Budget Sees Gold Bars +2.1% vs Rate-Rise Dollar, While Euro Rate-Rise Rumor Quashed

Bullion.Directory precious metals analysis 17 March, 2017

Bullion.Directory precious metals analysis 17 March, 2017

By Adrian Ash

Head of Research at Bullion Vault

The Euro held 2 cents higher for the week versus the Dollar at $1.0750, but retreated after spiking on a German newspaper report that a rate rise from the European Central Bank “could be on the way.”

“The ECB could…raise the deposit rate earlier than the prime rate,” Handelsblatt quoted Austria’s monetary policy chief Ewald Nowotny, suggesting that the ECB’s current €80 billion per month of new QE bond buying might also continue after the central bank moves to raise its current negative rate of interest paid to commercial banking reserves.

“This article’s headline was [then] corrected,” Handelsblatt said later on Friday, “to say the ECB could tighten monetary policy in a different way to the US Federal Reserve, rather than that a rate hike could be on the way.”

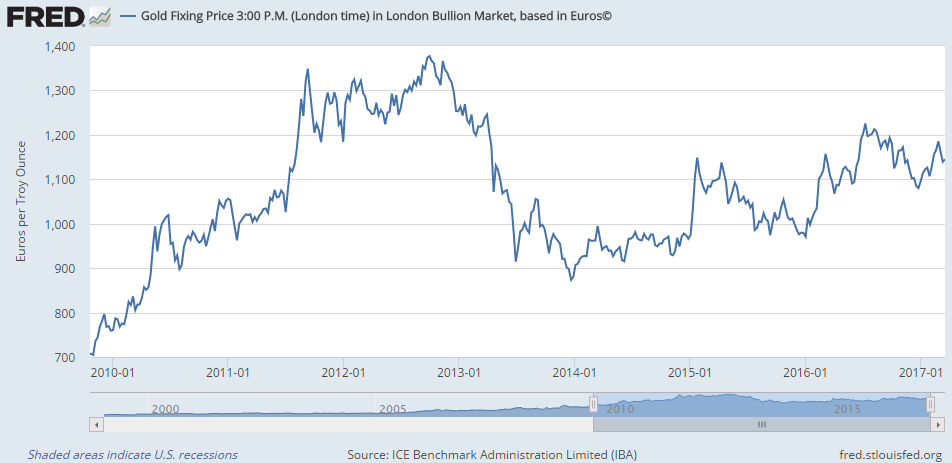

With the Euro retreating on the FX market, wholesale gold bars bounced back to €1144 per ounce, nearing the weekend with a 1.4% gain from last Friday’s finish.

Rising for the 9th week in 12 so far in 2017, that matches the Euro gold price’s mid-2016 run of weekly gains – when the UK’s Brexit referendum shocked world markets – and the best since early 2014.

“Our central scenario remains that no political earthquakes are likely in Europe this year,” says a new note on gold prices from Michael Haigh’s commodity team at French bullion market-making bank Societe Generale.

“Furthermore, with the prospect of the US Fed hiking by a total of 0.75 [percentage points] both this and next year…we expect the gold price to trend lower this year.

“We recommend selling rallies.”

The Fed’s “well-telegraphed rate hike…helped ensure another positive response from the markets,” says FX strategist Steven Barrow at Chinese banking giant ICBC’s Standard Bank, “with both bonds and stocks rallying.

“[But] investors need to remember that volatility-supressing Fed policy is not the main driver of financial markets anymore. Instead it is future fiscal policy…[now] far less predictable” under US President Trump.

Proposing $54 billion more defence plus $4bn to build a wall at the Mexican border while slashing health, social and diplomatic spending, Trump’s first Budget was accused overnight of being un-American by Democrats, a ” scorched earth” attack on environmental programs, and also ” draconian, careless and counterproductive” by one Republican Congressman.

Washington this week hit its legal “debt ceiling”, now set at Wednesday’s outstanding total of $19.4 trillion, as the suspension agreed by former president Obama and Congress in late 2015 expired.

That means “extraordinary measures” now apply, banning new borrowing to try and avoid a government shutdown before Trump and Congress reach a new deal.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply