As we wait impatiently for the next economic recession to get underway, we will also continue to keep an eye on inflation in the U.S. economy

Bullion.Directory precious metals analysis 24 May, 2023

Bullion.Directory precious metals analysis 24 May, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

George Milling-Stanley: Gold still has a solid shot at a new all-time high this year

George Milling-Stanley, chief gold strategist at State Street Global Advisors, says gold has a real chance to smash its old price records before the end of the year. Now, gold has been above and below $2,000/oz. for more than a decade.

Its initial foray into +$2,000 territory was supported by conditions nothing like where we are today…

As opposed to being a tail end of a multi-year bull run, many instead feel that $2,000 simply represents gold’s “fair value” right now. (If nothing else, the currency has eroded to the degree this is believable.) Milling-Stanley explained that prices above $2,000 are often interpreted by traders that it’s time to take profits.

This kind of protracted back-and-forth sentiment must have left many gold bugs wanting. Stanley sees enough reason for gold to affirm itself above $2,000, though not necessarily providing an exact timeline on when it will happen. His reasons are a mix of politics, economy and more strengthening of the robust ongoing gold demand.

Short term, gold hasn’t successfully reached a fresh high because the investors “suddenly came to the conclusion that there would be a favorable outcome to the debt-ceiling debate and the U.S. would not default on its debt,” Milling-Stanley explains.

Imaru Casanova, VanEck’s precious metals portfolio manager, agrees. Complacency among investors is to blame. Investors “assume the banking turmoil is over and ignore the risks that remain by the significant stress imposed on the economy by sustained higher interest rates, and persistent inflation above the Federal’s Reserve’s target,” Casanova says.

This is gold positive both because a weak economy sends investors running to gold, and because lower rates make gold more attractive to own. The longer-term implications of a Fed pause on inflation expectations could also support gold.

The oft-predicted recession ahead could easily drive gold to $2,400/oz by itself:

A recession would also be a potential catalyst, [Milling-Stanley] said, pointing out that there have been seven significant recessions over the past 50 years, and the annual average appreciation in the gold price during those seven recessions was over 20%.

In short? This year, it’s rather likely gold prices will climb back over $2,000. Furthermore, it’s “quite possible that gold will set a fresh all-time high,” Milling-Stanley said. And it’s easy to see why!

$100 silver? That’s a start, according to these forecasters

The consensus among the precious metals market participants appears to be that we’re in a bull run. And in past bull runs, silver tends to outperform gold.

Can we expect it to do the same this time around?

One might be faulted with wanting silver to do anything, as it hasn’t really turned heads with its price performance as gold became more of a talking point by the day. This is a dull price picture, says GoldSilver’s Jeff Clark, that might change in short order.

Clark set a $100/oz silver price target. Now, anyone can “set” a price target, but without some sort of analysis it’s not much more than a daydream… So how can this happen? Easy, Clark says: all we need is a five-year bull run that makes the most of silver’s higher volatility during such times.

That’s not the highest forecast we have lying around, either.

Wall Street advisor Goehring & Rozencwajg Associates predicts a normalization of the gold-to-silver ratio to what might be called an extreme compared to now. Hovering around 84, silver would gain 30% if it was to merely return to a century spread of 64. This projection is based on the assumption the U.S. dollar will crumble even faster than most critics are expecting. Along with a huge spike in silver, $10,000 gold wouldn’t be unreasonable.

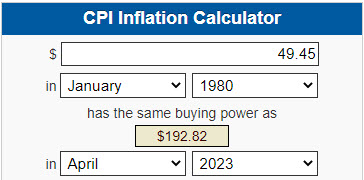

While we’re talking silver prices, let’s remember that the historic all-time high silver price of $49.45 back in January 1980 is an old record. What happens if we adjust for inflation?

Silver’s January 1980 all time high price adjusted for inflation as of April 2023. Via U.S. Bureau of Labor Statistics CPI Inflation Calculator

Isn’t it absolutely shocking how rapidly inflation can make historical prices utterly meaningless? This simple data point suddenly makes Clark’s $100/oz price target look a lot more realistic…

How much trouble the U.S. dollar is truly in is a point of debate of its own. Some don’t believe that the greenback is as crippled as cynics would have you believe. On the other hand, even the more upside forecasters expect a period of gradual dollar decline that ends the reign of King Dollar with the proverbial whimper, rather than a catastrophic bang.

Ancient gold coin fetches over $5 million at auction

An ancient Greek coin has managed to fetch one of those auction prices that continue to breathe new life into numismatics. The so-called “stater” gold coin, made in 4th century Panticapaeum (in Crimeria, between the Sea of Azov and the Black Sea), sold for $5.9 million and change at a Numismatica Ars Classica auction in Zurich.

We can only proceed by saying this makes it the most expensive ancient gold coin ever sold, but not the most expensive overall. The title of the priciest gold coin appears safely held by a 1933 $20 double eagle, which went for $18.9 million some two years ago.

What makes the coin so valuable? As Numismatica’s co-director Arturo Russo points out, the coin has been part of an equally successful series. Together, the auction brought in around $25 million from those interested in numismatics, especially of the more ancient variety.

This gold stater is designed with the head of a satyr on the obverse, and an eagle-winged griffin holding a spear in its mouth on the reverse. Thought to be one of only three such coins in existence, the gold piece’s unusual features contributed to the lofty price tag as detailed by the coin’s owner heading up to the auction.

The State Hermitage Museum in St. Petersburg is one of its previous owners, before the facility sold the coins when the Soviet apparatus needed to raise money. Godfrey Locker Lampson, an early 20th century coin collector of some fame, seems enchanted with this ancient coin:

The head of the satyr is a marvel of speaking portraiture. That so much expression could be packed into so small a round would not be believed by anyone who had not seen it.

Personally, I’m extremely interested in ancient gold coins, both as works of art and as stores of value that have endured down through the centuries. (Note that collectible and antique coins like this gold stater aren’t eligible for inclusion in a gold IRA. On the other hand, when you buy gold coins from us, you’ll find much more affordable prices…)

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply