What’s going on with housing? Home sales plunge to a record low – record high prices in many parts of the nation, combined with steep mortgage rates have led to a standoff between buyers and sellers

Bullion.Directory precious metals analysis 30 August, 2024

Bullion.Directory precious metals analysis 30 August, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

If that’s all you pay attention to, then you might think the inflation problem has finally been resolved for now.

But then reality presents itself (as it normally does) once you leave the world of corporate clickbait and 5-minute sound bites following one to two news cycles.

Don’t get me wrong, though. It is good news that the rate of consumer price inflation is finally easing after almost four grueling years of price increases on many consumer necessities, a trend that started in 2021 shortly after President Biden took office.

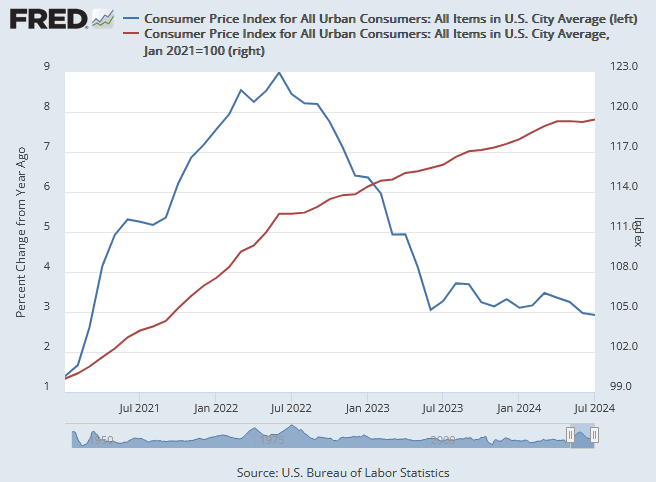

Looks like the rate of price inflation on a year-over-year basis is easing slowly. Yes, that’s good news! Any slowdown in the destruction of our purchasing power is certainly welcome.

In the chart below, the blue line represents the annual inflation rate – which peaked at 9% in June 2022 and has slowly declined since:

…but that’s where the good news about inflation ends

What you won’t hear on virtually any mainstream media reports or financial news channels is that inflation is cumulative. That purchasing power, once gone, is gone forever – even if inflation returns to the Fed’s target 2%.

The red line on the chart above tracks the total effects of inflation over the last three-and-a-half years. The cumulative purchasing power destruction since Biden’s inauguration? 19.4%

(We’ve reported on this Presidential Inflation Rate previously.)

This concept bears repeating: Inflation is cumulative. Lower annual inflation rates do not return our purchasing power!

If your total net worth hasn’t increased at least 19.4% over the last 43 months, you’re worse off. That’s not a political statement – it’s just simple mathematics.

And it’s simple mathematics based on the official numbers.

Are the official numbers correct? Probably not – Ron Paul calls them “just plain nonsense” for example. Ways of measuring inflation have changed repeatedly over the years for political reasons. Regardless, no matter what Paul Krugman says, most of us are noticeably worse off.

Except in one way.

What’s going on with housing?

Unfortunately, housing prices across the country are on the rise again, while mortgage rates are still elevated. (Though the uneasy Fed will likely cut rates quite soon.)

Here is how an article on CNBC summarized the current situation:

On a three-month running average ended in June, prices nationally were 5.4% higher than they were in June 2023, according to data released Tuesday.

The index’s 10-city composite rose 7.4% annually, down from 7.8% in the previous month. The 20-city composite was 6.5% higher year over year, down from a 6.9% increase in May.

Mortgage rates have fallen since June, but there is evidence that even the decline in rates has not been enough to bring buyers back into the market,” said Lisa Sturtevant, chief economist at Bright MLS. “Some buyers are waiting for home prices – and not just interest rates – to come down.”

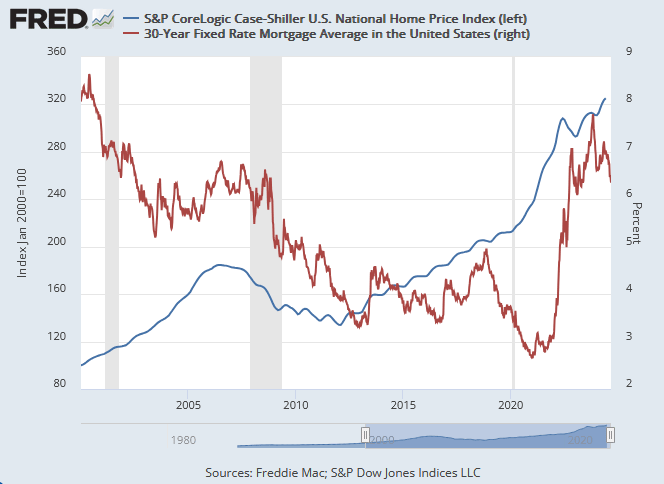

But unfortunately, home prices are still incredibly high in comparison to where they were in 2020, which you can see on the official Case-Shiller index graph below:

While housing prices have started to rise again, like Lisa Sturtevant pointed out above, mortgage rates aren’t declining fast enough to make those homes affordable.

In fact, the 30-year fixed mortgage rates have been hovering well above 6% for the last two years (red line in the chart above).

Most everyone knows that Americans love real estate. That’s “the American dream,” right? Owning a home? They’re the largest single contributor to net worth for virtually every family, especially the middle class.

Your home is definitely an asset. Whether your home is a financial asset is a topic of debate, and depends on context. But even if we were to land on the side that “your home IS an asset,” the current situation illustrated above would make it an expensive asset to own.

Higher home prices would obviously mean higher mortgage payments. Elevated mortgage rates would mean those payments are even higher than they should be.

Even more, though, your home is not a liquid asset. Real estate transactions take forever whether you’re a buyer or a seller. When prices are too high and financing is expensive, it’s even more difficult to buy or sell a home at a fair price. Wolf Richter refers to our current situation as a “buyer’s strike,” which is certainly one way to describe it.

From another perspective, real estate prices are simply too high. Those striking buyers may stay on strike until either prices decline into affordability, or inflation eventually makes a $450,000 price tag affordable for the typical American family.

So if your home is to be considered a financial asset, then…

Real estate assets (including your home) are higher risk than you might think

It boils down to this: Homes “as assets” are directly affected by mortgage rate changes as their price changes.

So right now, if you’re considering the use of your home to provide a return on investment, then your level of risk remains pretty high until rates come down.

The good news is physical gold and silver prices aren’t directly affected by rates. That means it would be a good idea for you to take a few minutes and learn about the benefits of owning precious metals.

That education would also include learning about the idea of proper diversification. We cover more on that topic here.

When compared to your home, gold and silver might prove themselves to be a better choice, especially in the current economic climate. In fact, inflation-resistant assets are so important, we’ve devoted an entire education page to them, too.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply