Every once in a while, one regrets not acting sooner, or not acting soon enough.

Bullion.Directory precious metals analysis 09 March, 2022

Bullion.Directory precious metals analysis 09 March, 2022

By Keith Weiner

CEO at Monetary Metals

Oh well. Our consolation is that they most likely are not calling for lower silver prices based on the same indicator we observe.

The basis.

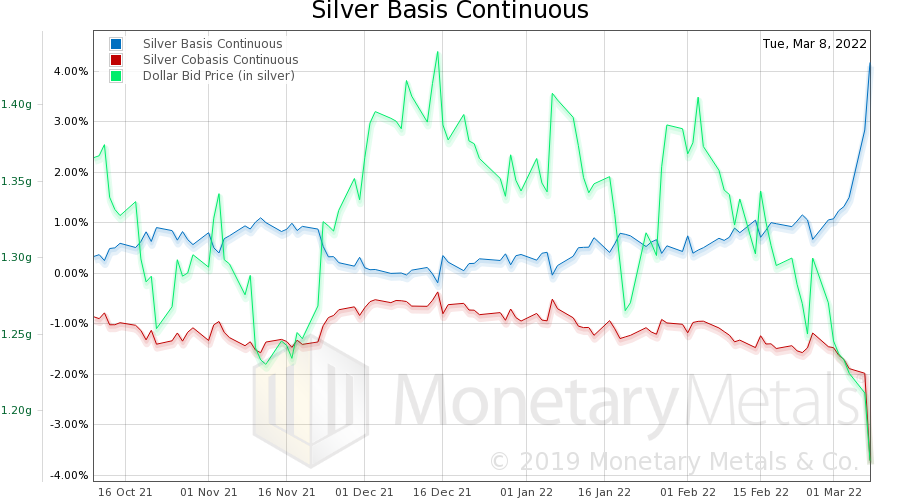

Here is the chart:

Silver Price Basis Chart

Look at that moonshot!

basis = future(bid) – spot(offer)

cobasis = spot(bid) – future(offer)

As the price has risen since February 25, from under $24, to yesterday around $27, the silver basis shot up. It went from 0.67% to 4.18%.

Silver Buyer Beware

Folks, it does not get any clearer than this. The big price rally in silver was driven by big buying of silver futures.

NOT physical metal.

This is not a bullish sign. Those who buy futures are playing with leverage. In the best of times, they will sell to take profits. And in volatile times, they may need to sell to cover margin calls. Even when the silver price is rising, they may have margin calls on other positions in their portfolio. Or they may just be jittery.

Argentum emptor cave.*

*Silver buyer beware

Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply