Six years after the initial quantitative easing [QE], FOMC still foresees considerable time before increasing rates.

Bullion.Directory precious metals analysis 18 September, 2014

Bullion.Directory precious metals analysis 18 September, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

Risk assets eat out of the palm of Fed Chair Janet Yellen’s hand, after deciding that there will still be “considerable time” before the potential of an increase in the Fed funds rate – and that provided the impetus the markets needed.

Gold and silver are hovering near yearly lows, as the US dollar is broadly higher solely based on the fact that the Federal Reserve paired back the monthly asset purchases. However, take heed the naivety of current markets.

People must ask themselves, is the Fed really tapering?

It has been, roughly, six years since the beginning stages of the financial crisis that provoked the Fed to embark on a path of easy money and lax rates, which has induced mammoth proportions of speculation.

In these six years, the Fed has conducted several rounds of quantitative easing.

It begain with QE1, which ended in a minor taper. But, that was not enough. So, QE2 began, and then Operation Twist. Those three did not work to start economic jet propulsion, and now the current QE round is down to its last $15 billion to be tapered. Four rounds of QE in six years.

After each round began to fade, another round took its place. Given the current, weak economy, why is this time different? To think the financial markets will go cold turkey from their hopium is nonsensical. It’s the only reason US equities are at all-time highs. The Fed could easily issue another round to prevent markets from crashing. Neither you or I know, but there is a pattern.

From Yellen’s lips to your ears from yesterday’s FOMC press conference:

The labor market has yet to fully recover. There are still too many people who want jobs but cannot find them. Too many who are working part-time but would prefer full-time work; and too many not searching for a job, but would be, if the labor market was stronger.

…although, the real GDP [gross domestic product] rose at an annual rate of about one percent during the first half of the year.

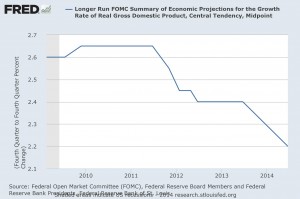

Yellen believes the economy is still still growing at a moderate pace and will eventually improve. However, the FOMC longer-term projection for growth rate of the real GDP. It has continuously declined regardless of ZIRP (zero interest rate policy) and asset purchases:

Growth has seemed to flat line, but don’t tell the S&P:

If the Fed’s programs are really helping the economy, why hasn’t growth exploded? Growth forecasts for the US are being cut, even projections by the Fed. Or does anyone on Wall Street care? The Fed cannot increase rates because there will be consequences.

“The Fed has a dilemma. It, of course, would like to come off of its present policy stance, but people are accustomed to it and if interest rates go up, you get an inverted yield curve with bad consequences,” said economist James Galbraith, professor at the University of Texas-Austin. He continued “I think that’s where they’re still wrestling with the consequences of trying to raise interest rates in a world climate where the world has a lot of very low-interest, long-term assets and a lot of expectation that it’s going to continue.”

The S&P 500 marched to a “new” all-time high, as market participants learned there was no change in the Fed’s stance.

Be it as it may, but reality has subsided.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply