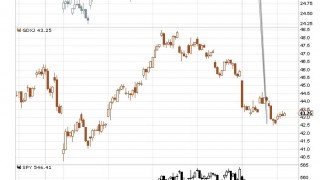

The precious metals market moved slightly higher yesterday. But the move up was too small to change anything, especially in the case of the GDXJ and FCX. The moves higher have indeed been tiny in those two – they were barely noticeable.

Full Article →ING Bank: This Gold Rally Is Just Getting Started

ING Bank has revised its short and midterm gold price forecast higher, saying the gold rally is “just getting started.” The Dutch financial group cites the prospect of a Federal Reserve rate-cutting cycle, geopolitical risks, and uncertainty going into the presidential election as potential catalysts to drive gold to new record highs.

Full Article →What We’re Told About “Sound Money” is a LIE

Economists predict the Fed will soon drop interest rates because the rate of inflation has slowed. Why the slowdown? One analyst is ready to celebrate lower inflation and lower rates as “the return of sound money.” What does that even mean? Step back with me, for a moment, to just four years ago…

Full Article →Gold’s Quick Reversal and Copper’s Major Indications

Copper is definitely the most important industrial metal out there. In the entire commodity sector, only crude oil is more widely used. This doesn’t mean that the only way in which its price can move is up (far from it), but it does indicate that this market is likely linked to multiple other markets – also to gold price.

Full Article →It’s hard to believe we’re at week one already and the 2025 public vote is off to a very strong start across all 6 categories. Of course this is early days and I will be making new updates every 2 weeks… The main public vote will be running until October 23 with winners announced November 6.

Full Article →Miners Are Dumping Every Single Ounce They Produce

On an annual basis, global silver supply generated by mines seems to have run into a ceiling of about 1 billion ounces. Supply has essentially flat-lined over the past several years. At the same time, explosive growth in demand is driving widening projected supply deficits for physical silver.

Full Article →Chinese Silver Demand Surges; Is This a Calculated Move?

Gold demand in China has been strong this year, reflecting a broader movement of the yellow metal from the West to the East. But the Chinese aren’t just accumulating gold. They have also been hoarding silver in recent months. Is China deliberately driving up the price of silver to drain the West’s resources?

Full Article →What’s going on with housing? Home sales plunge to a record low – record high prices in many parts of the nation, combined with steep mortgage rates have led to a standoff between buyers and sellers. How much is a home really worth if no one can buy it?

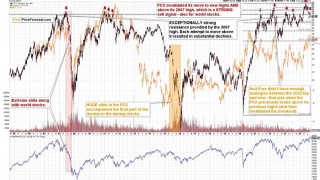

Full Article →Holding Gold Yields Better Returns Than Mining It

With spot gold prices at record highs, investors might expect that shares of precious metals mining companies are also trading at record highs. By and large, that is not the case. Mining stocks, as represented by the HUI Gold BUGS Index, are still underwater by more than 40% compared to their 2011 highs.

Full Article →Renewed Western Demand for Gold “Rocket Fuel”

Market participants are now extremely confident in the kickoff of an extended Fed rate-cutting campaign in September, especially in light of weak employment numbers. The stock market, however, continues to trade near its all-time highs — even as volatility increases. A correction would likely provide a new catalyst for gold

Full Article →The Bullion Dealer of the Year 2025 main public vote has now begun. Vote starts today (August 28) and closes October 23, 2024. Voting will be open until October 23 with winners announced November 6 – a day that may just have some major significance for the gold market FAR beyond our vote…

Full Article →Paper Money Not a Fix for Central Bank Digital Currency (CBDC)

There has been quite a bit of pushback against central bank digital currencies. But in the scramble to block CBDCs, some people seem to have forgotten that there is a more fundamental problem: government-issued paper fiat is the parent of a CBDC, and whether it is in physical or digital form, fiat currency isn’t real money.

Full Article →Remember how the Biden administration, the Fed, and corporate media kept saying the economy and job market were “strong”? Turns out that’s not true. Fed Chair Jerome Powell stepped up to the podium at Jackson Hole and announced the inflation fight was over – because the balance of economic risks has shifted. Here’s why they’re so worried…

Full Article →$1 Million Gold Bars for the First Time Ever!

For the first time ever, a 400-ounce bar of gold is worth $1 million. We hit the $1 million gold bar milestone on Friday when the price of gold topped $2,500 for the first time. The price of gold is up about 22 percent on the year and has set several new records along the way.

Full Article →Gold has embarrassed quite a number of analysts in the past few days, rocketing to another all-time high to $2,509.71 on Friday, August 16. Just a week ago we reported that a number of experts were fully convinced gold might clear $2,500 this year, but probably wouldn’t until well into 2025.

Full Article →Will Electric Vehicles Be the Killer App for Silver?

Industrial demand for silver has been surging in recent years. Solar panel manufacturers were largely behind the 11% jump in demand for 2023 versus the prior year. Forecasters predict another 9% jump this year. For silver investors, however, the future of demand from manufacturers may be even brighter than the recent past.

Full Article →Precious Metals Update 8/16/2024

Gold and silver have resumed their upward price movements again this week. And…buy the dip wins again!

Last week we wrote that the gold/ silver ratio was 89.45 and at that level silver usually makes an upward move. So far since that writing and as of this writing silver is up 3.3%. Gold is up 2.6%.

In a troubling echo of recent scandals involving other well-known precious metals firms, a Beverly Hills-based company, Oxford Gold Group, has reportedly ceased operations, leaving numerous investors fearing for their life savings. Investors have been left in a precarious position after moving substantial sums to Oxford Gold Group’s care.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.