The U.S. economy is at a fork in the road – one route leads to the return of market fundamentals and sane stock valuations, at the cost of a historic market correction. The other route leads to runaway hyperinflation that eats up the debt almost as fast as it devours the dollar’s buying power.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

CIBC: Gold is still going towards $2,000 and silver to $3. Despite the selloff that caused gold to drop more than 5% within a week, Canadian bank CIBC still optimistic on both gold and silver’s prospects over next few years. While the bank downgraded their average 2021 forecast for gold to $1,925, they expect metal to average $2,100 in 2022.

Full Article →Transitory Inflation Takes Hold of the Economy – How Long Will It Last? Just a couple of weeks ago, Bloomberg reported that Federal Reserve Chairman Jerome Powell sold investors on the idea that rising inflation wasn’t going to last. Officially, as of May 2021, inflation had risen 5%, the highest since August 2008.

Full Article →Social Security Under Pressure Thanks to These 3 Economic Trends: The Social Security Administration (SSA) is in enough trouble on its own. But now, there are three big cultural and economic forces that appear to be taking their toll on the program.

Full Article →The economic shock of the COVID-19 pandemic has forced many retirement savers to reevaluate their plans. That isn’t surprising, because the global economy tanked in late February, and that’s bound to have financial consequences.

Full Article →The last time the Fed was noticeably hawkish was back in August 2018. Starting October 3 of that year, the market imploded (you might remember the Dow losing 5,000 points). Now there could be a “second verse same as the first.”

Full Article →Gold price holds onto bullish level as markets brace for data reports. After breaking out of its months-long trading range and heading off towards $1,900, many analysts believe that the bullish moves in the gold market are just beginning…

Full Article →One source revealed that as much as 1 million ounces of gold recently left the BoE’s vaults at a premium between 30 to 40 cents, a figure that normally doesn’t exceed 20 cents “during normal circumstances.” Elevated central bank buying seems to indicate some skepticism about economic recovery.

Full Article →As The Daily Reckoning contributor Jim Rickards notes on Zero Hedge, the worst-case scenario for gold appears to be running its course. It’s often stated that the stock market is gold’s primary competitor, but the inverse correlation between the markets has been absent for some years.

Full Article →These “Fedcoins,” according to The Economist, “are a new incarnation of money. They promise to make finance work better but also to shift power from individuals to the state, alter geopolitics and change how capital is allocated.” But perhaps more importantly, “Fedcoins” could signal the beginning of an abandonment of the U.S. dollar

Full Article →There has been no shortage of stories of big-name investors touting or turning to gold over the past few years, and especially over the course of last year as the Federal Reserve sparked widespread inflation concerns with its multi-trillion-dollar stimulus.

Full Article →The U.S. economy isn’t a light switch that can be flipped on and off at will. Yet that didn’t stop the majority of state governors from turning off their economies in 2020 — causing financial misery for tens of millions of people.

Full Article →An economic framework called Modern Monetary Theory (MMT) governs the financial world today, but fails to account for the consequences of its practices. In fact, MMT is leading us to an extremely dangerous financial situation that could blow up at any time.

Full Article →Since the pandemic began a year ago, the term “new normal” has become part of the American lexicon. Not “new” as in better or improved. But rather “new” as in contrast to the way things used to be. Much of the mainstream discussion argues that returning to the “old” normal isn’t likely to happen. Things like pre-pandemic employment, closer-to-normal price inflation, and less economic uncertainty just aren’t on the map.

Full Article →In a recent interview, Digix co-founder and COO Shaun Djie spoke about the comparisons between gold and bitcoin, the metal’s role in the monetary system and what investors can expect in short-term economic conditions.

Full Article →IRAs Bridge the Social Security Income Gap

We’ve reported many reasons why you should not rely solely on Social Security to fund your golden years. Those reasons are in addition to the official advice that Social Security is only designed to replace about 40 percent of your pre-retirement income. Which naturally might get a retirement saver to think: “What about the other 60 percent?”

Full Article →Gold Price to $2,000 in 2021: BoA Analysts

Bank of America sets a 2021 gold price target of $2,000, why silver could jumpstart the next precious metals bull cycle, and thefts of catalytic converters from cars are on the rise, driven by high prices in platinum and palladium.

Full Article →Yellen Forces Fed to Begin Downsizing from $7.5 Trillion

The Fed attempts to maintain control of various rates (including inflation, unemployment and long-term interest rates) through its monetary policy decisions. In the past, poor choices arguably led to both the dot-com bubble and the Great Recession. But that’s old news.

Full Article →Near-Zero Rates Sound Good (Until This Happens)

In some cases, the idea of a “near-zero interest rate” is a good thing. For example, if you qualify for 0% interest when you buy a car, you save money…

Full Article →Weekly News: US Mint All Out of Silver and Gold

Stories include: U.S. Mint can’t keep pace with demand again, Goldman chief calls silver a supercharged version of gold, and amateur prospector unearths a long-lost golden treasure from Medieval times.

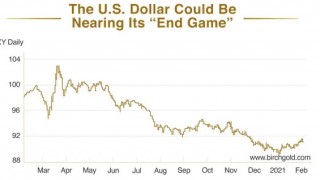

Full Article →Is the U.S. Dollar Nearing the “End Game”?

Jim Rickards said back in 2016: “The dollar won’t lose its reserve currency status overnight” — and he was right. But a new and disturbing signal could finally be revealing the end game.

Full Article →Weekly News: Silver Skyrockets on Retail Thrust

Stories include: Day traders piling into silver as analysts predict $50 price, gold’s reign as the top asset, and $400 million of civil war gold buried in Pennsylvania might have come to the surface.

Full Article →Potentially Catastrophic Inflation Surge Slips Under Radar (Until Now)

You’ve read about housing market bubbles, stock bubbles, and even credit bubbles. But the next bubble you’re about to discover could be even more dangerous, and may have even more far-reaching consequences.

Full Article →Does America REALLY Have a Retirement Crisis?

Because no matter what the headlines say, tangible physical assets can act as a hedge against inflation and diversification helps protect your savings no matter which direction the stock market heads. Take the steps you need to keep your retirement on track with a “sleep well at night” savings strategy.

Full Article →What Will Biden Mean For Retirement Plans?

When it comes to Social Security, taxes, and especially 401(k) plans in general, it goes without saying that Joe Biden has very different plans than President Trump.

Full Article →Fed Return to ‘Inflation Nation’ Could Increase Retirement Risk

Think of retirement savings like a football team: Making money is your offense and protecting your savings is your defense. Despite the potential for much higher price inflation (no matter how high it actually goes), gold and silver are looking good as potential hedges against the future of “Inflation Nation.”

Full Article →A very risky stock market and ballooning government debt should all keep investors close to gold, especially as the latter issue grows worse amid efforts to stimulate the economy in the wake of the pandemic

Full Article →The US FedCoin Takes Another Step Closer to Reality

How far in the future FedCoin will launch remains to be seen, but it sure seems like the U.S. is closer to the first major overhaul of the monetary system (and your private life) in decades.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.