In spite of some very powerful evidence to the contrary, the general investing public still questions both the validity and upside potential of physical precious metals and the share prices of producing miners.

Full Article →Stories include: The Fed is in no position to respond to the spike in inflation, Swiss hedge fund is offering clients a precious metals shield against inflation, and Michigan jeweler launches his own Treasure Quest.

Full Article →The torrid rally in the silver market reached a major milestone this morning as prices hit $21/oz, closing above $20 for the first time since 2016. Even bigger moves are likely still to come…

Full Article →The purchasing of gold in coins or bars is one of the more satisfying ways to own gold – being able to touch the gold coins or bars, feeling their weightiness all while admiring their sparkle and sheen brings a kind of emotional satisfaction to the owner unavailable in any other investment.

Full Article →Even basics, such as how to make payment, need a bit of explaining. Buying precious metal isn’t complicated, but there are some differences compared with other types of purchases. One of the biggest differences is that paying with your credit card will cost you.

Full Article →If people aren’t paying the bill that puts a roof over their head, that doesn’t paint a pretty picture for the state of the U.S. economy. Sadly, it looks like that picture could be taking shape right now.

Full Article →According to a study by the Consumer Finance Protection Bureau (CFPB), almost half of Americans do not have enough savings to maintain original spending levels past the first five years of their retirement.

Full Article →Summer doldrums? Not for precious metals markets! In early July, gold and silver each broke out to fresh multi-year highs. The yellow metal is within striking distance of new all-time highs and the headline-worthy figure of $2,000/oz.

Full Article →GOLD and SILVER bounced after overnight sell-off from multi-year highs against USD in London, rallying as commodity prices fell with global stock markets against backdrop of fading ‘V-shaped’ economic hopes

Full Article →Many retail businesses including grocery stores and fast food restaurants have been wrangling with a national coin shortage. Some say we need to pay in exact change or use alternative payment methods such as credit cards.

Full Article →After 1,500 bullion dealer listings added we’re delighted to announce our new high quality basic listing – available at an incredibly low one-off fee: $10

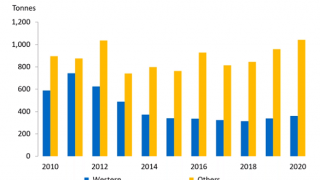

Full Article →Clean Gold: A Game Changer for Mining

Meet the Technologies that are Cleaning up the Gold Industry. Kevin Fell co-founder & Group CEO of Clean Earth Technologies discusses some of the ground-breaking solutions they are bringing to the mining world.

Full Article →GOLD PRICES tried but failed to match yesterday’s new 9-year US Dollar peak on Thursday while silver peeped above $19 per ounce for the first time since September as confirmed cases of Covid-19 in the United States rose above 3 million and Tokyo reported a record daily rise in new infections.

Full Article →Physical gold and silver are useful as investment and crisis insurance, but it takes a bit of explaining.

Some wonder how they go about actually realizing profits – it’s different than logging into a brokerage account and hitting the “sell” button…

Full Article →The fact the Fed is buying corporate bonds at all signals favoritism toward big existing players — indebted lumbering behemoths that can’t innovate. It’s not as if the Fed is going to take the largesse it creates from thin air and spread it around to a plucky but capital-starved startup, right?

Full Article →Gold Prices Erase Post-ISM Rally as US Jobs Data Beat Forecasts, Both for Gains and New Benefit Claims Bullion.Directory precious metals analysis 02 July, 2020 By Adrian Ash Head of […]

Full Article →The U.S. Mint, which has existed for 228 years, produces circulating coinage, bullion coins, numismatic coins and medals, is the nation’s sole manufacturer of legal tender coinage and the world’s largest coining facility.

Full Article →Part of the 2010 Dodd-Frank Act, the “Volcker Rule” was intended to prevent big banks from taking irresponsible risks. But in spite of an already-uncertain economy, regulators are now proposing to ease these rules…

Full Article →In a volatile trading environment for equities, a big move in one direction tends to beget a big move in the other. We’ve already seen a big move lower earlier this year – and a subsequent move higher that was nearly equal in magnitude.

Full Article →The Federal Reserve has printed trillions of dollars without generating runaway price inflation through the use of a neat trick. It’s quite the racket…

Full Article →As an investment, Gold can be hard to beat – but picking the wrong bullion dealer can cost you much more than time, money and stress. So how do you ensure you choose a dealer best suited to your needs?

Full Article →In another episode of “Strange 2020”, banks have become flush with deposits. But not in the way you might expect. In one month, deposits grew by $865 billion, which beat the record for an entire year

Full Article →GOLD PRICES rallied from $20 below yesterday’s new 8-year high near $1780 per ounce in US Dollar terms in Asian and London trade on Thursday, but edged higher against other major currencies as world stock markets extended Wednesday’s 2.6% drop in US equities.

Full Article →As if Social Security didn’t already have enough challenges ahead, we now have yet another complication. Not surprisingly, it’s a ripple effect from COVID-19. Before coronavirus hit the scene, experts agreed that if nothing was done, Social Security would be facing a 21% cut by 2035.

Full Article →The current phase of the gold bull market, which started last year, is – we believe – the third and final wave of the secular bull run tracking back to 2001. It’s going to create a tidal bore of immense size and power

Full Article →Gold prices have been trading within a well-defined $100 range over the past two months. Gold’s chart shows strong support at $1,675/oz and a zone of resistance at $1,750-$1,775. A breakout above the trading range could quickly send gold prices to $1,900/oz

Full Article →The national debt currently looks like a runaway freight train. Not only is it clocking in at $26.1 trillion at the moment, but it has made the jump of the last few trillion dollars fast… Really fast.

Full Article →Whereas previous financial crises were marked by a surge in bank failures, hardly any have gone under so far in 2020. The Federal Deposit Insurance Corporation (FDIC) reports that only 1% of FDIC-insured banks are on the “problem list” for financial weakness.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.