Quantitative easing’s failure is inevitable.

Bullion.Directory precious metals analysis 10 March, 2015

Bullion.Directory precious metals analysis 10 March, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Senior FX and Commodities Analyst at FX Analytics

The large-scale asset purchasing program implemented by the world’s major central banks has turned market participants into cult-like followers, yet the centrally planned asset bubbles are creating challenges for some. Ultimately, this will end with financial markets’ complete destruction of credibility in central banks.

Over the last few months, articles pertaining to the risk of quantitative easing began to pop up in various financial media outlets as former central bank officials began to verbally express concern over current policies that are being implemented.

Most recently, it looks like the Bank of Japan (BoJ) could be the first to suffer major blow back from financial markets.

BoJ Deputy Governor Hiroshi Nakaso said “the Bank of Japan must ease monetary policy further if oil price falls hamper its efforts to ramp up inflation expectations.”

Really? Too much of a “good” thing is really too much, more so when it just outright does not work.

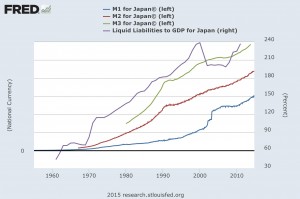

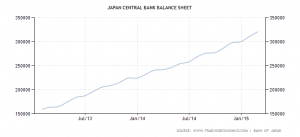

The BoJ has expanded their monetary based exponentially since the central bank began QE and is now buying 100 percent of debt issuances. Debt-to-GDP is revisiting a 14-year high of 240 percent and a public debt load into the quadrillions. Growth has been unstable and mediocre considering the level of stimulus the BoJ has conducted.

Growth falling below trend.

Back in September, I had the privilege to be on Dukascopy TV for a euro-yen forecast. I stated that I was bearish on both currencies, but I felt that the BoJ did too much, too fast.

I suppose Governor Kuroda really stuck it to me because a month later, the BoJ triple-downed on their QE efforts.

The Nikkei loved it, the USDJPY loved it. However, one thing was certain: central bank credibility will be challenged.

Yesterday, ZeroHedge posted an article about a recent survey the BoJ conducted.

The results were staggering. The central bank’s operations have killed so much liquidity that 60 percent of firms that deal in Japanese government bonds (JGB) are “having some or a lot trouble fulfilling orders,” according to Reuters. Bond dealers also saw the widening of spreads troubling.

The 10-Year JGB has been suffering weak auctions since the European Central Bank (ECB) issued their QE pledge. With central banks actively engaging in monetary warfare with the first currency to zero wins, it is only a matter of time before the time-bomb clock stops and financial markets are blown up.

The 10-year JGB yield is still under .5 percent, but if confidence further deteriorates then higher yields will undoubtedly cause the BoJ pain with their balance sheet ever-expanding.

Make no mistake, whether it’s the BoJ, ECB, or the Fed, if one central bank goes down, they all will inevitably crumble. But, let’s give them an “A” for effort.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply