Bitcoin has potential, but not as a substitute for gold. And not as a government-regulated get-rich-quick asset for people to gamble on in Wall Street’s rigged casinos…

Full Article →Sam Bankman-Fried FTX’ed Up

This disaster is sad because it taints an entire industry that was at first, built upon the premise of providing an alternative to centrally planned money and credit. That would be the one thing cryptobugs have in common with goldbugs – they both agree there needs to be a monetary alternative to fiat currencies.

Full Article →Inflation Reprieve Won’t Last Much Longer

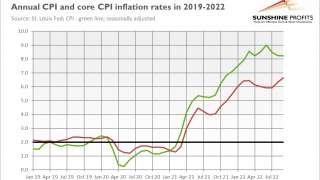

Inflation is still orders of magnitude too high, and not declining appreciably. (Should CPI continue to come in 0.2% lower every month, we’re still looking at over two and a half years of prices rising faster than the Fed’s targeted rate.)

Full Article →Inflation Down, but Gold Surges – Huh?

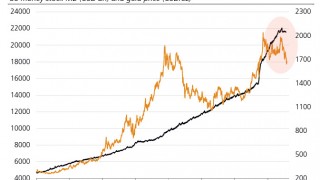

Gold’s $100+ rise to $1,760 from $1,650 last week wasn’t an intraday price move, but it feels so abrupt and rapid. And every time gold’s price surges like this, we expect there to be some crisis or calamity. After all, it was gold’s biggest weekly gain in 30 months. Remember what happened 30 months ago?

Full Article →Fed Note Suffers Pivotal Breakdown

While investors continue to await a possible Federal Reserve pivot toward monetary easing, the pivot has already occurred in major asset markets, including precious metals. Last week was indeed pivotal for multiple asset classes.

Full Article →The Best Way To Defend Your Savings

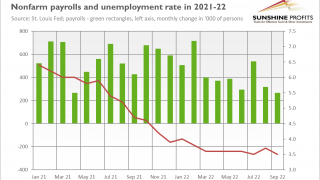

We are living through an economic crisis that will earn an entire chapter in introductory economics textbooks in the future… As of September, 63% of Americans were living paycheck to paycheck, according to a recent LendingClub report — near the 64% historic high hit in March.

Full Article →What’s Behind the Central Bank Gold Buying Boom?

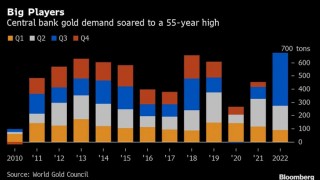

Central banks bought a record amount of gold last quarter as they diversified foreign-currency reserves, with a large chunk of the purchases coming from as-yet unknown buyers. The official sector has consistently been one of the main pillars of support for gold prices for more than a decade.

Full Article →Is Powell Planning a Pivot?

Currency traders may be looking ahead – specifically to the likelihood of a U.S. economic downturn in 2023. The potential of another housing-led Great Financial Crisis also looms. The full effects of the Fed’s latest rate hike won’t be known for months, but higher borrowing costs will hit struggling consumers

Full Article →Biden’s Gas Plans = Communism

Midterm elections are upon us, and Biden’s party seems poised for big losses. Inflation remains the #1 concern among American families. You can tell the President is a politician rather than an economist, because of his new idea for lowering fuel prices…

Full Article →Retirement Crisis Update

Inflation has been significantly elevated for a year and a half. And since the end of 2021, it’s been stuck at or near four-decade highs. Many of the consequences you’d assume would result from high levels of persistent inflation have indeed come to pass.

Full Article →The Fed has a Hammer, and You’re a Nail

Our present moment is precarious. Like it or not—we don’t—we live in the age of Central Banks. And as we witness, and alas participate in, the global drama to create or destroy wealth, there is a great and tragic irony at work.

Full Article →Another Jumbo Rate Hike, Another Gold Decline

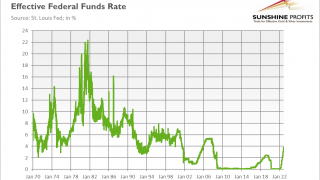

The Fed delivered another 75-basis points hike. Gold didn’t like the FOMC meeting and declined further. Bullion.Directory precious metals analysis 03 November, 2022 By Arkadiusz Sieroń, PhD Lead Economist and […]

Full Article →Why Gold’s Set to Turn Around

As long as silver continues to trade above its low from late August, it will continue to show a positive divergence versus gold. When silver leads, that generally a bullish a sign for the precious metals space. A strong close above $21 would point to a new uptrend.

Full Article →Gold to Skyrocket When Fed Makes Announcement

All that gold needs is a cowardly Fed, current monetary supply levels suggest gold is undervalued, and what a gold standard would require in modern times. The consensus is in: gold can’t shatter its former all-time highs until the Federal Reserve does.

Full Article →A Recession Is Coming, But Gold Feeds on Fear

I know that people can get fed up with recession warnings at some point, as they did with the boy who was constantly crying wolf. But there are more and more disturbing signals about black clouds gathering over the economy, despite the fact that the American GDP rose 2.6%,

Full Article →How to Destroy a Pension Fund in 22 Easy Steps

Our interest rate system is like a wrecking ball. It swings to one side of the street and destroys one side of town. Then when it swings to the other side of the street, it destroys the other side of town), without repairing any of the infrastructure it previously destroyed.

Full Article →Here’s Why Nouriel Roubini Recommends Gold & Precious Metals

Veteran Analyst Makes A Dire Prediction (Only Gold Investors Will Like This) – Nouriel Roubini’s recent feature in Time magazine tells us what we already know: inflation has become a trend word. It is no longer a term for resigned to economists, analysts, traders and speculators. These days…

Full Article →When Will Fed Throw in Towel on Rate Hikes

The Federal Reserve finally stopped referring to inflation as “transitory” earlier this year and got serious about trying to control the painful rise in prices it has caused. Officials have jacked the Fed funds rate up by 3 percent since March.

Full Article →Inflation Refuses to Go Away, Gold Refuses to Go Up

The recent CPI report shows that inflation remains high. It implies a hawkish Fed and bearish gold. To paraphrase a famous Pink Floyd song, I wish you weren’t here, inflation! The CPI increased 0.4% in September, after rising 0.1% in August, according to the Bureau of Labor Statistics.

Full Article →Could Inflation Target Be Raised?

Inflation is still running very close to its 40-year highs. And even though the Fed has raised interest rates 75 basis points a pop at each of its last three Open Market Committee meetings, those moves have had little – if any – beneficial impact on inflation.

Full Article →Banks on the Brink: Is Your Money Safe?

Banks operating outside the United States are presently most vulnerable. A spike in interest rates concomitant with a spike in the exchange rate of the Federal Reserve note “dollar” is wreaking havoc in global debt markets and driving capital flight

Full Article →FOMC Minuites Offer No Hope For Gold

For all those looking forward to the Fed’s pivot, I have bad news. The recently published FOMC minutes from the September meeting reveal strong concerns about “unacceptably high” inflation. The central bankers admitted that inflation is not falling as quickly as expected (is this surprising?).

Full Article →American Credit Card Debt Out of Control

To the surprise of many, Fed chair Jerome Powell believes that “households are in very strong financial shape.” Yes, he really said that as households continue to struggle to fight the inflation gains that are exceeding their wages.

Full Article →4 Best Reasons to Buy Gold Now?

It’s not that often that gold gets some exposure in the mainstream media, especially during a rout. So when it does, it’s almost our duty to mention it. This article breaks down and lists the primary reasons to buy gold today, specifically listing 4 things as the most important to the would-be gold investor. What are they?

Full Article →Gold Back Above $1,700. For How Long?

Gold has returned above $1,700! Does it mean that the worst is behind us and now the yellow metal can only go up? Well, such conclusions would definitely be premature. Let’s remember that September was really awful for the gold bulls, as the average monthly price plunged 4.7% compared to August.

Full Article →Dave Ramsey Doubles Down on Bad Advice

Longtime precious metals naysayers such as personal finance guru Dave Ramsey are pointing to gold and silver weakness throughout most of the year as evidence that they don’t protect against inflation. Are the anti-gold bugs right?

Full Article →Last week, my friend Dr. Ron Paul told us about Ben Bernanke’s “gold confession.” That got me thinking about world central banks – why do they keep buying gold? I understand why everyday Americans want to diversify their savings with gold but why central banks?

Full Article →Bridgewater, Stagflation and Gold

There’s little disputing the fact that retirement savers are living through a most confounding and hard-to-navigate economic environment. Inflation has been well above the Federal Reserve’s 2% average target for nearly a year and a half and interest rates have been rising steadily

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.