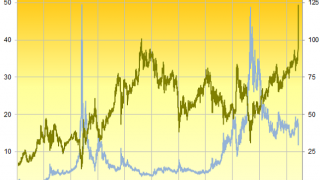

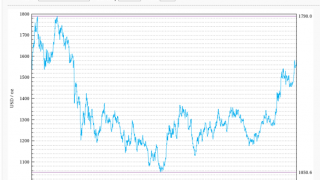

GOLD PRICES sank to 4-week lows at $1681 per ounce in London trade Friday, losing over $45 for the week as major government bond prices also fell, pushing interest rates higher, following a shock jump in the US government’s employment estimate.

Full Article →Adrian Ash

Adrian Ash is director of research at BullionVault, the physical gold and silver market with bullion owned by the citizens of over 175 countries and worth more than $2 billion.

Formerly head of editorial at London’s top publisher of private-investment advice, he was City correspondent for The Daily Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news.

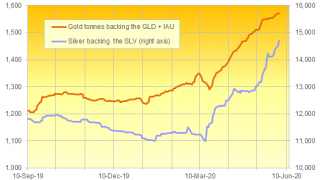

GOLD and SILVER prices slipped and rallied in London trade Wednesday after the two precious metals’ largest New York-listed ETF investment trusts expanded for a 5th session running.

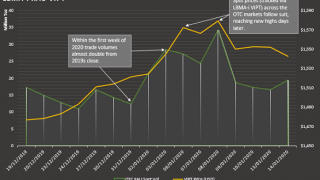

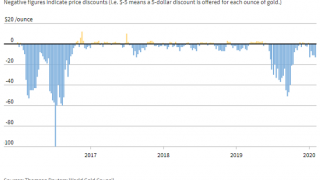

Full Article →GOLD PRICE gaps between London and New York whipped violently once more on Thursday, cutting what was a $100 premium for Comex futures contracts in March to a $10 discount per ounce as US warehouses continued to see fresh deliveries.

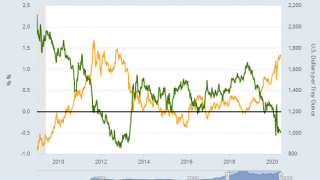

Full Article →GOLD PRICES rallied on Friday in London, cutting the week’s earlier 1.5% drop against the US Dollar to just 0.5% as Western stock markets struggled again despite fresh government and central-bank stimulus to boost the world’s post-Covid recovery as relations worsened further between the top 2 economies, the US and China.

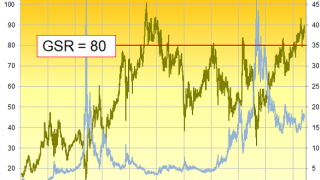

Full Article →SILVER PRICES erased the last of this spring’s Covid Crisis plunge in London trade on Wednesday, very nearly recovering the US Dollar level of New Year 2020 as gold snapped 2 days of gains to fall back to last week’s closing price.

Full Article →GOLD ETF prices steadied with bullion quotes in London on Tuesday, trading at the equivalent of $1733 per ounce after dropping hard from fresh multi-year and new all-time record highs against the world’s major currencies on news of a potential medical breakthrough in stemming the global pandemic

Full Article →GOLD BULLION headed for new record weekend finishes for Euro and UK investors on Friday, challenging 8-year highs in US Dollar terms as world stock markets rallied against new record lows in medium-term US interest rates.

Full Article →GOLD PRICES headed for their lowest weekly close in 4 in London on Friday, erasing the last fortnight’s gains to trade at $1676 per ounce as stock markets also fell in Asia, the UK and the Americas.

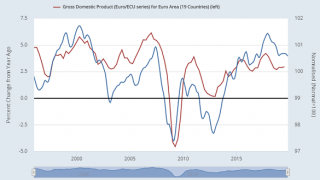

Full Article →Gold prices headed for their highest US Dollar month-end since November 2012 as European stock markets fell after the 19-nation Eurozone’s central bank followed the US Federal Reserve in announcing no new major stimulus or aid

Full Article →“The outlook for gold shows a more bullish trajectory than the 2009-2012 cycle” says a research note from Canadian financial services group and bullion dealers Scotiabank.

Full Article →GOLD PRICES headed for their strongest weekly gain since late 2008 on Friday, adding more than 8.2% as the rebound in global stock markets faded despite governments and central banks unleashing record financial aid

Full Article →GOLD PRICES fractured worldwide, with dealing spreads widening sharply while the US derivatives market spiked $100 per ounce above global market reference point after Boris Johnson put UK into official coronavirus lockdown.

