Financial mainstream media has an agenda that everything is OK, and we can go in and “buy the dip.”

Bullion.Directory precious metals analysis 10 October, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

The financial mainstream media has an agenda to promote: the US economy is strong and the Fed’s policies are working. It is important to note, bias breeds ignorance to what is really going on.

Today, I heard a clip of CNBC’s Bob Pisani (and CNBC’s Larry Kudlow yesterday) trying to reassure the few viewers left that this current move lower was overdone, and he pointed to how the recent initial jobless claims fell to 287,000 last week, lower than the 291,000 economists were expecting.

So, all is great in the labor market. The initial jobless claims have been a focus of late as volatility picks up.

However, initial jobless claims have been tracking the labor participation rate lower since 2012. It makes one wonder whether jobless claims are falling off simply because people disenchanted with the labor market choose not to participate.

By law, in order to receive unemployment insurance one must be actively looking for employment.

And when an agenda becomes too strong, the crazy starts showing.

I have noticed that CNBC’s anchors step into the ring with every bear that appears on their programs. Pro-gold, anti-dollar Peter Schiff, who warned of the sub-prime crisis as early as 2005, is always ridiculed; and the same goes for Marc Faber, a.k.a. Dr. Doom.

This brings up a very interesting confrontation between CNBC’s Jackie DeAngelis and successful short-seller Bill Fleckenstein. Instead of simply having a debate over monetary policy and the markets, DeAngelis attacks Fleckenstein (interview here), and a few floor traders add to the gang-up.

So what. When the market declines, how fast will it be taken away from you?

If you want to pursue idiots like the Fed doing crazy policies, and if you think you can get out in time, go for it. I don’t want to try and do that.

Short-sellers had a rough time up until recently, but contrarians are methodical and patient. Fleckenstein chose not to participate in the rally, but that is OK and no reason to assume he does not know what is best for him and his clients.

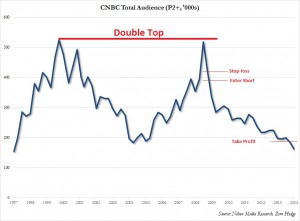

Now, the real juicy, short carry trade would be CNBC’s total viewership:

Moves in the S&P were technically apparent to those that do not have a picture of Yellen and Bernanke on their nightstand.

1,900/05 could potentially offer support, but the index will likely see 1,864 by the end of the year (check my view here).

![]() This license allows for redistribution of this article, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to Bullion.Directory, linking to the original article.

This license allows for redistribution of this article, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to Bullion.Directory, linking to the original article.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply