More red on Wall Street last night on growing concerns about the US economy and its ability to handle higher rates

Bullion.Directory precious metals analysis 20 May, 2022

Bullion.Directory precious metals analysis 20 May, 2022

By Paul Engeman

Director at Ainslie Bullion

However the night was more notable for the surge in both gold and bitcoin against that trend, and likewise bonds bid meaning lower yields in the face of rising rates.

The capitulation of a wide host of economic indicators is best illustrated in Bloomberg’s US Macro Surprise Index which has now fallen into negative territory:

As the market turns to assets like bullion, bitcoin and bonds in the face of the rising Fed Funds Rate it speaks volumes as to the markets certainty that a “hard landing” recession is the inevitable result of this tightening in the face of weak fundamentals.

To date Bitcoin in particular has enjoyed an unusual correlation with the NASDAQ in particular but S&P500 more broadly. That both have tanked heavily over the last few weeks has obviously weighed heavily on the crypto space (combined with the UST/LUNA fiasco).

Likewise, the normally uncorrelated gold and silver prices too have been under selling pressure as shares slide with gold falling from US$1960 to US$1840 at the time of writing despite last night’s US$30 rally. The latter is not historically unusual in the early stages of a large sharemarket correction as precious metals are a beautifully liquid asset that have performed well of late and so an easy thing to sell to meet margin calls on all that NSE margin debt.

Borrowing cheap money to buy shares that ‘only ever go up’ has been the trade du jour since the GFC as the Fed was always there to catch any correction. They have made it abundantly clear they will not be there this time and for now the market seems to be believing this.

The ramifications for gold on the falling US bond yields is we are back in real negative yield territory (‘rates’ via bond yields less inflation). The following courtesy of TME illustrates the perfect setup now for gold:

“Time for gold?

Gold is sitting at big support levels. The shiny metal is trading below the 200 day moving average, but note gold has behaved as a mean reverting asset for a long time. Note the trend line around these levels.

Gold and (real) yields

Yields matter for gold. We wouldn’t be surprised if gold caught some bids given the latest move lower in yields. US 10 year real yield inverted vs gold.

Gold and the mighty dollar

The dollar matters for the shiny metal. Goldman Sachs reminds us: “Since the vast bulk of gold is produced and consumed outside of the US, broad-based dollar appreciation should lead to a similar depreciation in gold, all things equal.

Near term, the impact of the dollar may be even larger due to repositioning of gold speculative positions which are very sensitive to dollar momentum. This means that further dollar upside could continue to put near-term pressure on gold.” The dollar has been strong, but did you know that the DXY has done nothing since April 28? Imagine if the DXY rolls over and starts trading below the steep trend line.

There is another currency that gold has followed closely over the past weeks. The Chinese Yuan. Watch this one closely as well for potential inputs for gold.

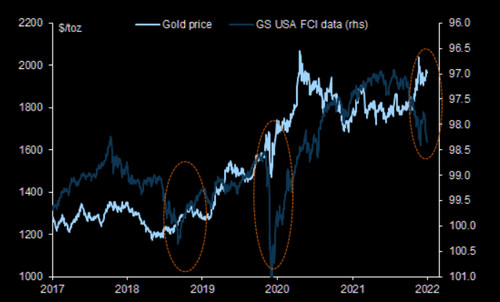

Gold loves tightening

During three previous periods of major US FCI tightening, gold prices increased

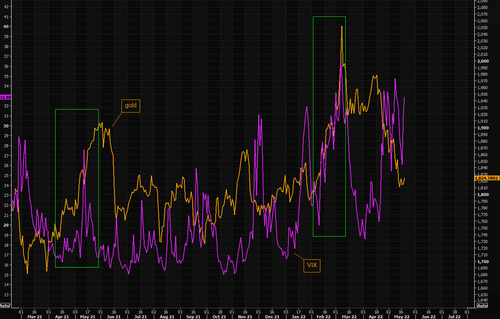

Could gold revive as a fear hedge?

So far people have sold most things, gold included, but at times gold tends to act as a fear hedge as well. Maybe people will realize gold just sits there and protects stuff?”

Return OF capital rather than return ON capital starts to become at the forefront of sophisticated investor’s minds at such times and the stars seem to be aligning for precious metals accordingly.

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply