This week the Fed continued its anti-inflation battle by nudging rates higher – and it may cost you more than you think…

Bullion.Directory precious metals analysis 05 May, 2023

Bullion.Directory precious metals analysis 05 May, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

First, the Fed continues to promote the delusion that the banking system is “sound and resilient.”

Second, they remain focused on bringing inflation back down to Chairman Powell’s pet target rate of 2%.

At that meeting, the FOMC members also decided to raise the federal funding rate by 25 basis points (equal to .25%). That put the official number at 4.83%, the highest interest rate since 2007.

Taken at face value, almost anyone who doesn’t constantly research economic conditions might think everything is heading back to normal.

But everything isn’t heading back to normal, far from it.

The rate hike panicked several Democrat lawmakers, who desperately pleaded for the Fed to reverse course:

A group led by several prominent Democrat lawmakers is calling on the Federal Reserve to halt rate hikes to avoid risking too much damage to the economy.

The 10 senators and representatives, led by Sen. Elizabeth Warren of Massachusetts and Reps. Pramila Jayapal of Washington and Brendan Boyle of Pennsylvania, raised their concerns about the Fed’s monetary policy strategy and its “potential to throw millions of Americans out of work,” in a letter Monday to Fed Chair Jerome Powell.

The benchmark federal funds rate is the highest since 2007 after nine consecutive rate increases by the Fed since last year. The failures of Silicon Valley Bank and Signature Bank in March – combined with the “lagging impacts of the Fed’s earlier rate hikes” – have also left the U.S. economy “even more vulnerable to an overreaction by the Fed,” the lawmakers wrote.

Well, Elizabeth Warren and the rest of Congress can better afford the steep prices plaguing the economy right now. Like most politicians, they’re far more concerned with re-election than the price of eggs.

Here’s the reason Chairman Powell’s Fed decided to stay the course, raising rates to fight inflation:

Inflation has proven to be more persistent than officials anticipated, borne out through the Atlanta Fed’s “sticky price” CPI that compares prices for goods and services that don’t change a lot over time against those that do.

Sticky prices increased 6.6% annually in March and have been generally on the rise, while “flexible price CPI” climbed just 1.6% and has declined precipitously since peaking at 19.7% in March 2022. Sticky prices include housing.

It’s worth remembering that the Federal Reserve chair is an appointed, not an elected, position. Powell can survive a period of unpopularity more easily than any member of Congress (with an election year on the way).

And that’s good news for him, because he’s going to be unpopular in the White House (and on Wall Street) for quite some time…

A pause in rate hikes is looking unlikely this year

Those investors, bankers, and economists who were hoping for the Fed to pivot aren’t going to like Powell’s May 3 statements…

Reporters were trying to nail him down: Has a decision been made about “pausing” the rate hikes in June? And he was asked if there will be “rate cuts” this year?

Over and over again, he refused to lock in a pause for the June meeting – “A decision on a pause was not made today,” he started out with. Over and over again, he said that a pause would depend on the incoming data.

And he brushed off the rate-cut question – “If our forecast is broadly right, it would not be appropriate to cut rates; we won’t cut rates,” he said. [emphasis added]

The Fed’s official post-meeting press release promises a focus on inflation:

In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective. [emphasis added]

That, at least is good news. So much for Wall Street crybabies, bankers and hand-wringing politicians trying to pressure Powell into shifting course.

Of course, that doesn’t mean there won’t be consequences.

Recession this year “now inevitable”

Murray Sabrin, who predicted parts of the current dilemma, explained in Fortune magazine why a recession is inevitable this year:

Recently, Goldman Sachs, a bellwether of Wall Street profitability and employment, announced layoffs of around 4,000 employees and cut bonuses. If Goldman’s announcement is a forerunner of 2023’s Wall Street’s downsizing, then higher unemployment is unfolding in the canyons of lower Manhattan – and soon in the rest of the country as 2023 unfolds. Facebook parent Meta and Amazon recently announced another major downsizing of their workforces. If layoffs accelerate in the next few months, a recession – a readjustment to the end of the easy money policies of the past few years – will be underway. [emphasis added]

The truth is, it takes the economy a long time to adjust to a “new normal” where credit isn’t as abundant or as cheap as it has been for the last 20 years or so.

Sabrin then explained why, despite Biden’s claims that the job market is the strongest in history, it’s quite likely the unemployment rate will soar quite soon:

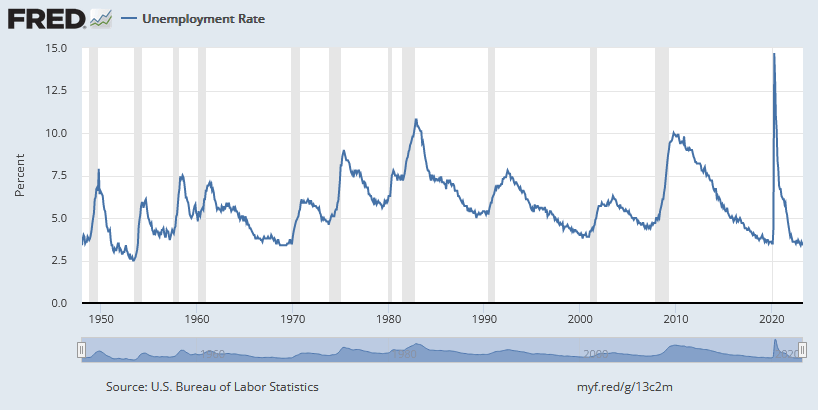

…according to a long-term chart of the unemployment rate, layoffs tend to begin early in the recession phase of the business cycle, and then accelerate markedly as companies realize they must cut expenses to deal with the new economic reality of tight money and slowing demand.

When the unemployment rate reaches a trough as the economy peaks, it tends to “stabilize” at the lowest level of the cycle – and then it is off to the races.

You can see the unemployment trend that Murray described, as it has played itself out since 1950:

Also take note that the last time unemployment was 2.5% was in 1953, just before a brutal recession.

So the economy seems teetering on the brink of a deep recession.

You can be certain that many, many more voices are going to be begging for the Fed to give up the inflation fight in the near future.

Planning for financial security in any economic environment

Once again, looks like the Fed is stuck between a rock and a hard place. Either the Fed resists panicking lawmakers and bankers, nudging the economy closer to the edge; or the Fed capitulates, returns to money-printing and pours gasoline on the inflation fire.

Whatever the Fed does, the economic situation is precarious…

There’s one thing you can do right now to prepare your savings to thrive in any economic environment. The SEC calls it “The Magic of Diversification.”

The practice of spreading money among different investments to reduce risk is known as diversification. By picking the right group of investments, you may be able to limit your losses and reduce the fluctuations of investment returns without sacrificing too much potential gain.

Are your savings diversified across different types of assets? Do they include physical precious metals like gold and silver, which have historically served as safe havens during times of economic uncertainty?

If you want to add a little peace of mind to your financial future, it’s easy to learn more about adding physical precious metals to your savings.

When the economic outlook is as messy and uncertain as it is today, what else can you rely on?

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply