It’s time to entertain some of the more extreme gold price forecasts

Bullion.Directory precious metals analysis 29 April, 2025

Bullion.Directory precious metals analysis 29 April, 2025

By Peter Reagan

Financial Market Strategist at Birch Gold Group

It’s a testament to just how far currency debasement has gone. A large part of the market has already incorporated these targets into their models…

So we must look elsewhere. We have to go higher. And, as it turns out, we don’t need to look far at all.

There are plenty of established industry figures that are calling for anywhere between $6,000 to $55,000 gold. (That’s not a typo.) These aren’t insane baseless claims, either, but numbers backed with ample research from mainstream sources.

On what you might call the lower end, we have Frank Holmes, CEO of U.S. Global Investors and Executive Chairman of Hive Digital Technologies, expecting gold to hit $6,000 in the next four years.

Holmes is focused heavily on President Trump’s administration and how it translates to gold prices.

Holmes bases his target almost exclusively on trade wars, tariffs and the Trump administration’s insistence to balance trade more in favor of the U.S.

If tariffs go rise to 25% overall (a level which Trump seems to be targeting), the dollar has to fall 25%, and gold in turn rises 25%.

In reality, we could see even more upside in such a scenario, as most of gold’s run over the past two years happened amid a stronger dollar.

Gold’s price explosion not-so-coincided with the first real slump in the U.S. dollar index we’ve seen in two years, so one can only imagine how far a 25% fall in the dollar could take gold.

Holmes argues that China is making a concentrated effort to weaken global reliance on the U.S. dollar. Well, that’s no secret – in fact, it’s official BRICS policy, and what the Rio Reset is all about.

As for the Federal Reserve, he expects real rates to dip into negative territory once again, along with money printing, bailouts and the typical disastrous response to financial crises we’ve grown accustomed to.

Another interesting forecast last week came from Tavi Costa, Partner & Macro Strategist at Crescat Capital, who says $25,000 to $55,500 is gold’s fair value.

He bases this prediction on how gold reserves compare to issued debt. Right now, the market price of U.S. gold reserves are about 2% of total government debt, a steep fall from 17% in the 1970s and 40% in the 1940s. It’s a slightly different take on the gold revaluation that we’ve been hearing about recently, and while it’s interesting, I’m not entirely certain it’s reasonable…

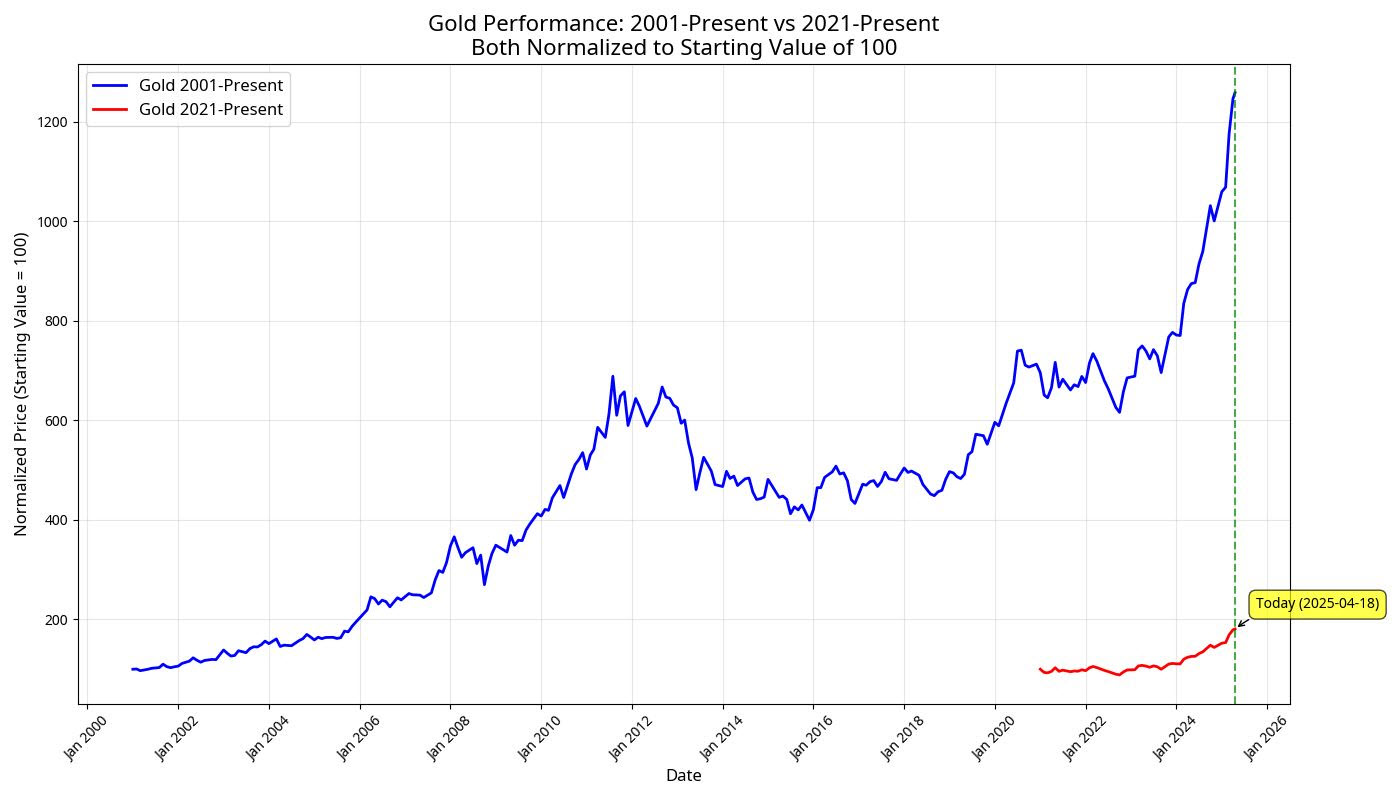

On the other hand, if we look at the 2001 gold price surge in comparison to today’s price action, well, gold has a whole lot farther to run:

Image via Clive Thompson on LinkedIn

That’s right. Gold’s price rose more than 12x over the last 24 years. If the present resembles the past? Well, do your own math because I’m not certain you’d believe mine.

Costa makes some other good points though – he believes the U.S. dollar has peaked in value, overvalued compared to other currencies. Critics will be quick to point out this is a ticking time bomb.

He says that a weakening of the U.S. dollar would act as a signal to a lot of asset classes, namely gold and silver, essentially echoing what Holmes has said above.

We may be seeing the early beginnings of that already, although silver, as always, waits in the wings still.

I’ve said it before, and I’ll say it again – with the gold to silver ratio at or near 100, silver is a more compelling asset right now.

Dominic Frisby: Nobody should be taking profits on gold right now

Dominic Frisby tends to have some insightful commentary on the precious market regardless of how he oscillates between bullish and bearish views.

Right now, he is decidedly bullish, noting that gold has already hit 27 all-time-high prices this year. In doing so, it looks to somehow bury the wild price action of 2024 as if it never existed.

Gold hit $3,500 last week before pulling back, but we have not really made it a highlight of our own weekly coverage.

Why? Because a week ago, we said that everyone appears to be treating $3,500 as a given, and that became true a couple of days later.

These days, analysts are going after bigger price targets, while we ourselves are trying to raise awareness about other issues.

For instance:

“It now takes more work than at any time in the last 100 years to buy an ounce of gold,” says Frisby.

“This is as much a function of declining wages in real terms, and the erosion in value of fiat, as it is the price of gold, but all the same it’s pretty incredible: how we’ve all been lied to!”

So much for gold tracking the price of purchasing power. Frisby calls gold fully valued, yet abnormal. Silver has yet to go anywhere even though silver production is actually dwindling.

In other words, there is plenty more room to go up. He has compiled plenty of reasons to urge any would-be speculator to back off from the idea of profit-taking in the gold market.

As he says, you might be living in the U.K. Frisby’s notes often have a humorous tone, and this one is no different, but with very real things to think about in the background. Being from across the pond himself, he says that any claim of pound strength is a lie.

Brits have had to contend with a 37% loss in purchasing power of the pound sterling over just five years. As he goes over the many reasons not to store wealth in the pound as a Brit, we can’t help but notice they apply equally to the U.S. dollar, the euro, and any other currency we can think of.

There is also China’s retail market. In it, Frisby sees a billion prospective buyers who will only sell if their local markets stabilize, which won’t happen. He says that China officially bought closer to 50 tons of gold vs. the reported five tons last month, with plenty of follow-up for those wanting more of his analysis.

Frisby further points out that, somehow, both retail and institutional gold demand in the West has yet to materialize.

This has been a theme ever since gold’s breakout in 2023, and it’s one we covered in-depth. What will happen when Western private investors, including institutions, wake up?

Whatever the answer to that is, it bodes well for anyone who wants to buy gold bullion today.

We’ve been among the early voices pointing out that portfolio managers began abandoning the old rules of thumb somewhere around the start of the lockdowns. This analysis presents us with a new rule of thumb, where 20% is invested in tangible assets. Listen: “Tangible assets” is about more than just physical precious metals! Tangible assets can include real estate, commodities (although it’s tough to build a reasonable financial position in tangible form), fine art, luxury watches, rare whiskeys and wines… There are a lot of inflation-resistant investments that are tangible. None of them offer the same level of liquidity and historic reliability as gold and silver. Even so, I don’t want to mislead you into thinking that “tangible assets” only means “gold and silver.” While plenty is said about gold, we’d actually like to turn to copper first and what it means for silver. “For example, taking a closer look at copper, studies indicate that the copper market could face a structural deficit over the next 4 to 5 years,” says the author. That’s great for copper investors 5-10 years down the line, but aren’t we forgetting something? Silver already faces a structural deficit of millions of ounces year over year, one which continues to expand. So whatever bullish point copper hopes to reach in 5 to 10 years in regards to deficit, lackluster mine supply and so on, silver is already there. Furthermore, at $5 per pound, it’s just not easy to build yourself a reasonable financial position in physical copper. (And you know how I feel about speculating on commodities markets.) And, best of all for those considering buying silver, it has still not translated to higher prices for whatever reason. It will eventually, with anyone’s guess as to how high the price can go. But right now, silver investors have a unique opportunity to get their hands on an asset whose fundamentals have long been pointing to a much, much higher price. As far as gold goes, the analysis notes that central banks no longer really care about prices. Global central banks have taken to stockpiling ever since the sanctions on Russia. And this makes sense, considering that a big part of this gold stockpiling is a form of dedollarization – in other words, they care less about the price of gold than they care about getting rid of their dollars. Their steady gold purchases near all-time high prices just shows how intensely focused they are on dedollarizing. And that’s a lesson that bears repeating – if you’re serious about diversifying out of dollars, today’s gold price is irrelevant. Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios. Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website. This article was originally published herePeter Reagan

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply