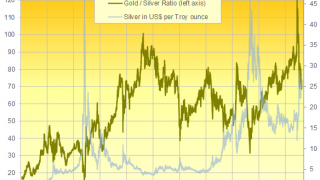

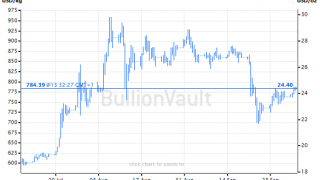

GOLD and SILVER split on Friday, with the yellow metal failing yet again to hold above $1900 per ounce as its more industrially-useful cousin set its highest weekly close since last August’s 7-year high.

Full Article →Adrian Ash

Adrian Ash is director of research at BullionVault, the physical gold and silver market with bullion owned by the citizens of over 175 countries and worth more than $2 billion.

Formerly head of editorial at London’s top publisher of private-investment advice, he was City correspondent for The Daily Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news.

GOLD PRICES hit and rallied from 1-week lows Thursday in London, falling within $10 per ounce of $1800 as crypto currencies sank and global stock markets extended yesterday’s steep drop on Wall Street following news of the strongest ‘core’ inflation in the USA for 25 years.

Full Article →GOLD PRICES popped higher but silver struggled to follow Thursday lunchtime in London after new US data said the world’s largest economy grew a little faster than previously estimated at the end of 2020 but only thanks to a slowdown in price inflation.

Full Article →GOLD PRICES struggled to show any change for the week so far Thursday afternoon in London, erasing yesterday’s $30 pop as government bonds resumed their plunge, driving longer-term interest rates higher despite the US Federal Reserve vowing to continue its zero-rate and massive QE policies in the face of surging inflation expectations.

Full Article →GOLD erased the last of this week’s earlier 2.4% rally in London trade Friday, moving back to $1705 per ounce as silver held 1.3% firmer and platinum prices showed a 4.6% weekly gain.

Full Article →GOLD PRICES traded near 1-week highs after rising and then slipping $10 from $1740 per ounce in London trade Thursday, and bullion reached the highest so far in March for Euro investors as longer-term interest rates retreated further from this month’s spike after the European Central Bank vowed to raise the pace of its government bond purchases to ensure “favourable financing conditions”.

Full Article →GOLD PRICES slipped back below $1800 per ounce Wednesday as longer-term interest rates rose further on government bonds, hitting new multi-month and multi-year highs for rich Western economies’ borrowing costs as new US President Joe Biden pushes for $1.9 trillion in Covid relief and stimulus.

Full Article →FRESH outflows from gold-backed ETFs failed to stop the metal holding above what traders called the “psychological $1800 level” in Asian and London trade Tuesday, defying yet more investment liquidation as longer-term interest rates reach multi-year highs

Full Article →SILVER surged Monday morning towards 8-year highs at $30 per ounce after “the call-to-arms” on Reddit brought record new interest to precious metals

Full Article →GOLD PRICED in terms of sister metal silver fell near its cheapest in 4 years in London’s bullion market Friday, despite rising near 3-week highs of its own in the aftermath of silver’s dramatic jump after users of the Reddit chatroom called on other readers to buy shares in the cheaper precious metal’s largest ETF trust.

Full Article →GOLD PRICES fell Friday in London even as infections, deaths and economic lockdowns in the winter wave of Covid-19 worsened worldwide and new US data said the world’s largest economy shed jobs last month rather than expanding as Wall Street expected.

Full Article →GOLD PRICES slipped further on Thursday, extending yesterday’s 2.1% plunge from new 9-week highs even as US interest rates lagged inflation forecasts by a wider margin – usually a driver of higher gold prices – and US President Donald Trump was condemned worldwide for inciting angry supporters to storm the Capitol in a violent and failed attempt to stop Democrat Joe Biden taking over at the White House in 2 weeks’ time.

Full Article →There is little doubt that when we return to safer pastures, gold’s attractions will be reduced…[but] what we are seeing at the moment is a market in which some participants can’t decide whether now is the time to get out, or whether there is more upside ahead.

Full Article →GOLD PRICES fell within $5 per ounce of a 4-month low in London trade Thursday, retreating to $1853 even as world stock markets fell together with long-term interest rates and commodity prices amid tighter anti-Covid restrictions plus a surprise jump in US jobless benefit claims.

Full Article →GOLD PRICES on Wednesday gave back most of yesterday’s bounce from a $100 plunge, retreating to $1865 per ounce as interest rates on government bonds rose again with both global stock markets and commodity prices following Monday’s headline news of a Covid-19 vaccine.

Full Article →GOLD PRICES regained almost a third of yesterday’s $100 plunge in Asian trade Tuesday before easing back to $1880 per ounce in London as global financial markets stabilized from the apparent shock of pharma-giant Pfizer announcing successful trials of a Covid-19 vaccine.

Full Article →GOLD PRICES rose against a falling US Dollar in London trade Wednesday, reaching 1-week highs above $1920 per ounce as global stock markets fell amid fresh Covid-19 lockdowns and restrictions across Europe, plus continued rumors and counter-rumors over US politicians agreeing a new stimulus package ahead of 3 November’s White House.

Full Article →GOLD PRICES crept higher against a rising US Dollar in Asian and London trade Friday, halving the week’s earlier $50 drop to reach $1910 per ounce as European stocks markets rose over 1.3% despite the collapse of UK-EU trade talks in Brussels.

Full Article →GOLD and SILVER held onto yesterday’s gains in London trade Tuesday, consolidating as news of mergers and acquisition activity among mining companies continued to accelerate.

Full Article →Gold Down Fourth Day as Fed Urges Fiscal Stimulus

GOLD PRICES slipped for the 4th day running in London on Thursday, dipping through $1850 per ounce as the US Dollar rose, inflation expectations fell, and world stock markets extended yesterday’s plunge in New York.

Full Article →Gold Rebounds as UK Readies Military Support for New Lockdown

GOLD PRICES held above $1900 per ounce Tuesday in London, rallying to $1916 from yesterday’s $70 plunge as world stock markets also bounced from a 4-day losing streak despite weak economic data and the tightening of social restrictions aimed at slowing the global ‘second wave’ of Covid-19.

Full Article →‘Dovish’ Central Banks ‘Bullish for Gold’

GOLD BULLION recovered from 1-week lows against Dollar in Asian and London trade today, edging 0.4% higher from last Friday’s finish as global interest rates slipped and equities headed for 0.8% gains on the MSCI World Index after dovish policy comments.

Full Article →GOLD and SILVER bounced after overnight sell-off from multi-year highs against USD in London, rallying as commodity prices fell with global stock markets against backdrop of fading ‘V-shaped’ economic hopes

Full Article →GOLD PRICES tried but failed to match yesterday’s new 9-year US Dollar peak on Thursday while silver peeped above $19 per ounce for the first time since September as confirmed cases of Covid-19 in the United States rose above 3 million and Tokyo reported a record daily rise in new infections.

Full Article →Gold Prices Erase Post-ISM Rally as US Jobs Data Beat Forecasts, Both for Gains and New Benefit Claims Bullion.Directory precious metals analysis 02 July, 2020 By Adrian Ash Head of […]

Full Article →GOLD PRICES rallied from $20 below yesterday’s new 8-year high near $1780 per ounce in US Dollar terms in Asian and London trade on Thursday, but edged higher against other major currencies as world stock markets extended Wednesday’s 2.6% drop in US equities.

Full Article →GOLD and SILVER PRICES edged back from 1-week highs in London trade Thursday, but kept half of last night’s 1.7% and 3.4% spikes against a falling US Dollar after the Federal Reserve gave a dire forecast for the world No.1 economy’s recovery from the Coronavirus pandemic and shutdowns.

Full Article →GOLD PRICES recovered more of last week’s 2.6% plunge in Asian and London trade Tuesday, rallying to what was a new 7.5-year Dollar high in April at $1715 per ounce as industrial commodities fell back, longer-term interest rates fell, and world stock markets retreated after Wall Street’s S&P500 index of US corporations rose back to New Year 2020’s level

Full Article →Adrian Ash

Adrian Ash is director of research at BullionVault, the physical gold and silver market with bullion owned by the citizens of over 175 countries and worth more than $2 billion.

Formerly head of editorial at London’s top publisher of private-investment advice, he was City correspondent for The Daily Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.