Full Article →GOLD prices in London, heart of the world’s wholesale bullion markets, again tried to rally above $1500 per ounce on Friday, while global stock markets bounced together with industrial metals and major government bond prices as the death-toll from novel coronavirus rose past 10,000

Full Article →GOLD prices ticked higher in London trade Friday, rising against the US Dollar for the 6th of 7 weeks so far in 2020 and setting fresh all-time highs against the Euro currency as global stock markets struggled despite a drop in new cases of coronavirus reported by world No.2 economy China.

Full Article →Gold Price Sets Fresh Euro Record as ETF Investing ‘Offsets’ China’s Coronavirus Slump Bullion.Directory precious metals analysis 13 February, 2020 By Adrian Ash Head of Research at Bullion Vault GOLD […]

Full Article →GOLD PRICES struggled $5 below last week’s closing level in London’s bullion market on Wednesday, trading at $1565 per ounce as world stock markets rose yet again, nearing last month’s fresh all-time highs on the MSCI World Index

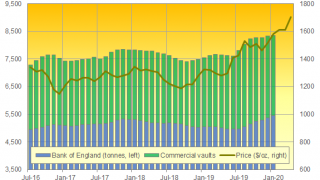

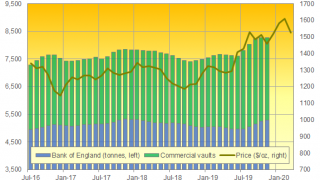

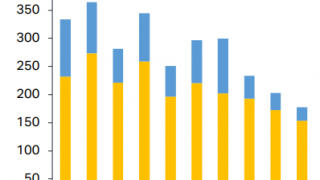

Full Article →Over the last 2 years, gold bullion accounted for 7.0% of all UK imports of goods by value, and 5.9% of all exports according to source data from the HMRC tax authorities.

Full Article →GOLD PRICES headed for their first weekly drop in 9 on Friday, but held onto a $25 rally from Wednesday’s 2-week lows despite the United States reporting much stronger-than-expected January jobs data as the coronavirus outbreak and lockdown in China saw the death of a whistleblower spark anger with the authorities on social media

Full Article →GOLD PRICES struggled to regain half of this week’s $40 losses in London on Thursday, trading below $1565 per ounce as world stock markets rose yet again despite a fast-worsening economic outlook amid the coronavirus outbreak spreading from China.

Full Article →GOLD INVESTING prices steadied above 3-week lows of $1550 in London trade Wednesday, rallying $6 per ounce as world stock markets surged for a second day after Chinese TV claimed scientists have developed an effective treatment for coronavirus.

Full Article →GOLD and SILVER PRICES rose trading at $1579 and $17.85 per ounce respectively as the WHO met to decide whether the coronavirus outbreak marks a global emergency and the Bank of England followed the US Fed in keeping its low-rate unchanged yet again

Full Article →“Going forward, gold is likely to continue benefiting from supportive central bank policies” forecasting an annual average gold price of $1515 per ounce – a rise of 9% from last year’s daily average – with a peak of $1650 to hit late in 2020.

Full Article →GOLD eased back Tuesday, below yesterday’s new 7-year US Dollar highs at London’s benchmarking, as confirmed cases of the deadly coronavirus spread, Hong Kong closed its borders with mainland China.

Full Article →Ultimately it will be very easy,” Trump told Fox, “because if we can’t make a deal, we’ll have to put 25% tariffs on [European-made] cars.”

Full Article →Gold Prices Firm as ECB Seeks ‘Robust Inflation’ with Negative Rates, Deadly Virus Hits Chinese New Year Bullion.Directory precious metals analysis 23 January, 2020 By Adrian Ash Head of Research […]

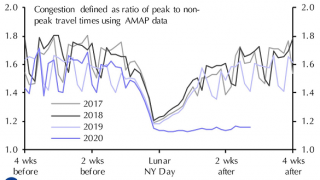

Full Article →Already killing 17 and infecting 440 people in China, the coronavirus outbreak “is threatening to wreak havoc on Lunar New Year travel plans,” says the South China Morning Post, “at a time when many Chinese people journey to their hometowns for family reunions.

Full Article →GOLD BULLION rose to trade dead-flat for the week against the Dollar and all other major currencies lunchtime Friday in London as new US jobs data came in well below analyst forecasts.

Full Article →GOLD PRICES jumped to fresh all-time highs in a raft of major currencies early Wednesday as news broke of Iran striking US targets in Iraq with 2 dozen rockets in retaliation for last week’s assasination of special forces commander Qasem Soleimani.

Full Article →Adrian Ash

Adrian Ash is director of research at BullionVault, the physical gold and silver market with bullion owned by the citizens of over 175 countries and worth more than $2 billion.

Formerly head of editorial at London’s top publisher of private-investment advice, he was City correspondent for The Daily Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.