Welcome to Bidenomics – and your $5,600/yr Paycut!

Bullion.Directory precious metals analysis 20 July, 2023

Bullion.Directory precious metals analysis 20 July, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

There is finally some good news!

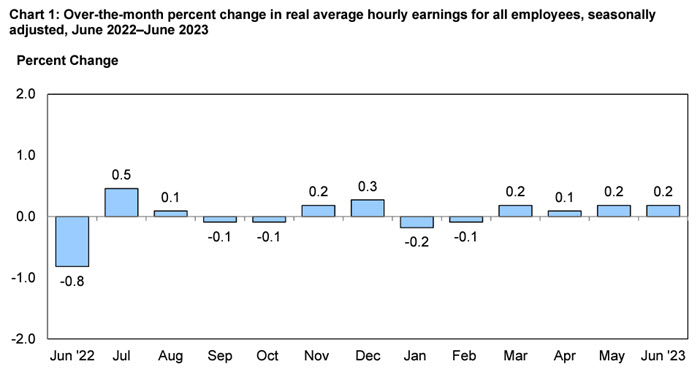

According to data released from the Bureau of Labor Statistics (BLS), wages are finally outpacing inflation:

In June, for the first time in 26 months, US workers’ real weekly earnings (a week’s worth of wages adjusted for inflation) grew on an annual basis, according to data released this week from the Bureau of Labor Statistics. Annual real weekly wages were up 0.6% last month, a rate that’s a tick below the 0.7% gain seen in February 2020. [emphasis added]

You can also see the good news represented on the bar graph below, followed by an official explanation that revealed “hours worked” actually decreased:

I‘ll not mince words – this is legitimately good news for American families struggling with out-of-control costs of living. And it’s about time for some positive economic developments.

As you’d expect, mainstream media outlets are making the most of this. Headlines like Pay Raises Are Finally Beating Inflation and Pay Is Growing Faster Than Prices abound. President Biden has been touting the recent good news about wages, and even took a big victory lap when official CPI only increased 3% year-over-year.

Again, this is legitimately good news. I don’t want to downplay that.

Unfortunately, there’s a huge caveat that completely overshadows this good news story…

Let’s talk about the big Bidenomics pay cut

Worker pay, on average, rose faster than inflation for the first time in 26 months.

Focus on the second part of that sentence and you’ll see the problem.

I explained this a while back:

Inflation might be transitory, but its damage is permanent

Consider our imaginary friend Arthur. He nets $100 per month. After year of 5% inflation, Arthur’s monthly money buys 5% less. Next year, it turns out the inflation spike really was transitory, so the inflation rate goes to 0%.

Here’s the thing: Arthur’s monthly income STILL buys 5% less.

It’s as if Chairman Powell reached into Arthur’s pocket and stole $5 every month. Forever.

That’s why we called inflation the Federal Reserve’s tax that no one voted for and everyone pays.

After 26 consecutive months of losing purchasing power to inflation, it’s going to take a lot more than a single month of after-inflation wage gains to undo the damage. Households are still way behind:

The White House is quick to point out that nominal hourly earnings have risen quickly since [Biden] took office, and that part of the story is true…

Hours worked per week have also declined, pushing weekly earnings down more than hourly earnings. For the average American family, their weekly pay has jumped about $200 but it buys about $100 less. It amounts to a $5,600 loss in annual purchasing power.

That’s right – and considering the median household income is currently about $71,000, that’s an 8% annual pay cut.

We don’t usually think of inflation as a “pay cut” – however, the effects of rising prices and declining purchasing power are indistinguishable from a reduction in household take-home pay.

It’s no wonder some Americans feel they have no choice but to dip into savings:

To make ends meet, 27% of Americans said they’ve had to take money out of savings and more than half, or 54%, said they used that money to pay for everyday expenses, such as groceries and rent, the recent Country Financial Security Index found.

Roughly 64% of Americans are now living paycheck to paycheck, according to a LendingClub report – up from 61% a year earlier and in line with the historic high first hit in March 2020.

The idea that positive wage growth of a fraction of a percent would even put a dent in the overall lost purchasing power is simply silly.

Let the White House have its victory lap. Let them claim “Mission Accomplished” as much as they want – so long as you understand what’s really happening from the average family’s perspective.

There’s another concern, though – and it’s bigger even than the $5,600/year pay cut.

The Federal Reserve could possibly repeat the mistake of the 1970s:

“The Fed does not want to repeat the mistake of the 1970s, when they stopped the tightening and inflation bounced back up,” said Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist at SS Economics.

The Fed is almost as desperate for good news as the White House. If Chairman Powell decides to grasp at this straw, and use it as an excuse to call a time out in the inflation fight?

Well, the economic situation would likely get a whole lot worse.

History tells us it’s WAY too early to declare victory over inflation.

Of course, that’s no guarantee that the Fed won’t repeat the mistakes of the past.

In the meantime, since we have absolutely no influence over the monetary policies of the Fed and the Biden administration seems determined to double down on deficit-spending the nation into “prosperity,” what can we do?

Insulating your savings from the Bidenomics pay cut

If you’re concerned about the corrosive effects of inflation on your savings, you aren’t alone. Central banks around the world have the same fear – and you know what they’re doing about it?

They’re diversifying their national reserves – away from U.S. dollars, and into physical precious metals. (At an unprecedented rate!)

Why physical precious metals? According to central bankers, the top reasons include:

- Performance during times of crisis

- Inflation protection / long-term store of value

- Effective diversification asset

- No default risk

- High liquidity

The value of precious metals like gold and silver tend to hold up despite inflation, and they’re less correlated to overall economic growth. “Performance during times of crisis” means that precious metals often benefit from economic catastrophes, rising in price when everything else plummets.

What applies to central banks applies to us, albeit on a smaller scale. Diversifying with physical precious metals can help preserve your long-term buying power, especially in your retirement savings.

As with all financial decisions, education is the first step. You can get all the information you need about both gold and silver for free right here.

I encourage you to learn as much as you can about the benefits of physical precious metals – after all, it’s clear we can’t count on the White House or the Fed to look out for our best interests. It’s up to us to ensure our finances have the long-term stability necessary to plan for our own futures.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply