Precious metals prices keep falling even though the experts say they should be going up

Bullion.Directory precious metals analysis 3 September, 2014

Bullion.Directory precious metals analysis 3 September, 2014

By Terry Kinder

Investor, Technical Analyst

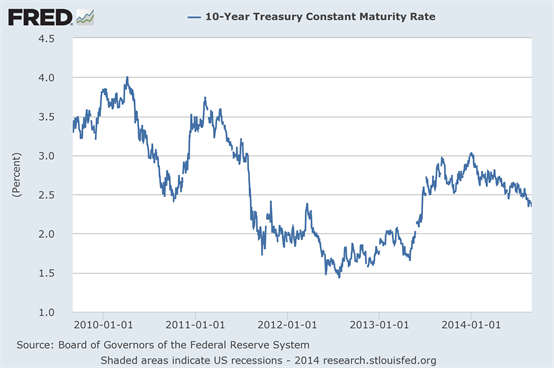

The 10-Year treasury rate today is lower than it was in 2011 when precious metals prices were much higher.

1) Rising Interest Rates:

The financial news often says that higher interest rates will be bad for precious metals prices. However, if you look at the chart above you will see that interest rates were higher in 2011, when precious metals prices were much higher than they are today. The truth is that interest rates are a measure of inflation today and the fear of future inflation. Interest rates start to rise when higher inflation is seen in the economy. Inflation and the fear of future inflation drives people to buy precious metals to protect themselves against a falling dollar. This demand, over time, drives precious metals prices higher.

2) Negative Real Interest Rates:

For much higher precious metals prices, negative real interest rates should appear. This will likely happen before interest rights move higher, and at a time when the inflation rate is higher than the interest rate. A negative real interest rate means that if your money is in a savings account, it is likely losing value after inflation. Because of this, people look for other investments that preserve the value of their savings. Precious metals are one investment that people use to protect their wealth from being eaten up by inflation.

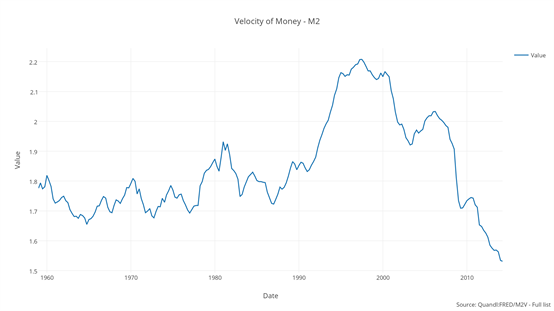

The velocity of money measures how fast money moves through the economy. A high velocity of money can indicate inflation and inflation can drive up demand, and ultimately, the price of precious metals.

3) Higher velocity of money:

A higher velocity of money is linked to higher inflation. Higher inflation leads to higher demand for precious metals as a way to protect the value of savings. Increased demand can lead to higher precious metals prices.

Chart Courtesy of Shadowstats.com

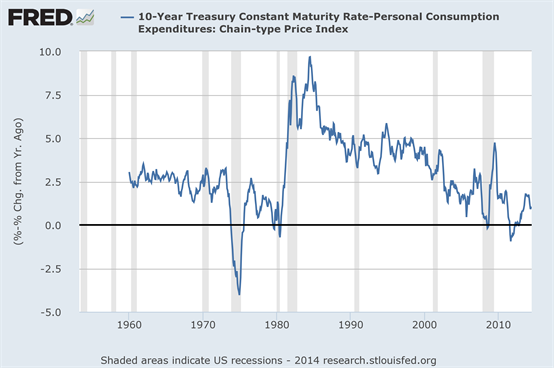

4) Higher inflation:

Higher inflation is the final key for higher precious metals prices. Inflation should be high enough that it is reported on the nightly news and people are talking about it every day. In other words, inflation has to be high enough that it can’t be ignored. The above chart from Shadowstats makes the case for inflation that can’t be ignored. The red line on the chart is the inflation level (consumer price index) the way it was calculated before 1990. The blue line on the chart is the inflation level the way it was calculated before 1980.

Together, the 4 key signs – rising interest rates, negative real interest rates, higher velocity of money, and higher inflation set the stage for higher precious metals prices. Other things, such as a fall in the value of the dollar, war, distrust of government, higher government debt levels or some other unknown event(s) may also cause precious metals prices to go higher. But, know that the reasons listed above have been talked about for years. Harry Browne, the author of How you can Profit from the coming devaluation, wrote about these ideas over forty years ago. Browne was right about many things. He was right about the value of the dollar dropping. He wrote about a Permanent Portfolio that included precious metals. Browne’s Permanent Portfolio isn’t perfect, but it is made to do well in almost any economy. Browne made his portfolio to set and forget, only re-balancing it once a year.

Conclusion

Why even talk about Harry Browne at all? Because, as a precious metals investor, you should know why you are investing in them. You should think of precious metals and how they fit into your larger portfolio. If you have extra cash, you can invest in precious metals apart from your larger portfolio. But, don’t invest money you can’t afford to lose. Do your own research, seek the advice of experts and people you trust, but use your own judgment. Then, keep an eye out for the four key signs that signal higher precious metals prices:

1) Rising interest rates;

2) Negative real interest rates;

3) Higher velocity of money;

4) Higher inflation

Understand too, the four key signs above make it more likely precious metals will rise higher, but they may or may not be enough by themselves. However, without the four key signs, it is less likely precious metals prices will move higher.

In the end, know why you invest in precious metals, be able to spot the 4 key signs that prices may be about to move higher, and have a plan for buying and selling that keeps your emotions from leading you to make a bad decision.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply