A few weeks ago, gold sold off on news that the People’s Bank of China didn’t add any gold to its reserves in May. At the time, I called it a “kneejerk reaction,” and said the news wasn’t “a particularly good reason to sell gold.” Before the news, China had bought gold for 18 straight months. However…

Full Article →Inflation has persisted so long now I’m forced to consider whether the Fed is really as concerned with it as Powell lets on. Maybe they realize the cure could kill the patient? The cost of living has risen even more… Data confirms that housing expenses, energy and vehicle maintenance costs have all increased by double digits since January 2021

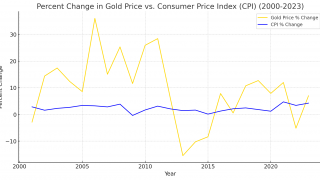

Full Article →Since mid-2021, we lived through the worst price inflation since the 1970s. CPI peaked in June 2022 at 9.1 percent. During this inflationary period, a lot of people sold gold as evidenced by the rangebound price through most of 2023. Was selling a good move?

Full Article →Gold prices could realistically reach $7,000 to $40,000, according to experts. The U.S. may be deliberately weakening the dollar to boost exports. Gold is unique in its inability to go to zero, making it a safe haven asset – accumulating more physical gold and silver during price drops is wise

Full Article →Central-bank buying has been credited as a key source of gold support for years. High-volume gold buyer China “paused” acquiring any gold in May. Analyst: “Nothing has changed for gold except the price” – Precious metals’ fundamental drivers are intact despite headwinds

Full Article →No matter who’s in the White House, the federal government is facing a reckoning. Here’s why “business as usual” is over… As the election approaches, I expect more people just like you will become interested in owning gold and silver. Right now, over in the UK, an upcoming election has citizens queueing up outside the Royal Mint

Full Article →Most people don’t understand the enormity of the national debt, the amount of government spending, or the size of the monthly deficits. As a result, they come up with all kinds of absurd “solutions” to the problem. Whenever I talk about the national debt and government spending, somebody says, “We just need to tax the rich more.”

Full Article →We’ve reported on young Chinese investors buying gold beans and gold flying off convenience store shelves in Korea. Gold demand in India recently surged during an important festival season. And now we have a gold-buying spree in Vietnam. Banks reported long lines as customers queued up to take advantage of lower gold prices…

Full Article →Gold-backed exchange-traded funds (ETFs) reported net inflows of gold for the first time in 12 months in May. Funds based in Europe and Asia led the way as total gold holdings by ETFs globally rose by 8.2 tons. ETFs globally now hold 3,087.9 tons of gold.

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. The world’s #2 reserve currency, the 20-nation euro, is losing ground as central banks load up on gold. Today, we ask, what’s going on? Is the dollar next? Against gold, currencies aren’t just losing value, they’re losing relevance.

Full Article →The Federal Reserve was sold as a way to “provide the nation with a safer, more flexible, and more stable monetary and financial system.” That’s not what the central bank does. In fact, the Fed destabilizes the monetary system by constantly interjecting itself into it, tinkering with interest rates, and creating money out of thin air

Full Article →The rapidly eroding confidence in our institutions gets plenty of news coverage. We expect it will be a dominant theme for investors in the years ahead. Investing success may require correctly answering the question about what to own in a world where free market forces are taking a back seat to crooked politicians and incompetent central planners.

Full Article →Analysts credit gold with helping Russia avoid sanctions impacts with the “Sanctions-proof” property of gold being a key reason for its current popularity among central banks. In spite of inflation numbers that keep confirming relentless price pressures, precious metals continue to demonstrate great resilience

Full Article →The Reserve Bank of India recently brought a little over 100 tons of gold home from the UK. According to a Times of India report, moving 100 tons of gold over 4,000 miles was “a massive logistical exercise, requiring months of planning and precise execution.” The process required specialized aircraft and detailed security arrangements.

Full Article →Last month, Zimbabwe officials introduced a gold-backed currency in an effort to stabilize the country’s economy. At the time, I warned that a gold-backed currency would be a great step, but that it wasn’t going to solve Zimbabwe’s problems unless the government changed its ways. So far, things don’t look good.

Full Article →Steve Forbes believes that “the world is beginning to lurch toward a gold-based monetary system. This, despite the fact that the historical gold standard is held in almost universal contempt by economists and financial officials…” Should we be excited? Concerned?

Full Article →If you listen to government officials and central bankers talk about price inflation, you might think they don’t have the foggiest idea of what caused it. It might have been supply chain problems, or perhaps it was Putin’s fault. Maybe greedy corporations are jacking up prices. Or it could be that consumer expectations are driving prices higher…

Full Article →Dominic Raab’s New ‘Golden Boy’ Role

Dominic Raab, who once dispensed justice as the Lord Chancellor, has now struck a different pot of gold as a senior strategic advisor to the World Gold Council (WGC) and Appian Capital LLP. With a gleam in his eye and a smile worthy of a ‘golden boy,’ Raab is ready to navigate the murky waters of international mining and global affairs.

Full Article →Every time the rate of inflation has been released each month over the last few months, the Biden Administration and some media outlets appear to claim economic victory. But any small “victories” are equivalent to squeezing a fire hose so less water comes out. Unfortunately, the liquidity is still coming out at high pressure.

Full Article →More than 80% of largest fund managers own gold in their portfolios because hedge funds see gold as asset that can help minimize risk and maximize return. Leading asset manager: This is the “most fraught global environment since World War II” with “Big Short” legend Michael Burry making a large commitment to gold.

Full Article →Could the world REALLY be creeping closer to a monetary gold standard? Steve Forbes sees signs that it is. In a recent article published by Forbes Magazine, Steve Forbes wrote that it may seem hard to believe, but the world is “beginning to lurch toward a gold-based monetary system.”

Full Article →Are the central bankers at the Federal Reserve just winging it? It sure seems that way if you step back and take a long view of their decision-making. Fed officials project this aura of authority. You might imagine them as hyper-intelligent experts in the field of economics and finance making carefully calculated monetary policy decisions… but.

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: $2,400 proves strong support as gold shifts gears towards $2,500, silver’s biggest move above $30 in a decade, and ways to interpret central banks’ portfolio theory today.

Full Article →All that glitters isn’t gold. Silver also has quite a shine lately. While gold has gotten the headlines, silver has had a solid bull run over the last several months. In fact, the white metal has outperformed gold in this gold bull market. Last week, silver charted an 11 percent gain, cracking $30 an ounce for the first time in over a decade.

Full Article →Last week, Rep. Thomas Massie (R-KY) introduced the Federal Reserve Board Abolition Act (HR 8421). The bill would do exactly as its title suggests: abolish the Fed. “Americans would be better off if the Federal Reserve did not exist,” Massie said. “The Fed devalues our currency by monetizing the debt, causing inflation.”

Full Article →Alabama Governor Key Ivey today signed a bill that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles and joins a growing number of states prioritizing the protection of citizens against inflation and mounting federal debt.

Full Article →These days, between bank runs and debt defaults and trade wars, trust is in short supply. When the global financial system relies on trust to function, we have to ask – without trust, what are we left with? Almost no one in their right mind trusts what is going on in today’s chaotic economy.

Full Article →Perfect Combination for Dollar, Perfect Signal for Gold

It’s rare when a target is reached so perfectly as it’s the case in the USDX right now. In yesterday’s analysis, I provided a lot of contexts for the current prices moves. Today, I’ll focus on the short-term price moves and I’ll start with the market where we saw the clearest, immediate-term indication: the USD Index

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.