Gold Price ‘Super Bullish’ on Virus-Crisis Reflation Plans as ETFs Surge, But Slips on Rumors of Covid ‘Cure’

Bullion.Directory precious metals analysis 17 April, 2020

Bullion.Directory precious metals analysis 17 April, 2020

By Adrian Ash

Head of Research at Bullion Vault

GOLD PRICES fell Friday, erasing most of this week’s earlier 3.8% rise to new 7-year Dollar highs, while world stock markets jumped after a leaked video from University of Chicago Medicine showed a specialist saying a trial of Ebola-drug Remdesivir is helping very sick Covid-19 sufferers recover quickly.With after-hours action in Remdesivir‘s patent holder Gilead Sciences (Nasdaq: GILD) taking its stock price to 4-year highs, Tokyo’s Topix index rose to trade 14% higher from this time last month, while Hong Kong’s Hang Seng has added almost 5% from mid-March and the EuroStoxx 600 has now regained 15%.

US crude oil slipped further below $20 per barrel, but industrial resources more broadly rose to stand 5% above last month’s multi-decade lows on the Bloomberg Commodity Index.

Sovereign bond prices also rose across Europe on Friday, pushing government borrowing costs lower again after European Commission president Ursula von der Leyen called on the 27 EU nations to make Brussels’ cross-border spending the “mothership” of economic reflation against the virus-crisis depression.

US Treasury bond prices slipped however, putting 10-year yields on Washington’s debt – now totalling well over $17 trillion and equal to more than 80% of the world No.1 economy’s annual GDP – at 0.64% per annum, 10 basis points above 9 March’s new all-time low.

Gold prices that day crossed above $1700 per ounce for the first time since the end of 2012.

Today the metal fell to $1683 before recovering the $1700 level as New York opened.

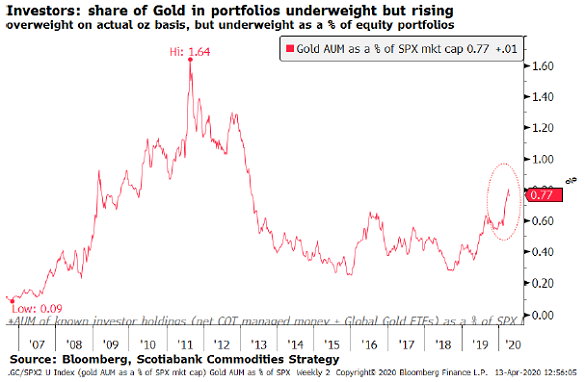

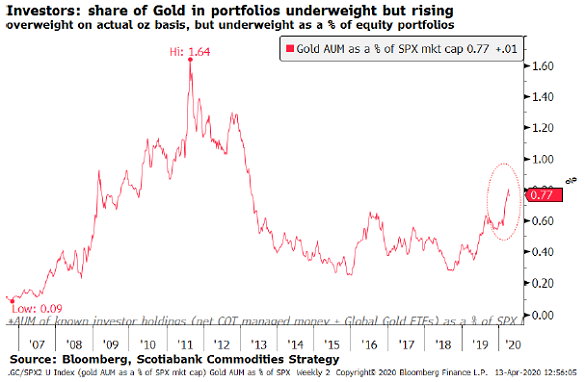

“The outlook for gold shows a more bullish trajectory than the 2009-2012 cycle” says a research note from Canadian financial services group and bullion dealers Scotiabank.

“New super bullish structural themes have emerged faster than anticipated,” explains Scotia’s metals strategist Nicky Shiels, pointing to “bigger government, unlimited QE, negative interest rates,

unlimited deficits, Fed buying junk bonds,

MMT-like policies.

“Large-scale inflow from Western retail & institutional [investors] should offset the short-term headwinds [of lockdown-hit] iquidity, subdued Asian physical demand, inactive central-bank activity.”

While the giant SPDR Gold Trust (NYSEArca: GLD) did not change in size Thursday, the world’s largest stockmarket-traded gold product held at its largest since May 2013 after 11 consecutive trading days of growth, needing over 1021 tonnes of bullion backing in total.

Cheaper gold-backed ETF competitor the iShare Gold Trust (NYSEArca: IAU) grew again to a new all-time record, needing 410 tonnes and expanding nearly 3% this week alone.

Consumer demand in Asian, in contrast, remains very weak according to dealers, retailers and also local pricing relative to the global benchmark of London quotes.

Domestic prices in No.2 gold consumer nation India did edge higher towards London quotes in mid-March, says a blog from the mining industry’s World Gold Council, as “global restrictions to curb the spread of Covid-19 impacted the global gold supply chain, from production to refining.

“[Because] these supply-chain disruptions impacted both bullion and gold doré imports into India, the average discount in the Indian domestic market narrowed to $4.75 for the week ending 20 March.”

But data from news-wire Reuters says that discount then fell sharply to $48 per ounce in the final week of March, just before India’s wholesale spot markets were shut by the Modi administration’s lockdown orders, the steepest discount since September 2019’s peak in London gold prices.

No.1 gold miner, importer and consumer China meantime saw jewelry giant Chow Tai Fook report a drop of 54% in Q1 gold sales across the mainland versus the Jan-March period of 2019.

Shanghai’s wholesale gold-bar discounts to London prices today set the 3rd new all-time record of the last 4 trading days, reaching over $70 per ounce.

Industrial output and retail sales in China, the world’s second largest economy, fell 8.4% and 19% respectively in the Jan-March period from Q1 last year, official statistics from Beijing said today, putting GDP down 6.8% overall in the coronavirus’ source nation, the first official drop since the Great Revolution of Chairman Mao was abandoned on his death in 1976.

Traders in China, “as per the last few sessions, were on the offer at [today’s Shanghai] open and spot prices proceeded to grind back lower,” says the Asian trading note from Swiss refining and finance group MKS Pamp.

“Not sure what to think here – short term I would not be surprised to see some form of correction in gold maybe toward $1670-75 area, although over the short-medium term I am still favourable.”

Today’s global anti-virus stimulus spending could see gold top $2000 an ounce, says Tom Palmer, CEO of No.2 mining producer Newmont (NYSE: NEM), and it could even hit $3000 reckons former investment-bank Merrill Lynch and now independent economist David Rosenberg.

This article was originally published here Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals. Bullion.Directory precious metals analysis 17 April, 2020

Bullion.Directory precious metals analysis 17 April, 2020

Leave a Reply