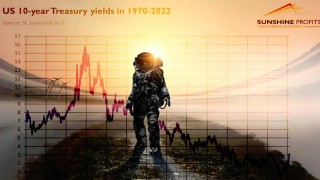

Last week, Powell testified before Congress. He reiterated many things he said during his recent press conference, but I believe that a few issues deserve our attention. First, Powell repeated that the Fed is strongly committed to additional rate hikes coming.

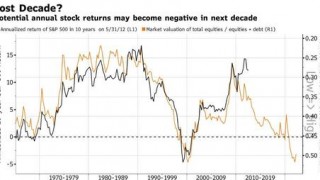

Full Article →Headlines abound overnight as H1 of 2022 closed at the worst in 60 years for the world’s biggest share index, the S&P500, down 21.2% so far this year. The NASDAQ had its worst H1 ever, down 30% and eclipsing the dot.com bubble’s 25% for the same period.

Full Article →Two weeks ago, the heavily-watched Michigan consumer sentiment index dropped to its lowest level ever. But in spite of “achieving” that remarkable record, it turns out the index had still more room to fall.

Full Article →With China, India, Brazil and South Africa fearing sanctions, the BRICS nations are forming a viable alternative to the US Dollar. Putin stated Wednesday “The matter of creating the international reserve currency based on the basket of currencies of our countries is under review.”

Full Article →Over the weekend, leaders of the G-7 nations announced formal sanctions on the import of gold from Russia. That move is expected to be largely symbolic because the LBMA and Western refiner volunteered to ban imports shortly after the war began.

Full Article →Fed Desperately Wants to Postpone Return to Reality – But It’s Not Going Well. Today, we’re seeing multiple signals of economic stress flashing simultaneously. Historically, that implies a near-term economic recession…

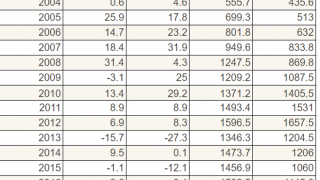

Full Article →Since 2001, Gold has outperformed any other mainstream asset class, although that’s not what you are likely to hear from the mainstream. While gold lagged in 2013 and 2015, for long term investors, the yellow metal is up 553% in USD terms and 360% in AUD.

Full Article →It’s worth remembering the Federal Reserve is not looking out for your wellbeing. They’re looking at statistics, not individuals. They see surges in food and energy prices as “normal volatility.” Chairman Powell doesn’t care it cost you nearly $100 to fill your gas tank.

Full Article →In a Capitol Hill hearing Powell was asked yesterday: “Would you say that the war in Ukraine is the primary driver of inflation in America?” Fed Chair Jerome Powell responded: “No. Inflation was high before, certainly before the war in Ukraine broke out.”

Full Article →Jim Cramer has been one of the most die-hard stock bulls since 1987, and rose to national fame in the late 1990s thanks to his frequent guest appearances on CNBC during the run-up of the dot-com boom. That’s why it’s so surprising that he recently recommended diversifying with gold.

Full Article →Yesterday we heard the RBA chief assure us “I don’t see a recession on the horizon”. As we have seen repeatedly since the GFC, central banks have deployed ‘words’ as much as rates and QE in an effort to control markets…

Full Article →How bad is the Consumer Sentiment Index? Try this: The index now is at “its lowest recorded value,” according to survey director Joanne Hsu. That’s right. The outlook of consumers, as measured by the Michigan consumer sentiment index, has never been worse. But that’s just one bad number…

Full Article →The U.S. economy appears headed for a hard landing. After months of ignoring the steadily growing inflation problem, the Federal Reserve is now using monetary blunt force to try to rein in rising prices.

Full Article →There are some analysts that think the only thing you need to look at to know where the price of gold and silver are going is the weekly Commitment of Traders report that presents all the positions of the big players on COMEX futures. It just got wildly bullish…

Full Article →Will Gold Save Souls in the Inflationary Apocalypse?

The end is nigh! There should be no doubt about it now, as more horsemen of the Apocalypse are coming. The first was Pestilence. Two years ago, the COVID-19 pandemic plunged the world into a Great Lockdown and the deepest recession since the Great Depression.

Full Article →The explosion in retail demand for gold has made headlines, but retail investors aren’t the only ones steadily stockpiling the yellow metal. As doubts over currencies increase and as the world becomes increasingly polarized, nations are seeking to hedge their risks with the tried-and-true asset capable of doing so: gold.

Full Article →Another night of deep red on Wall Street last night and another night of gold and silver price strength in the face of it. Markets were rocked by the surprise rate hike of 50bps by the Swiss National Bank but more particularly the expected sell off of their mountain of US shares,

Full Article →It’s hard to deny that inflation is the most pressing economic issue for most of us these days, whether we’re saving for retirement or just filling up our tanks at the gas station. Ask anybody what’s on their minds, and you’ll get an earful. It doesn’t matter who you ask, liberals or conservatives. It doesn’t matter how you ask,

Full Article →The US Fed has a new yarn to spin you. After months and months of trying to convince the market that inflation was just ‘transitory’ despite all the data, Fed Chair Powell was last night, with a straight face, telling us: “There is no sign of a broader slowdown in the economy that I can see.”

Full Article →Treasury Secretary Admits She Was Wrong About Inflation: Treasury Secretary Janet Yellen said many times last year that inflation would be both mild and transitory. Now she’s admitting she got it wrong. And some observers say she continues to get it wrong.

Full Article →Why Did Gold Fall Despite Accelerating Inflation?

According to the Bureau of Labor Statistics, the CPI increased 1.0 percent in May, after rising 0.3 percent in April. This is a huge increase, especially since we are talking here about changes from month to month. The core CPI, which excludes energy and food prices, rose 0.6%, the same increase as in April.

Full Article →The Japanese yen is down to 135 yen to the dollar from 127 earlier this month as the Yen is starting to crack. Against the US dollar, this is the weakest yen in 24 years. The Japanese central bank issued currency tumbled along with Japanese bonds and their stock market yesterday.

Full Article →Senator Elizabeth Warren and President Joe Biden claim that inflation[i] is caused by greedy corporations. And they propose to solve this problem by making the corporations pay. Whether it’s extracting a “windfall profits” tax, crushing them under even more regulation, or attacking them with antitrust enforcement, the idea is the same.

Full Article →Friday’s Consumer Price Index Report sent shockwaves through financial markets. The 8.6% annual reading was yet another new multi-decade high – dealing a body blow to analysts who believed inflation pressures had peaked.

Full Article →Unless you live under a rock you will have seen the US CPI print on Friday night was a whopping 8.6%. That was higher than expected and a new 40 year high. Watching gold react live and thereafter was an interesting journey of market cognitive dissonance.

Full Article →There isn’t any doubt, when inflation accelerates like it is right now, the lower income class has their financial worlds turned upside down. After all, that’s what happens when most of the food that we eat and fuel we use every single day suddenly becomes 10% – 43% more expensive.

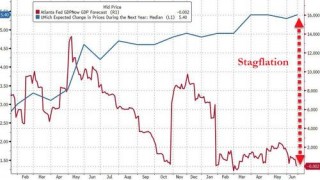

Full Article →The signs this tangled web of stagflationary high and increasingly sticky looking inflation, tumbling growth, and hawkish (tightening) central banks is fast approaching a second big capitulation in shares and property are growing.

Full Article →Houston, We Have a Stagflation Problem

Experts from the World Bank finally admitted that the risk of stagflation is getting bigger and more real. For gold, however, that’s pretty good news. Better Late Than Never – First they ignore you, then they laugh at you, then they fight you, and finally you win.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.